We’re invested in gold stocks not just to make money, but for the chance to change

our lifestyles and with their lackadaisical [dare I say dismal] year-to-date performance, one may begin to wonder if they’re still going to bring the magic. [Here are my views on the subject.] Words: 740

our lifestyles and with their lackadaisical [dare I say dismal] year-to-date performance, one may begin to wonder if they’re still going to bring the magic. [Here are my views on the subject.] Words: 740

So says Jeff Clark (www.caseyresearch.com) in edited excerpts from an article* which Lorimer Wilson, editor of www.munKNEE.com has further edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Clark goes on to say, in part:

While the answer will depend as much on the individual investor as it does the market, let’s look at some historical patterns to get a hint as to how similar or different our situation is to past bull markets, as well as what realistic expectations we can hold about the future…

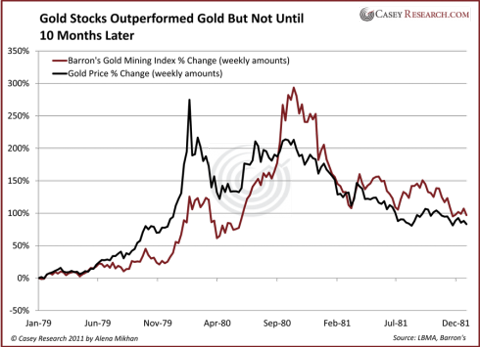

1. Gold stocks underperformed gold for two years prior to the 1979-‘80 mania:

- leading up to the blow-off top in gold in 1980, gold producers lagged the metal for two full years. From January 1977 through the end of 1978, gold rose 58.4% but gold stocks, as measured by Barron’s Gold Mining Index, were up only 11.7%. The metal outperformed the producers by a margin of four to one, despite it being the middle of a bull market.

Today, gold is up approx. [6.2%] year-to-date (through [March 22]), while gold stocks (GDX) have [fallen]… 3.2%. This is a pattern [that is more or less similar] to the pre-mania behavior of the last bull market; it tells us that the current relationship between gold and the equities is not abnormal…

Here’s a chart of gold and gold stocks in 1979 and 1980:

(Click to enlarge)

2. Once the mania began, gold producers returned roughly four times the money:

- From January 1, 1979 through their peak in October, 1980, gold stocks rose 293.6%.

- The metal gained 274.8% during its part of the mania, hitting its pinnacle of $850 on January 21, 1980.

- The big action was with the juniors and explorers; the average return of 15 companies we sampled was 2,313% during this 22-month period. What’s ahead could be truly spectacular.

3. Gold stocks peaked nine months after gold:

- The April Fool’s joke in 1980 was on those who thought the bull market was over at that point. What’s important to realize is that the public’s biggest shift from gold to the equities occurred after gold’s blow-off top.

Regardless of the extent to which the public may be buying gold today, it’s clear gold stocks aren’t on their radar screens. If history is any guide, they will be.

4. Gold stocks did well in spite of the world being a tumultuous place:

- Inflation was over 12% in 1980 and interest rates hit 13.5%.

- Two recessions occurred in the late ‘70s and early ‘80s.

- An oil crisis hit in 1979, and

- Iraq invaded Iran.

In the midst of all this, gold stocks soared.

Home Delivery Available! If you enjoy this site and would like to have every article posted on www.munKNEE.com (approx. 3 per day of the most informative articles available) sent automatically to you then go HERE and sign up to receive Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

With our debt and currency concerns demonstrably worse now, one could easily argue that our present environment is even more supportive of the gold industry.

5. Gold stocks exploded even though the S&P was subdued:

- The S&P rose 36.8% in the same time frame (1-1-79 through 10-20-80) … Not too shabby – but gold stocks outpaced it almost eightfold…

I think there’s one last lesson from these data.

6. Make sure you invest in gold and not just gold stocks:

- Not only is your risk decidedly higher if you invest solely in equities, you lack an alternate form of money that has been used repeatedly throughout history. You’d hate to be part of the mania only to see one or more of your stocks plummet from a political issue or flatline because of a management problem. Gold, meanwhile, will be serving its unfaltering role as money – what I use for a large chunk of my savings. Don’t make the mistake of thinking you don’t need gold just because you own gold stocks.

