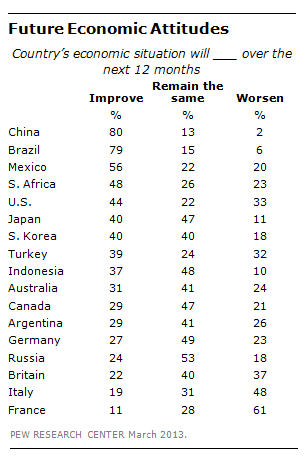

To what extent do residents of these 39 countries think their country’s economy will improve or worsen by the spring of 2014? Take a look.

improve or worsen by the spring of 2014? Take a look.

The original article* was written by Bruce Stokes, Director of Global Economic Attitudes at the Pew Research Center’s Global Attitudes Project (pewresearch.org) entitled Downbeat views prevail in G20 countries as summit begins.

The original article below is paraphrased by Lorimer Wilson, editor of www.munKNEE.com and www.FinancialArticleSummariesToday.com and the FREE Market Intelligence Report newsletter (sample here – register here). Please note that this paragraph must be included in any article reposting with a link to the article source to avoid copyright infringement.

The article conveys the following:

According to a survey of the residents of 39 countries conducted by the Pew Research Center earlier this year x% of the residents of the following countries were:

The Most Pessimistic:

- France (61%),

- Italy (48%),

- Britain (37%),

- U.S. (33%).

The Most Optimistic:

- China (80%),

- Brazil (79%),

- Mexico (56%),

- South Africa (48%),

- U.S. (44%).

The Status Quo:

- Russia (53%),

- Germany (49%),

- Indonesia (49%),

- Canada (47%),

- Japan (47%),

- Australia (41%).

*http://www.pewresearch.org/fact-tank/2013/09/04/downbeat-views-prevail-in-g20-countries-as-summit-begins/

Related Articles:

1. We’re Heading Toward Another Nightmarish Financial Crisis! Here’s Why

We have not seen so many financial trouble signs all come together at one time like this since just prior to the last major financial crisis in 2008. It is almost as if a “perfect storm” is brewing, and a lot of the “smart money” has already gotten out of stocks and bonds. Could it be possible that we are heading toward another nightmarish financial crisis? Read More »

The madmen who are responsible for the coming economic disaster continue to behave as if they can manage to avoid it. Violating Einstein’s definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. The end is certain, only its timing is unknown, and, once interest rates begin to rise, and they will, it’s game over so it begs the questions “How much longer this can possibly go on?” and “What will happen to the U.S. and the world when it does?” Read More »

We often take things far too seriously when looking at the world of high finance, the global economy and the ins and outs of investing. Lighten up and relax. See the world for what it really is through the eyes (and words) of some individuals who can do just that. Read More »

There is one vitally important number that everyone needs to be watching right now, and it doesn’t have anything to do with unemployment, inflation or housing. If this number gets too high, it will collapse the entire U.S. financial system. The number that I am talking about is the yield on 10 year U.S. Treasuries. Here’s why. Words: 1161; Charts: 2 Read More »

5. Another Crisis Is Coming & It May Be Imminent – Here’s Why

Is there going to be another crisis? Of course there is. The liberalised global financial system remains intact and unregulated, if a little battered…The question therefore becomes one of timing: when will the next crash happen? To that I offer the tentative answer: it may be imminent…[This article puts forth my explanation as to why that will likely be the case.] Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money