With the S&P 500 (SPY) off to its strongest year-to-date start since 1999, some market participants may be looking to heed the advice of the old market proverb “Sell in May and Go Away”. The question this article seeks to answer is whether this calendar effect is spurious, or whether this is something…readers should heed.

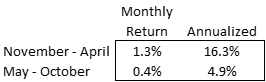

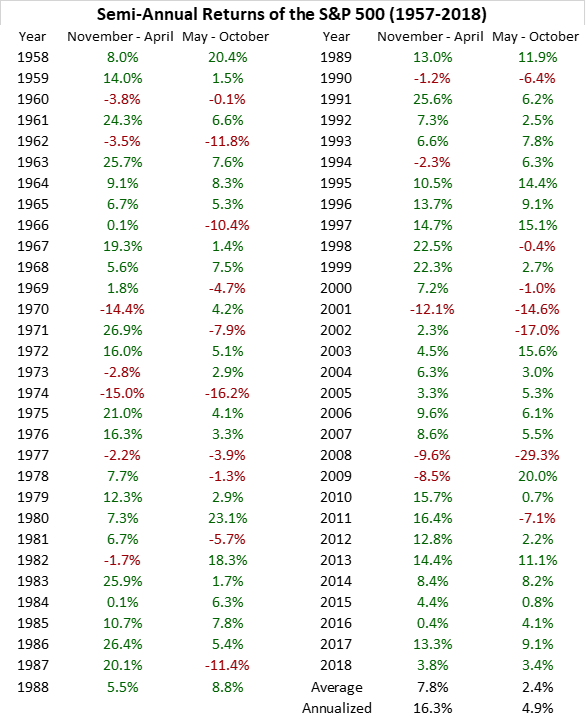

As seen in the table below, the annualized return for domestic equity investors for the six months from May to October inclusive was a disappointing 4.9%. Conversely, returns from November to April were an astounding 16.3% annualized.

In 2001, Dutch researchers Sven Bouman and Ben Jacobson published The Halloween Indicator, ‘Sell in May and Go Away’: Another Puzzle. The authors found:

- that this timing mechanism held in 36 of 37 developed and emerging market economies in a dataset stretching from 1970-1998.

- that the effect is particularly strong in European countries and is robust across time.

In 2013, Sandro Andrade, Vidhi Chhaochharia, and Michael Fuerst published, “Sell in May and Go Away” Just Won’t Go Away”. Building on the Bouman-Jacobson study, the authors found:

- that the “Sell in May” effect persisted with the same economic magnitude from 1998 to 2012. In the United States, the phenomenon has persisted for five of the last six years, further elongating the seasonal outperformance.

…Why does this seasonality exist and why has it persisted? Perhaps seasonality is induced by vacations. This might suggest that investors have less demand for risky assets when they are away from the office. This possible explanation might explain why the “Sell in May effect” is even stronger in Europe where the summer holiday is longer. There is probably some merit to this calendar effect…While calendar effects are a violation of the Efficient Market Hypothesis, it does appear that market structure and human behavior could allow for their existence.

Another interesting observation on the seasonality of returns was captured in a 2003 paper by Mark Kamstra, Lisa Kramer, and Maurice Levi of the Federal Reserve Bank of Atlanta. In Winter Blues: A SAD Stock Market Cycle, the authors documented low returns prior to the winter solstice and strong returns following that date. They posit that seasonal affective disorder, a documented medical condition linking length of day to feelings of depression in some people, influences risk-taking and market returns. Adding support to this claim, the influence in the dataset appears stronger at higher latitudes (shorter days in winter) and is present in the Southern hemisphere at a six-month lag (opposite seasons from the Northern hemisphere).

Maybe “Sell in May” is bolstered by these calendar effects and weather’s impact on mood, but these could be simply small variables adding heft to what is simply a spurious correlation in a relatively short dataset. Unfortunately, we cannot wait around for another sixty years of S&P 500 data to test this hypothesis.

…While I was surprised at the evidence supporting market seasonality, I am certainly not advocating selling your risky assets and sitting in cash for the next six months even after a historically rapid market rally.

- Over this sixty-year period, investors who sat out the lower returning semi-annual period would have still sacrificed returns.

- Young investors with a long-time horizon, should capture equity risk premia over long time intervals…

- Timing markets consistently is a difficult proposition. Digging deeper and investing more in down markets with a long-run view is likely better advice for most investors.

As strange as it sounds, the “Sell in May” adage seems to correctly capture an abnormal period of seasonality in markets.

* Calendar year returns begin in the previous year (e.g. 1958 November – April includes November and December 1957 and the first four months of 1958).

Investors with shorter time horizons may desire to dial back their risk exposure, especially after the strong seasonal run we have seen from November through April.

Related Articles from the munKNEE Vault:

1. Should You “Sell In May & Go Away”?

The saying “sell in May and go away” infers that the stock market is seasonally weak from May to September and, as such, one should not own stocks during that period of time. As illustrated in the chart below, however, the stock market is not particularly bearish then. It is merely less bullish (i.e. the odds of the market going down vs. up are equivalent). That’s why “sell in May and go away” is not a good trading strategy. Let me illustrate that fact further in the 10 charts below.

2. “Sell in May and Go Away” – in 9 out of 11 Countries it Makes Sense to Do So

The “sell in May and go away”, which implies that the market’s performance is far worse in the six summer months than in the six winter months is the case with respect to US stock markets but what is the status in other countries? I have examined the patterns in the eleven most important stock markets in the world and found that it does, indeed, make sense to “sell in May and go away” in 9 of the 11 countries. In which two countries has it not been the case – at least until now? Read on for the answers.

3. Does “Sell In May & Go Away” still hold true?

One of the most enduring of Wall Street axioms – falling somewhere under “buy low and sell high” but above “greed is good” – is to “sell in May and go away” and, indeed, there appeared to be some truth to the saying. Between 1950 and 2012, the Dow Jones gained an average of 7.6% annually during the November-April period, but only 0.4% during May-October. Does “Sell In May and Go Away” still hold true as a viable investment strategy? Not according to my analysis. Here’s why.

4. May Day! May Day! Should You “Sell in May and Go Away”?

Many articles have been posted today, May 1st, regarding the investing adage “sell in May and go away”. Below are links to 10 such articles on the subject to help you decide what course of action you should take.

5. Stocks: ‘Sell In May And Go Away’ – or Even Sooner! Here’s Why

Taking profits is rarely a bad idea, and staying fully invested at these levels seems foolish. That is why it might pay to raise some capital now, before the sell in May strategy comes up. Having a core position of equities along with some dry powder and keeping a look out for short-term trading opportunities is how I plan to play this market through 2013. [This article presents 5 specific reasons why it might be wise sell in May and go away – or even sooner – this year.]

6. Stop! If You Sell in May and Go Away This Year You’ll Regret It – Here’s Why

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money