The Western gold community needs to let go of all bad past memories, grab this exciting gold stocks bull by the horns, and enjoy the ride! A multi-decade rise in gold stocks versus all other assets is likely beginning. Institutional money managers are buying on days of strength, weakness, and sideways price action!

The comments above and below are excerpts from an article by Stewart Thomson (GracelandJuniors.com) which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

Gold stocks continue to take out key highs, but in the big picture, the upside action has barely started. Below is This is the quarterly bars XAU index versus gold chart.

A multi-decade rise in gold stocks versus all other assets is likely beginning. Institutional money managers are buying on days of strength, weakness, and sideways price action!

Why are these money managers so enthusiastic about gold, and even more enthusiastic about gold stocks? Well, central banks around the world are engaged in a bizarre policy of low interest rates and quantitative easing that is ostensibly designed to “kickstart the economy”, but is really designed to allow governments to borrow and spend until the cows come home.

Negative interest rates allow governments to borrow money, and make a profit on their reckless actions. In America and Japan, where a lot of citizens are elderly, negative real interest rates on pensioners is very destructive.

In Japan, most pensioners lost large amounts of money in the huge equity bear market that began in 1989. Now, the remnants of those investments are subject to negative interest rates. They are pulling money out of the banking system, holding cash, and buying gold.

American bank loan profits have been in a twenty-year bear cycle, and so has money velocity. Savings are funnelled to government, where it is quickly spent on bizarre and violent programs to promote regime change in Muslim nations.

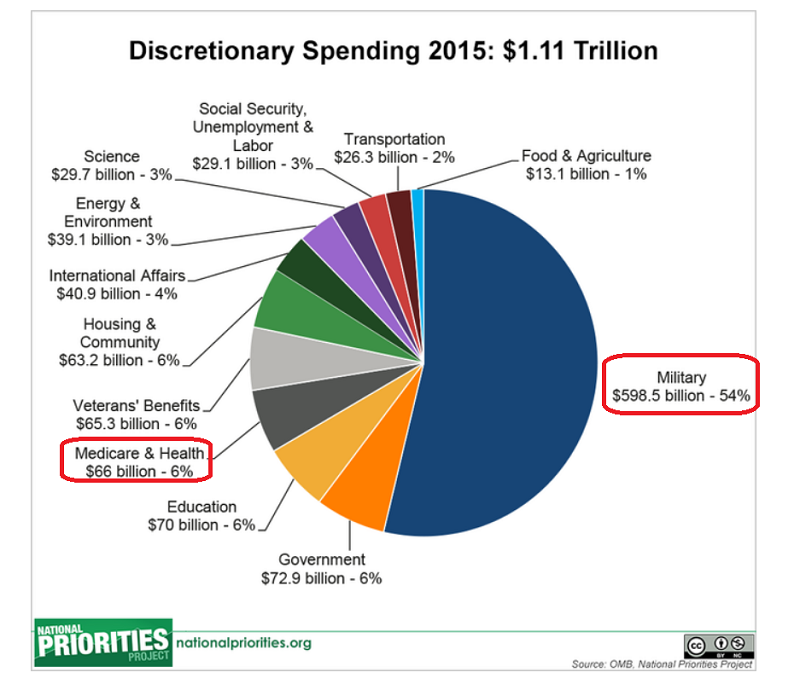

Most government spending is a useless endeavour that gives almost no boost to GDP. The US government is particularly notorious for wasting money on a vast array of guns and bombs, while refusing to buy a dying elderly citizen a needed prescription pill.

Horrifically, as India’s top central banker found out the hard way, if central bankers don’t print money for governments to spend on a regular basis, governments will find another “whipping boy” who will do what is asked of them so most of the world’s central banks continue their policy of low/negative rates and QE. This is a very dangerous situation, and it is causing top institutional money managers to worry about the growing likelihood of a global sovereign bond crisis. Gold is their only protection against that type of crisis, and right now these money managers are clearly engaging in significant buying in the gold market.

What about gold stocks? Well, a bond market crisis can create massive inflation in the current situation, because so much money is sitting idle at the Fed. Interest rates soar during a credit market crisis. Money pours out of government bonds and into the private economy. Stock markets can crash horrendously as that happens, and consequently gold stocks become the go-to asset for institutions.

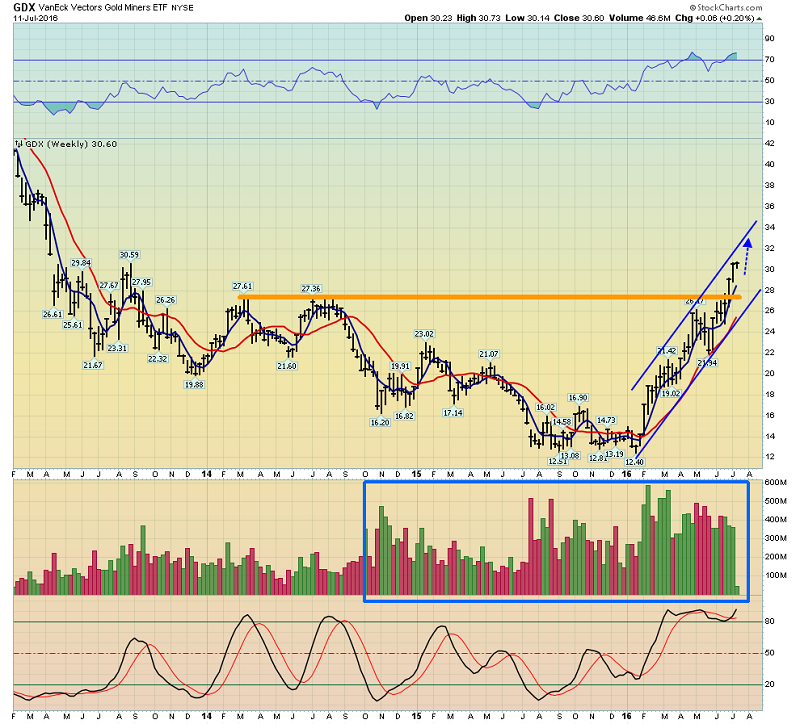

Below is the important GDX weekly chart. The surge to above the highs of 2014 and 2015 is turning the $27-$28 price zone into massive support. All $2 – $3 corrections in the GDX price can be bought by gold stock enthusiasts with a smile, because that’s what a myriad of institutional money managers are doing.

Gold is moving higher in an up channel that looks like it was sculpted by historically world famous Michelangelo.

The Western gold community needs to let go of all bad past memories, grab this exciting gold stocks bull by the horns, and enjoy the ride!

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money