No one has a crystal ball and I certainly don’t claim to have one. I do strongly believe, however, that the prices we see today in gold and silver will be looked back upon in the next few years as a great buying opportunity. The data I read and understand tells me the case for gold and silver is now a strong one. I believe the bottom is in for gold and silver for the reasons given below.

believe, however, that the prices we see today in gold and silver will be looked back upon in the next few years as a great buying opportunity. The data I read and understand tells me the case for gold and silver is now a strong one. I believe the bottom is in for gold and silver for the reasons given below.

So writes Doug Eberhardt (http://buygoldandsilversafely.com) in edited excerpts from his original article* entitled Is This the Bottom for Gold and Silver?

[The following article is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Eberhardt goes on to say in further edited excerpts:

I don’t believe the claims that we are in an economic recovery and, as such, that the Fed will begin to taper. Those who are depicting gold and silver as irrelevant investments can’t be seeing the same data I see…Sentiment [couldn’t be more] negative…

What’s On the Horizon for Gold and Silver?

The hardest thing to do is to buy when there has been carnage in the streets, but Market Makers really do…create carnage and invest accordingly. The name of their game is simply profit, any way they can obtain it…

Below are some of the common reasoning against gold and my thoughts. (Much of what I write about goes against the gold bugs typical mantra of weak dollar and inflation. I simply read the data differently than they do. [That] doesn’t mean they and I won’t be right in the long term, but the short term has cost many gold bugs credibility.)

Strong Dollar: I have been dollar bullish since gold’s high in September of 2011. I am still dollar bullish and believe the price of gold will move higher along with the dollar. This is because the dollar simply represents a basket of other currencies, primarily the Euro/Yen/Pound, of which I am more negative on than the dollar. Perception I believe will dictate safety of the U.S. dollar, propping it up. While this typically has been negative for gold, there are many other reasons why the insurance gold provides will be a good hedge against the uncertainty with the banking systems abroad. Eventually this uncertainty will again come home to roost in the U.S., which is the subject matter of my forthcoming book, “Illusions of Wealth.”

There Is No Inflation: I have been in the deflation camp for quite some time as the Fed continues to fight it with QE purchases that are swallowed up by the credit contraction that is still occurring from the pre-2007 excesses. When one ignores credit as part of the equation, they only see the printing of dollars and assume this will be inflationary. The result has been what Keynes describes as “pushing on a string.” The Federal Reserve can’t force businesses and consumers to spend; they can only hope they do. When they don’t spend, the Fed has to keep pumping. There is inflation in the money supply, for sure, but it’s just being swallowed up by other countries that prefer to exchange their currency into dollars.

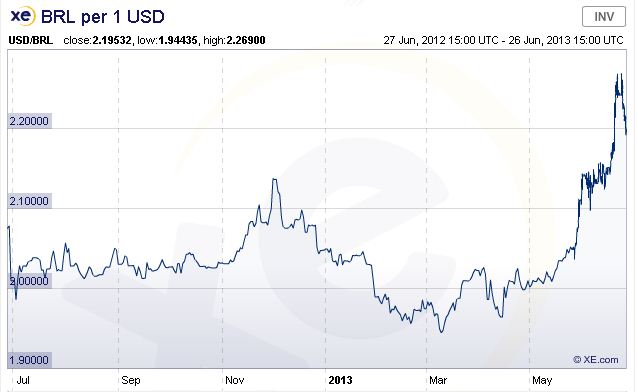

Inflation is not just a U.S. phenomenon. Those in other countries are chasing the same gold and silver with their falling currencies [see the 3 charts below]. On the street [in Argentina,] the exchange rate can be as high as 30% to exchange pesos for dollars. Argentinians remember what occurred in the 80′s. The same could be said for those in Brazil where the Real has plummeted and in India where the Rupee is crashing lower of late.

Argentine Peso vs. Dollar

Brazilian Real vs. Dollar

Rupee vs. Dollar

Perhaps they could have planned ahead. Perhaps you should too. All currencies will be in a race to the bottom to make their products more attractive for the world to buy and increase their GDP.

The Gold Price Is Falling Despite Fed QE: Any improving economic activity is in the sectors where the Fed’s money has flowed, but the cracks are beginning to come to the surface. Higher rates are something the Fed can’t afford to [allow to] occur. Don’t be fooled by any talk of a recovery. You can’t “talk” up a recovery. The data has to be there and it isn’t.

Meanwhile, Obama is continuing Bush policies with talk of more wars (Syria and of course Iran still on the table). Obamcare is causing more layoffs and health insurance premiums to rise in some states with no caps. It’s only a guess as to how long this country can afford wars and paying for things with printed money. They have done a good job of it so far, but just a small rise in interest rates makes all the projections skewed. Banks still are not Marking to Market their assets and play a dangerous derivatives game with interest rate risk. Believe what you want from the likes of Goldman Sachs but don’t pretend all is well in America just because the stock market has moved higher.

