Many investors believe…that the rise of the federal funds rate is detrimental for gold prices…[but,] although this relationship may often hold, investors should be skeptical about this rule of thumb. This article explains why that is the case.

The above introductory comments are edited excerpts from an article* by Arkadiusz Sieron (sunshineprofits.com) as posted on GoldSeek.com under the title Gold and Interest Rates.

Sieron goes on to say in further edited excerpts;

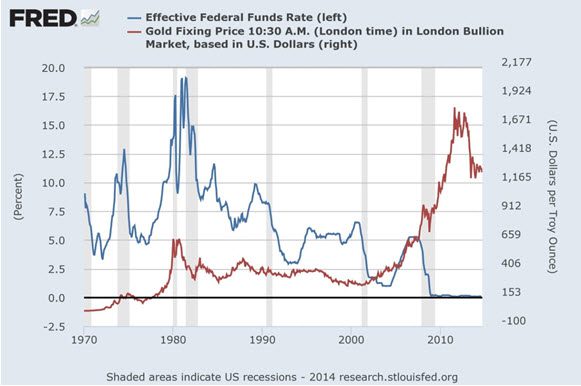

There are many cases when an increase in this rate was accompanied by parallel moves in the price of gold [as can be seen in the chart below].

- From 1971 through 1974, the federal funds rate rose from 5 to 10%, while the gold price flew from $35 to $200 per ounce.

- Similarly, between summer 2004 and 2006 the funds rate soared from 1 to 5.25%, while the gold price rose from $400 to $700.

There are 3 reasons why the changes in the federal funds rate are not the best predictor of gold prices:

- Real interest rates are more important than nominal ones. This is why the federal funds rate soared from 1977, peaking at more than 20 percent in 1980, and gold reached a peak of $850 per ounce in the same period. Though nominal interest rates soared, the real interest rates remained negative (because of the stronger rise in the inflation rate), causing the rise in gold prices.

- Low federal funds rate enables commercial banks to borrow cheap money from the central bank to buy assets yielding higher interest rates, i.e. bonds and stocks, or to lend them to consumers or entrepreneurs. When the federal funds rate falls, the interest-bearing assets seem to be more attractive than precious metals. When borrowing at 1%, it is better to buy bonds bearing 1.5% than gold (at least most investors will very likely see it this way). Similarly, when the federal funds rate rises, gold becomes relatively more attractive than many interest or dividend bearing assets. In other words, the rise of the interest rates lowers the price of bonds and stocks. Therefore, when the bond or stock bubble bursts, investors may reallocate their funds from equity and bond markets to the precious metals market.

- The rise in the federal funds rate, which means a higher price for shorter-term credit, does not guarantee a deceleration in money supply growth, which is more important for the gold market. The current period of extremely low interest rates has shown that the money supply can be raised (remember quantitative easing?) without changing the federal funds rate.

Conclusion

Even with a raised rate of federal funds, the price of gold does not have to fall…because the changes in the interest rates cannot be analyzed in isolation from the economic context, especially the movement in the real interest rates. Therefore, if CPI inflation remains at around 2%, real rates will stay negative or extremely low, unless the nominal rates rise to more than 2% (the current 1 year Treasury bill yield is 0.1%), which still seems to be a matter of the rather distant future (with the federal funds rate at 0.25%).

Summing up, the real interest rates are much more important for the gold market than sole changes in the federals funds rate.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://news.goldseek.com/GoldSeek/1413205675.php (© GoldSeek.com, Gold Seek LLC )

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. To What Extent Is Price of Gold Affected By Changes In U.S. Monetary Policy?

This article presents a historical analysis of the impact of U.S. monetary policy announcements on the price of gold in U.S. dollars over subsequent 3-month periods beginning with the Federal Reserve’s extra-ordinary 75 basis point Fed Funds rate cut in January 2008 and the most significant central bank policy announcements since. The findings are very interesting, indeed. Read More »

2. Gold Price Dependent on Extent of Money Supply NOT Direction of US Dollar Index – Here’s Why

…When the USD starts to rise many assume that this is negative for paper gold ETFs such as GLD as well as physical gold. I’m sure you have heard it before, if the USD goes up then gold goes down, and vice versa…but, in reality, this “rule of thumb” isn’t the case and, in actuality, it would be impossible for the USD and gold to trade inversely with each other. Let me explain. Read More »

3. What Do Current Low Interest Rates Mean For the Future Price of Gold?

Investors commonly assume that rising interest rates adversely impact the gold price, and vice versa. They believe that a rising interest rate environment is indicative of a strong economy, which is supposed to drive investors out of gold and into the stock market. They further assume that investors will want to exchange their gold, which has no yield, for stocks and bonds, both of which have yields and generate income but this intuition is unfounded. Let me explain why that is the case ans why, as such, gold investors shouldn’t fear rising interest rates. Read More »

4 What Affect Will Rising Interest Rates Have On Inflation & the Future Price of Gold?

Though the stock, bond and currency markets, at the moment, are preoccupied with the question of when the first interest-rate increase will happen, the real story lies in where interest rates are ultimately headed because that answer defines where stock, bond and currency prices are ultimately headed and the reality, dear reader, is that the Fed simply cannot — and will not — allow interest rates to crawl very high. Why is that you ask? Read on! Read More »

If the past long-term cyclical correlations between interest rates, equities, and commodities were to play out as they have done going back to the 1880s, U.S. stocks and interest rates should continue to rise as commodities either fall or underperform according to a 60-year cyclical pattern model referred to as The Market Map. Read More »

6. Goldbugs Should Pray for Higher Interest Rates – Here’s Why

Interest rates cannot stay low forever so, while the Fed’s low interest rate policy is pushing stock and bond prices higher, it is also infusing potential energy into the gold market. Therefore, it is only a matter of “When?” and not “If?” this trend reverses and gold catapults higher. Read More »

7. Weak Gold Price & Falling Interest Rates Say Current Monetary Policy Is Too Tight – Here’s Why

A change in monetary, fiscal, and regulatory policy is necessary to beat back the forces of recession and deflation. If the messages of falling gold prices and falling interest rates are not enough to gain the attention of policy makers, I suspect that the specter of future falling stock prices throughout the world will be. That is what is in store for us if the recessionary/deflationary bias in the world economy that gold and bonds are signaling, reasserts itself. Read More »

8. The Future Price of Gold and the 2% Factor

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Let me explain. Read More »

9. U.S. Gov’t Ensnared in a Debt & Interest Rate Trap – Here’s What It Means For Gold

Should the Fed raise interest rates at some point in the future, as is widely expected, such higher interest rates might bring far worse consequences than can be achieved by simply staying the course. While some small, even token, rate hike would be tolerable, a return to historical norms could reap consequences in the general economy far beyond the direct effect on the federal government’s fiscal status. The fact is that the federal government is ensnared in a debt and interest rate trap of its own making from which it will be difficult to extricate itself. Read More »

10. Fed Funds Cycle Suggests Positive Outlook for Gold – Here’s Why

Below is some interesting research by Doug Peta of BCA Research regarding the Fed Funds Rate Cycle, and what that research – as well as our own in-house research – could mean for gold to help you understand the positivity we see for the precious metal looking towards 2015. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money