The following edited excerpts come from an article* by Paul Craig Roberts, Dave Kranzler, and John Titus as posted on globalresearch.ca under the title The De-industrialization of America: “The True U.S. Rate of Unemployment is 23.2%.

The U.S. had entered a new economic era in which American workers face direct global competition at almost every job level–from the machinist to the software engineer to the Wall Street analyst. Any worker whose job does not require daily face-to-face interaction is now in jeopardy of being replaced by a lower-paid equally skilled worker thousands of miles away. American jobs are being lost not to competition from foreign companies, but to multinational corporations that are cutting costs by shifting operations to low-wage countries…

The U.S. already looks more and more like a Third World country.

- America’s great cities, such as Detroit, Cleveland and St. Louis have lost 20-25% of their populations.

- Real median family income has been declining for years, an indication that the ladders of upward mobility that made America the “opportunity society” have been dismantled. Last April, the National Employment Law Project reported that real median household income fell 10% between 2007 and 2012.

- 67% of American households are unable to raise $400 cash without selling possessions or borrowing from family and friends.

- Although you would never know it from the reports from the U.S. financial press, the poor job prospects that Americans face now rival those of India 30 years ago.

- American university graduates are employed, if they are employed, not as software engineers and managers but as waitresses and bartenders. They do not make enough to have an independent existence and live at home with their parents.

- 50% of those with student loans cannot service them and 18% are either in collection or behind in their payments. Another 34% have student loans in deferment or forbearance. Clearly, education was not the answer.

Effects of 2008 Recession STILL Affecting Majority of Americans – How About You?

Majority of Americans In Dire Economic Shape – Here Are The Facts

Resurgence of Subprime Auto Debt Spells T-R-O-U-B-L-E

Jobs off-shoring, by lowering labor costs and increasing corporate profits, has:

- enriched corporate executives and large shareholders, but the loss of millions of well-paying jobs has made millions of Americans downwardly mobile…[and]

- destroyed the growth in consumer demand on which the U.S. economy depends with the result that the economy cannot create enough jobs to keep up with the growth of the labor force.

The U.S. Unemployment Rate

Between October 2008 and July 2014 the working age population grew by 13.4 million persons, but the U.S. labor force grew by only 1.1 million. In other words, the unemployment rate among the increase in the working age population during the past six years is 91.8%.

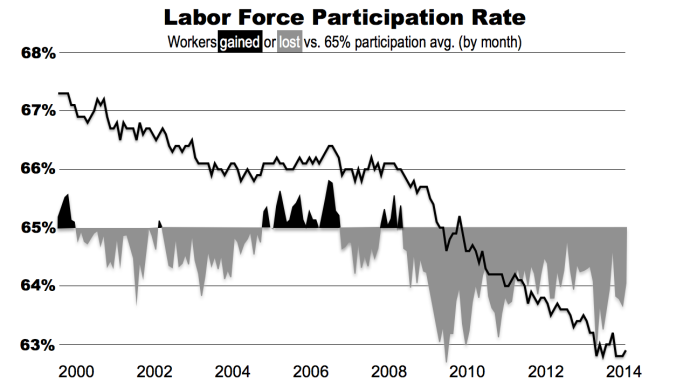

The U.S. Labor Force Participation Rate

Since the year 2000, the lack of jobs has caused the labor force participation rate to fall, and since quantitative easing began in 2008, the decline in the labor force participation rate has accelerated. Clearly there is no economic recovery when participation in the labor force collapses.

Right-wing ideologues will say that the labor force participation rate is down because abundant welfare makes it possible for people not to work. This is nonsensical. During this period:

- food stamps have twice been reduced,

- unemployed benefits were cut back

- a variety of other social services were also cut back. Moreover, there are no jobs going begging.

Being on welfare in America today is an extreme hardship.

The graph below shows the collapse in the labor force participation rate.

- The few small peaks above the 65% participation rate line show the few periods when the economy produced enough jobs to keep up with the working age population.

- The massive peaks below the line indicate the periods in which the dearth of jobs resulted in Americans giving up looking for non-existent jobs and thus ceased being counted in the labor force.

- The 6.2% U.S. unemployment rate is misleading as it excludes discouraged workers who have given up and left the labor force because there are no jobs to be found.

John Williams of Shadowstats.com calculates the true U.S. unemployment rate to be 23.2%, a number consistent with the collapse of the U.S. labor force participation rate.

Conclusion

In the last 10 years the U.S. has become a country in which:

- the norm for new jobs has become lowly paid part-time employment in domestic non-tradable services.

- Two-thirds of the population is living on the edge unable to raise $400 cash.

- The savings of the population are being drawn down to support life.

- Corporations are borrowing money not to invest for the future but to buy back their own stocks, thus pushing up

- share prices,

- CEO bonuses, and

- corporate debt.

- The growth in the income and wealth of the 1% comes from looting, not from productive economic activity.