Gold is simply insurance against all these issues and more. Things can implode on a dime. People buy car insurance just in case someone slams into you. With the data presented above, the odds are ever increasing that you’ll need that insurance. Why not buy it cheaper?…

80% Probability of Higher Prices for Gold the Next 3 Months

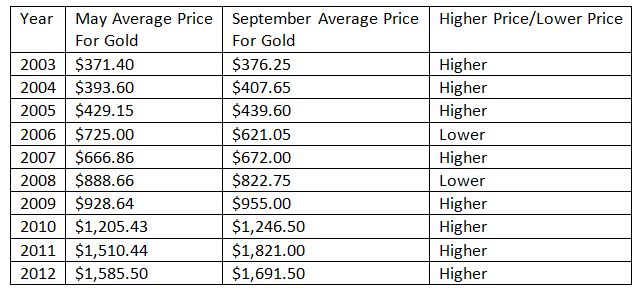

What gives me even more confidence that a bottom is in, or close to being in, comes from the fact that 8 out of the last 10 summers, including the last 4 years straight, have been positive for gold (See Table Below).

If you are conservative, gold would be a safer play than silver right now, but:

- I personally like the risk vs. reward for silver.

- The gold/silver ratio is almost 66 right now and I see that ratio returning to the mid 30′s range again.

- From gold and silver’s current prices, just to reach their 2011 highs again, it would be about a 55% return for gold but a 160% return for silver.

Conclusion

No one has a crystal ball and I certainly don’t claim to have one. [Nevertheless,] I strongly believe that the prices we see today in gold and silver will be looked back upon in the next few years as a great buying opportunity. The data I read and understand tells me the case for gold and silver is now a strong one…If you are conservative dollar cost average into a position for a long time now [otherwise] I am OK with a full allocation into gold and silver at this point in time…

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://buygoldandsilversafely.com/gold/is-this-the-bottom-for-gold-and-silver/ (© Copyright 2012 Buy Gold and Silver Safely; All Rights Reserved)

Related Articles:

1. Goldrunner: Gold Complex So Underpriced Reward Is VERY High & Risk Is VERY Low

A more aggressive devaluation of paper currencies is on the horizon thus the whole PM Complex is completely underpriced. Averaging in from this point on seems warranted. Below is a full explanation as to why that is the case. Read More »

2. Gold is Being Supported By 19 Pillars of Sand & the Tide is Coming In!

I am now bearish on gold because the bulls are bullish for all the wrong reasons, and the price action is supporting my position. In my opinion, gold is being supported by pillars of sand – 19 in total – and the tide is coming in. Read More »

3. Gold: What Will It Take to Remain Bullish?

This year has been an ugly one for gold bulls, but this article answers 5 major questions about gold and provides reasons to stay positive about the future of gold. Read More »

4. Gold & Gold Stocks: A Look At the Current Weakness & Future Expectations

Nearly all markets except the dollar reacted rather badly to Ben Bernanke’s news conference – even though it actually contained no news – Treasury yields soared, stocks were whacked, and so was gold. While the charts certainly don’t look good in the short term, though, it should be pointed out though that investors with a longer time horizon probably won’t make a big mistake by buying on weakness. That being said, however, in the short term all the tentative evidence that a bottoming process may be under way has by now been eradicated. Below are a number of charts illustrating the situation. Read More »

5. Increasing Evidence Indicates a Reversal in Gold & Silver Trend Is Near

We can find nothing – nothing – that has happened over the past two years that invalidates the principal reasons we’ve laid out for owning precious metals. [This article] looks at the key reasons why we originally recommended gold and silver plus, sadly, several new drivers that have developed recently all of which confirm that the bruised precious metal investors out there should still sleep well at night, secure that the foundational rationale for holding gold and silver remains intact. Read More »

6. A Balanced Assessment of the Future of Gold

Volatility in the gold market often results in extremely bullish and bearish views. Below are 4 facts to remember about gold that should help neutralize such views and allow you to take a more balanced and thoughtful approach to the yellow metal. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

It certainly looks like the bottom was hit a few weeks back, there was a huge amount of buying in our office. Not a lot of selling going on, when gold rebounds do you think there will be more selling like last year? or more holding?

It’s all about what JPM decides they want to do. In extricating themselves from their short position in gold and nearly so for silver, they have bought many millions of “representative” ounces on a sale of a lifetime — a sale price induced because of that very same concentrated short they are positioning away from.

The real measure of what we see for the next year will be whether these giant too big to fail banks short the next rally. Stay tuned.

I agree, love gold even though prices have been in flux. But I wonder what your take is on physical gold vs paper gold and the correlation between the two? Paper assets seem too risky right now?

I agree with what this article is saying, things are looking better and better for PM’s…