You can twist it as you like: there is no European debt crisis. There simply isn’t. The uncontrolled media frenzy that we are experiencing is undifferentiated, baseless and harming investors. They are selling shares in Spain instead of profiting from these extraordinary times and buying more of them – as any serious investor would do. Words: 506

uncontrolled media frenzy that we are experiencing is undifferentiated, baseless and harming investors. They are selling shares in Spain instead of profiting from these extraordinary times and buying more of them – as any serious investor would do. Words: 506

So says Global Value Investor (http://www.global-value-investor.de/) in edited excerpts from the original article* as posted on SeekingAlpha.com.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

Spain is NOT Greece!

[Yes,] Spain has one of the largest unemployment rates in Europe with 21.5% and has to deal with the bursting of a major property bubble…but one thing Spain does not have, however, is high outstanding public debt as measured as a percentage of GDP.Automatic Delivery Available! If you enjoy this site and would like every article sent automatically to you then go HERE and sign up to receive Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

Spread the word. munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

Spain’s public debt as a percentage of GDP was 50-60% between 2009 and 2010…and, according to recent estimates by the IMF…will be around 70% [in 2011 yet] the harbors of stability Germany and France are expected to reach ratios of 81.5% and 86.26 respectively. With so many other countries (the U.S., Japan, European member countries) having higher debt levels, wouldn’t it be an inconsistency to isolate Spain in particular for its debt levels and budget deficits?

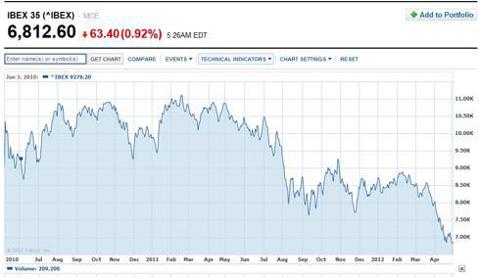

The market has been quite clear that it is not willing to distinguish between Spain, Italy and Greece despite fundamental and starkly contrasting debt levels, refinancing costs and structural differences in the national economies. The market is very negative toward Spain as can be seen in the 2-year IBEX chart:

The main argument critical investors have is: Spain will not be able to resort to expansive monetary policy as austerity measures require restrictive fiscal policies. Since the ECB controls the monetary policy and not Spain’s central bank, Spain is effectively deprived of its ability to devalue its currency and rehab itself through exports.

What the above argument neglects is that:

- Spain is a sovereign nation and can leave the union any time it wants, and

- Spain profits hugely from the Euro in terms of trade and tourism. With Greece having even higher debt levels and worse fundamentals than Spain, its decision to not leave the Euro speaks to the advantages of staying in the Union, which provides both tangible and intangible benefits.

Conclusion

Spain is not Greece. The “crisis” is overhyped. It is more likely that the news cycle follows its main purpose: Pick one, destroy one, move on to the next one. One year from now, nobody will talk about Spain.

*http://seekingalpha.com/article/567911-there-still-is-no-crisis-in-spain-or-europe?source=email_macro_view&ifp=0 (To access the article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1.Spain is an Absolute Disaster! Here’s Why

Spain is an absolute disaster on a level that [it seems] few, if any, analysts can even grasp. [Let me try to.] Words: 428

2. Graham Summers: Collapse of Europe is Guaranteed! Here’s Why

I continue to see articles in the media claiming that Europe’s problems are solved. Either the folks writing these articles can’t do simple math, or they don’t bother actually reading any of the political news coming out of Europe [so let me present 3 data points that guarantee Europe will collapse at some point in the near future]. Words: 722

3. Graham Summers: Spain Has Brought Europe to the Point of NO Return – Here’s Why

Spain is a catastrophe [of major proportions and] to fully understand [why that is the case] we need to understand Spain in the context of both the EU and the global financial system. [Once you read what I outline below you will more fully understand why] I believe that the EU in its current form is in its final chapters. Whether it’s through Spain imploding or Germany ultimately pulling out of the Euro, we’ve now reached the point of no return: the problems facing the EU (Spain and Italy) are too large to be bailed out! Words: 1345

4. Graham Summers: Spain’s Fiscal Problems Will Result in Collapse of European Union! Here’s Why

On the surface, Spain’s debt woes have many things in common with those of Greece – bad age demographics and a toxic bank system – but you’ll note that, as we tackle each of these, Spain is in fact in far worse fiscal shape than Greece. [Let’s take a look.] Words: 700

5. Germany Could Initiate the Collapse of the European Union Within Months – Here’s Why

As many of you know, my primary forecast regarding Europe is that the EU will be broken up and/or collapse within the coming months. The reasons for this are financial, monetary and political in nature [with much of the latter dependant on what happens in Germany. Let me explain.] Words: 516

6. Europe is Heading Off a Financial Cliff! Here’s Why & How to Protect Your Portfolio

Europe is heading off a cliff! From one end of the continent to the other, the numbers suggest a double-dip recession is striking with brutal force…and with the world as interconnected as it is these days, what happens in Europe WILL impact our companies and markets here so now is the time to position your portfolio to weather the storm. Words: 900

7. D-Day is Coming: A Financial Crisis is Brewing in France – Here’s Why

“The real risk for the euro zone now is not Greece, but France,” says a top French finance boss. Nicolas Baverez, a commentator who foresaw the country’s looming debt problems in a bestselling book of 2003, agrees: “I’m convinced that France will be the centre of the next shock in the euro zone.” [below their views are substantiated with some alarming and disturbing facts about France;s financial situation and how their politicians are failing to address the brewing crisis.] Words:740

8. Campbell Asks: Can Italy Be Far Behind Spain?

About three months ago, shortly before Greece’s sovereign debt was restructured, I began to warn about Spain as the next Eurozone country to focus on. That has, indeed, turned out to be ‘all the news’ with reports every day on Spain’s deteriorating financial condition. Given the ongoing world economic uncertainty and volatility, however, I suggest you now begin to pay very careful attention to Italy going forward, but doing so without losing sight of what is transpiring in Spain. [Let me explain why I see ‘Italy’ eventually surpassing Spain as ‘all the news’.] Words: 485

9. Spain Ignored S&P’s Warnings & Downgrades Quickly Followed! Here’s Why

It was just 6 months ago that Spain enjoyed a credit rating of AA. In early October, 2011, S&P downgraded Spain to an AA- rating with a negative outlook (details below as to why) and then again in January, 2012 from AA- to A for failing to make much in the way of improvements. Then, just last week, having clearly forewarned Spain that it was at risk of having it’s credit rating even further downgraded with all the financial implications of such a move, S&P further reduced Spain’s credit rating by two levels to BBB+. When you read what S&P said back in October and again in January, Spain has only itself to blame for its amazing mismanagement and sorry state of affairs. Words: 2000

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money