This is the profile of a Third World country.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.globalresearch.ca/the-de-industrialization-of-america/5395635 (Copyright © 2005-2014 GlobalResearch.ca)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Effects of 2008 Recession STILL Affecting Majority of Americans – How About You?

The Fed has just released a 200 page study on the Economic Well-Being of U.S. Households in 2013 that reveals that 52% of the respondents to the survey said they did not have a mere $400 in savings for an unexpected emergency. That suggests to me that over half the county is on a paycheck-to-paycheck struggle. Below are my key findings from the survey presented in a concise easy to understand format. Read More »

2. NO Amount of Money Printing Can Cleanse the Rot of the U.S. Economy

The U.S. economy is on life support, graciously provided by Central Planners but no amount of money printing can cleanse the rot of the U.S. economy. In this Markets at a Glance, we investigate the U.S. consumer and show that for a large portion of the population, things are not anywhere close to being better, in fact they are worse than before the recession. Read More »

3. Majority of Americans In Dire Economic Shape – Here Are The Facts

We live in a country where almost everyone is drowning in debt and where most people are either flat broke or very close to flat broke…The following are 21 ways to end the phrase “Americans are so broke”. Read More »

4. Resurgence of Subprime Auto Debt Spells T-R-O-U-B-L-E

During the credit crisis, one of the problems that occurred was that too many loans were being made to people that had no ability of paying their debt back. We see this trend in full stride once again in the auto industry. Subprime auto lending is back in a big way. Why is this happening? What are its repercussions? This article explains. Read More »

5. Average American Can’t Afford To Own A House – Here’s Why

Regular home buyers are wondering why they are unable to partake in the American Dream of owning a home now that they actually have to document their income and put some skin in the game. The reason is that the current median selling price of $201,000 puts real estate out of reach for most Americans earning the typical $50,000 a year unless they go into massive levels of debt. They are too broke to own a home! Read More »

6. What Happened to America’s “Middle” Class? Here’s What!

Most American households are making less money than they would have 14 years ago with adjusted dollars. It begs the question, what is happening with America’s middle class? Why is there a decline? Read More »

7. Never Have SO Few Owned SO Much – Where Do You Place in the Wealth Hierarchy?

9. How Much Do Americans Earn?

How much does the typical American family make? This question is probably one of the most central in figuring out how we can go about fixing our current economic malaise. In this article we break down the U.S. household income numbers. Words: 464 Read More »

10. How the Poor, Middle Class and Rich Spend Their Money

How do Americans spend their money and how do budgets change across the income spectrum? The graph below answers these questions. Words: 240 Read More »

Visit wsj.com – HERE – to find their calculator which shows where your household income stands compared to others in the U.S.. $506,000 puts you in the top 1%; the much talked about $250,00 in the top 6%; $200,000 in the top 10% while an annual salary of $43,000 puts you in the top/bottom 50%. Where do you stand? Read More »

12. The Miserable State(s) of America & the World

The Misery Index is a lens through which to look at quality of life and, from an American perspective, such misery has risen steadily since 1994. How miserable is your state (and your state of being)? Take a look.. Read More »

13. Black Male Unemployment Situation In U.S. Is Dire! Here’s Why

In early October, the Center for Law and Social Policy (CLASP) released a report entitled “Feel the Heat!” that details the economic status of black men in the United States. Author Linda Harris discusses this group’s high unemployment rates, which she attributes to high incarceration rates, low graduation rates, and a lack of support systems to help black men out of this low-income trap. Read More »

14. Don’t Believe the Lies – THIS Is the Economic Reality – Take a Look… Then Get Prepared

Don’t believe these big lies – the following charts illustrate just what IS reality. Take a look and then get prepared for when the —- hits the fan! Read More »

15. Talk of Jobs Coming Back Courtesy of the Fed is Ridiculous! Here’s Why

Despite the preponderance of evidence that money printing doesn’t create jobs, Bernanke and his Central Bank colleagues continue to perpetuate the myth that the recovery is just around the corner, as long as we continue to print money. It’s complete and utter insanity as all it will accomplish is bankrupting the U.S. resulting in higher costs of living – and lower quality of life – for all of us. [Let me explain why I believe that is the case.] Read More »

16. This Gov’t Chart Shows That There Is NO Economic Recovery

5 years into the official economic “recovery” the labor participation rate is still lower than when the recession was declared over in June 2009 by almost a percentage point. It is still over 4 percentage points lower than when the recession officially began. The Federal Reserve chart of employment as a percentage of working age adults proves the point that sometimes a picture is worth a thousand words – sometimes much more. Words: 388; Charts: 1 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I’d add that all the US employment and unemployment stats are being “gamed” to make things look much better than they really are.

Example:

When we lose many high paying jobs and replace them with many low paying jobs (like restaurant servers), the effect on the economy is huge but this is never reflected in Gov’t. stats.

The workers of the USA are now being forced to work for much less money so that they will be more competitive as compared to using foreign workers because BIG business knows that as workers become desperate for work they will accept glow paying jobs that they never would have accepted a few years ago.