With the October PMIs [having all been reported] I had another look at what to expect on the economic front with regard to economic growth in the major economic regions [Eurozone, U.S., Japan, China and the U.K. – and it is a mixed bag, to say the least. Let’s take a look at a few charts.] Words: 475

with regard to economic growth in the major economic regions [Eurozone, U.S., Japan, China and the U.K. – and it is a mixed bag, to say the least. Let’s take a look at a few charts.] Words: 475

So says Prieur du Plessis (www.investmentpostcards.com) in edited excerpts from an article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

du Plessis goes on to say, in part:

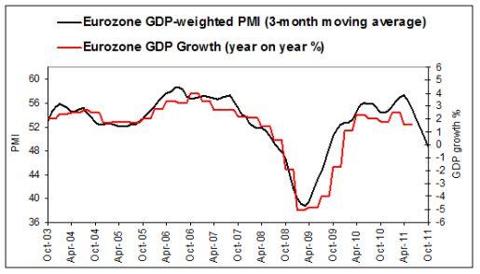

Eurozone

The outlook for the eurozone is grim…The eurozone is therefore firmly in the grip of a recession.

(Click charts to expand)

Sources: Dismal Scientist; Markit; Plexus Asset Management

The German IFO Business Expectations Index indicates that the eurozone economy will face further headwinds going into the first quarter next year.

Sources: Dismal Scientist; Markit; Plexus Asset Management

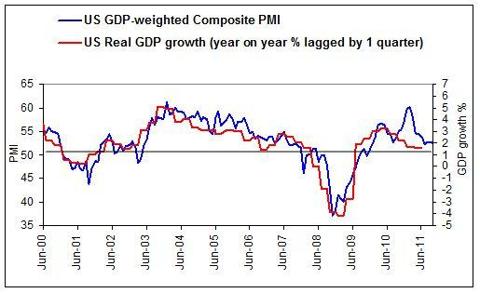

USA

In the U.S. the current level of the ISM GDP-weighted PMI (manufacturing and non-manufacturing) is consistent with year-on-year GDP growth of 1.5 – 2.0%. I expect year-on-year growth of about 1.75% in the fourth quarter – up slightly from 1.6% in the third quarter. On a quarter-on-quarter annualized basis I therefore expect a slight acceleration to 2.86% from 2.46% in the third quarter.

Sources: Dismal Scientist; Markit; Plexus Asset Management

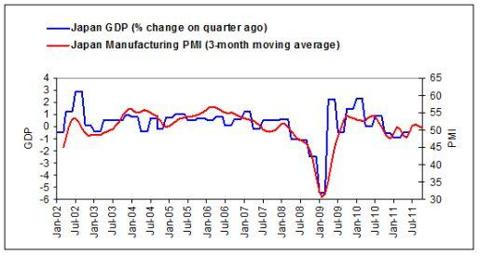

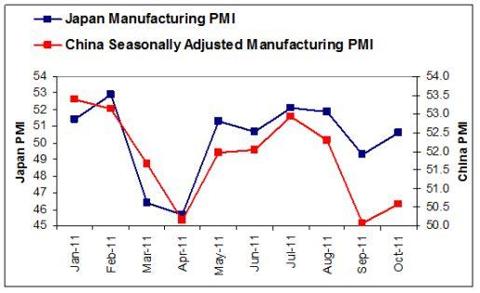

Japan

Japan’s GDP probably stopped contracting in the third quarter and may have expanded for the first time since the third quarter of last year. The manufacturing PMI also indicates a further but tepid expansion in the Japanese economy.

Sources: Dismal Scientist; Markit; Plexus Asset Management

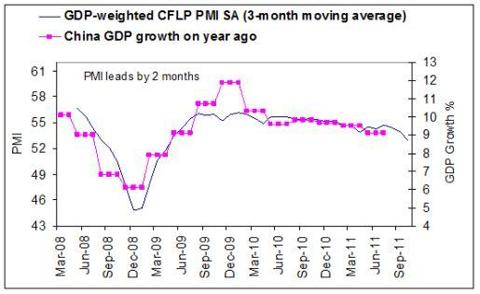

China

The GDP-weighted CFLP PMI (manufacturing and non-manufacturing) for China indicates further weakening of GDP growth on a year-ago basis to below 9%.

Sources: Dismal Scientist; CGLP; Li & Fung; Plexus Asset Management

The fortunes of China’s economy and especially the manufacturing sector remain closely tied to those of Japan.

Sources: CFLP; Li & Fung; Markit; Plexus Asset Management

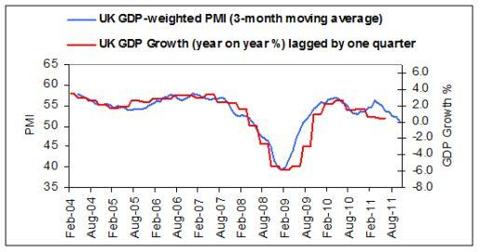

United Kingdom

The U.K. economy is heading for a recession. The GDP-weighted PMI that I calculate indicates that year-on-year GDP growth in the fourth quarter has stagnated, if not contracted. I estimate that the economy has probably contracted by approximately 1% or an annualized rate of more than 4% from the third quarter.

Sources: Dismal Scientist; Markit; Plexus Asset Management

To summarize:

- Japan: expanding at last

- China: growth slowing

- U.S.: slight acceleration in growth

- Eurozone: in deepening recession

- U.K.: entering recession

*http://www.investmentpostcards.com/2011/11/09/outlook-for-major-economies-mixed-bag/

Related Articles:

1. Latest Data Suggests American Economy Is Fighting Off Another Recession

This week’s rail data was somewhat mixed with total carloads showing a decline while intermodal jumped 4.2% YoY. [Thissuggests]…an economy that is growing modestly… It’s not a great environment, but it’s also misguided to get bogged down in the debate over a new recession. Words: 235

2. Latest Freight Shipment Indices Indicate NO Global Recession is Imminent!

Economic inflection points are seldom obvious but if we take the time to analyze all the data, there are at least five indicators that suggest another U.S. recession is not imminent. [Take a look.] Words: 920

3. Chicago Fed National Activity Index: Recession Coming?

If you’re inclined to sit on the fence these days in the delicate art of anticipating the next phase of the business cycle, you’ll get no argument from the latest update on the Chicago Fed National Activity Index, a monster index of indexes that encompasses 85 measures of U.S. economic activity. This benchmark has weakened this year but it’s still not flashing a formal prediction of economic contraction…[Let me explain.] Words: 255

50 economists forecast their estimates for real GDP over the next 6 quarters in a recent Wall Street Journal survey [and their projections, on average, show a modest increase through to the end of 2012 as the table below shows. In addition, they were asked] to forecast… the probability of a recession in the U.S. in the next 12 months] and the results were quite surprising – quite. [Let me show you.] Words: 600

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money