The equation of exchange shows the relationship between the money supply, velocity of money, price level, and real GNP. This equation is a tautology that no competent economist would argue against.

Money-supply * Velocity-of-money = Price-level * Real-GNP

On the scale that we are currently increasing the money supply, the real GNP is basically constant. Inflation can be thought of as too much money chasing too few goods. When looking at a 400% change in the base money supply over the last 5 years, the change in real GNP (change in goods) is so small that we won’t be off much by ignoring it. To help understand this short period of time with a big change in the base money supply, we can make a simplified version of the equation of exchange.

Money-supply * Velocity-of-money = Price-level * constant

If the velocity goes down as the money supply goes up, it is possible to increase the money supply without changing the price level.

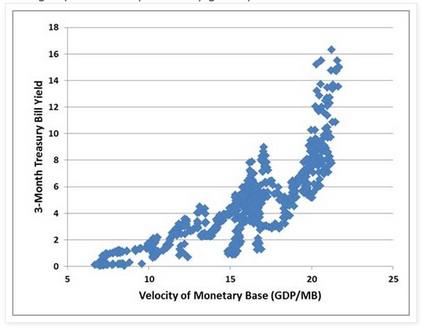

Hussman has shown that as interest rates go down the velocity of money goes down and as interest rates go up the velocity of money goes up.

At first when the Fed makes new money and buys bonds, they increase the price of bonds, which means they lower the interest rate. Hussman’s data shows this lowers the velocity of money. The lower velocity can compensate for the increased quantity of money so that often new money does not cause inflation right away.

The equation of exchange can be used with whichever definition of money supply you want to use (base money, M1, M2, etc). It is most clear that inflation will come if we use base money as our definition of the money supply. The base money supply has gone up by around a factor of 4 in about 5 years.

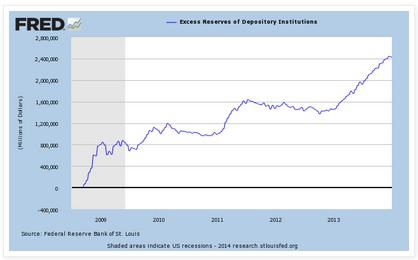

Since we have so far avoided inflation, the velocity of base money must have gone down by about a factor of 4 during this same period. The way this happened is that most of the new base money the Fed has made has just sat still in the Fed as excess reserves. This huge amount of non-moving money lowers the overall average velocity of money. If you think about it, it makes sense that making new money that does not leave the Fed should not cause inflation. Paying higher interest on excess reserves than short term bonds were paying was Bernanke’s great new trick to hide a few trillion dollars out in the open.

From Hussman we should expect the velocity of money to go up as interest rates go up. From the simplified equation of exchange, when the velocity of money and the money supply are both going up we should expect inflation.

As interest rates return to normal levels, the velocity of money will also return to normal levels. Then we will have 4 times the money supply and a normal velocity of money. By the simplified equation of exchange, we will then have 4 times the price level. We will have very high inflation.

You may be wondering, “why can’t the Fed hold interest rates down forever?”. Good question. If inflation is higher than the interest rate, then everyone and their brother can make money by borrowing and buying random stuff. To hold rates down the Fed would have to make an ever increasing amount of money, resulting in ever increasing inflation and ever increasing borrowing. The Fed seems interested in tapering their money creation which will mean letting interest rates go up. Japan, at least for the moment, seems to have chosen to try to hold interest rates down no matter how much money creation it takes. Once government debt and deficit are out of control, there is no good path for the central bank.

For the velocity of money to return to normal, it is reasonable to expect the excess reserves at the Fed will enter the real economy. There are those who think these excess reserves are somehow trapped but a bank with excess reserves can send an armored truck to the Fed and withdraw paper Federal Reserve Notes with no restrictions on them. This could happen at any time and possibly very suddenly. A couple trillion dollars suddenly flowing into the real economy would clearly result in high inflation.

Even Krugman has said that increasing the money supply is only safe when interest rates are near the zero lower bound. With interest rates going up, even by Krugman’s logic, we should expect inflation.

Here is another way to look at it. From 1913 to 2007 the Fed made about $800 billion in new money total. Since then it makes around that much each year. Nearly 94 years worth of money every 12 months. In this environment, one should expect to see “too much money chasing too few goods”.

Another way to look at it. In order to not cause inflation the central bank would need to be able to withdraw all the new money they created. There is just no way this can happen. Interest rates would shoot up, the value of the bonds the Fed held would crash, and they could not sell them for enough to withdraw as much money as they created.

High inflation will come. It is just a question of when.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/2451485-how-we-know-high-inflation-is-coming?ifp=0 (© 2014 Seeking Alpha )

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Inflation or Deflation: Are We Approaching the Tipping Point?

Might our Inflation-Deflation Watch be suggesting a breakout in asset price inflation is about to take place? Could it, in fact, be presaging the start of John William’s hyper inflationary depression in which prices rise exponentially even in light of massive unemployment and bankruptcies? This article analyzes the situation. Read More »

2. These 21 Countries Have Experienced Hyperinflation In the Last 25 Years

Hyperinflation is not an unusual phenomenon. 32 countries have experienced hyperinflation over the last 100 years of which no less than 21 have experienced it in the past 25 years and 3 in the past 10 years. The United States is one of the few countries to have experienced two currency collapses during its history (1812-1814 and 1861-1865). Could it happen again? Words: 1450 Read More »

3. Fed & Yellen So Far Behind Inflation Curve Chance of Hyperinflation Is Now 35%! Here’s Why

Janet Yellen and the Federal Reserve are so behind the inflation curve, and many other market implication curves, that we probably are staring at a 35% chance of a Hyper-Inflationary period by the time the Federal Reserve realizes that “noise” is actually real inflation! Read More »

4. Probability of Deflation Is 60%, Inflation Is 25% and Muddling Through Is 15% – Here’s Why

At the end of last year virtually every every single economist expected interest rates to rise this year as the Fed tapered their purchases and the economy improved but, in fact, interest rates on the 10 year U.S. Treasury have been going down year to date (from 3% to 2.5% after rising from about 1.6% to 3% last year). The masses, going along with this crowd, got fooled but we have been calling for a decline in interest rates for some time now due to world-wide deflation and it couldn’t be clearer to us that this is the most likely scenario for the United States. Let us explain. Read More »

5. Tips from TIPS on Prospects for Growth, Outlook for Inflation & Future for Gold

TIPS are telling us that the market is quite pessimistic about the prospects for real growth, but not concerned at all about the outlook for inflation. Read More »

6. there is no inflation, There is No Inflation, THERE IS NO INFLATION! Yeah, Sure!

Don’t listen to what the official numbers say. Inflation is a big problem already for the U.S. economy – and in an inflationary environment, gold bullion goes up and stock prices go down, because materials cost more and consumers spend less. I’d adjust my portfolio accordingly for the rapid inflation that awaits us. Read More »

The March year-over-year inflation rate was 1.51%, which is well below the 3.88% average since the end of the Second World War and 37% below its 10-year moving average. Read More »

8. Ignore the Hype: Inflation Is NOT That High – Anywhere!

There is very little evidence of high inflation at present, despite what the hyperinflationists say, and a little bit of common sense totally debunks the idea that there is. Read More »

9. Rapidly Rising Interest Rates Could Lead to Financial Collapse – Here’s Why

The global financial system is potentially heading for massive amounts of trouble if interest rates continue to soar. So what does all this mean exactly? [Let me explain.] Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money