Conclusion

So, will gold stocks bring us riches? History doesn’t repeat in exact terms, but it usually rhymes – and given our similarities to the last great bull market, I think we’re in the right place.

*http://www.caseyresearch.com/articles/how-long-might-it-take-get-rich-gold-stocks

Editor’s Note: The above article has been has edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. John Embry: PM Stocks One of the Greatest Buying Opportunities of ALL Time!

If we’re not at a bottom [in gold and silver and precious metals stocks], we’re very close to it. The sentiment is dismal and you can see that particularly in the stocks which are almost tragic. I’m shocked quite frankly at the valuations and how low they are. In the fullness of time, this will be seen as one of the great buying opportunities of all-time.

2. Get Positioned: “Gold Rush” Will Cause Gold Stocks to SOAR – Here’s Why

Whatever their reasons, the number of investors wanting exposure to gold is increasing. Many who ignored it a decade ago are now buying. Those who started buying, say, five years ago, continue purchasing it today in spite of paying twice what they paid then. Slowly but surely, it’s becoming more important to more people…but what happens when it becomes a must-own asset to a substantial majority instead of a small minority? Sure, the price will rise, probably parabolically, but putting aside speculation on the price of gold for now, have you thought about what happens if you have trouble finding any actual, physical gold to buy? [Let’s explore that possibility and what that would mean for gold stocks in such an eventuality.] Words: 870

3. Is it Time to Load Up on Gold Stocks?

By almost any measure, gold stocks are undervalued but should we load up? Gold mining companies are earning record margins. Stock prices, however, have not responded in similar fashion but when the broader investing community begins to take notice, investors will snap up these highly profitable stocks and push prices higher. The “catch up” in gold stocks could be tremendous but the question, of course, is timing. We don’t know when gold stocks will begin to catch up and the data don’t suggest they must rise right now or that they’ve hit bottom so should we load up just now? Words: 590

4. Five “M’s” for Picking Gold Mining Stocks

With gold miners, in general, so attractively valued relative to the gold bullion price, the question becomes which stocks are the most compelling and have the best leverage to robust precious metals prices…In order to find the diamonds in the rough, I use what I call “The Five M’s” for mining stocks… Market cap, Management, Money, Minerals and Mine life cycle. [Let me explain each .] Words: 1146

5. Is It Time to Nibble at Gold Miner Stocks?

The behavior of the stocks of the various gold miners in recent times warrants special attention. Let’s take a look at the GDX:GLD ratio, the Gold Miners Bullish Index and the volatility of the currencies and stock market indices of the emerging markets where most of these mines are located and determine what they suggest as to what we could well expect in the performance of such stocks in the months ahead. Words: 585

6. Jeff Nielson: More of What to Look for When Investing in the Gold Miner Sector

With gold recently trading at its nominal high it is only natural that investor curiosity about precious metals mining companies should start to grow and the fact that relatively few investors know much about the various types of companies in this market sector is an indication that this market is many years away from peaking. [This article will change all that.] Words: 1912

While investing in gold mining companies is not quite as simple as novices to this sector might at first conclude, neither is it so overwhelmingly complicated as to make these companies inaccessible to individual, retail investors. Below are a number of things to look for when considering an investment in such companies. Words: 2745

8. Gold Stocks: Get Ready, Get Set, GO!

Both gold and silver continue to trade well below their inflation-adjusted highs in nominal terms, and the market is now beginning to acknowledge the profit potential that precious metals equities offer at today’s bullion prices. We believe the equities will offer more upside than the bullion over time. Many of the smaller names are well priced and have momentum behind them. The prospects for gold stocks look extremely bright [for very good reasons. Let us explain.] Words: 2250

9. Gold Mining Stocks Are CHEAP Compared to Price of Gold

So far in 2011 gold prices have increased [approx. 8] percent.. while the stocks of gold [mining] companies in the HUI have… declined 13%…[As such,] this year’s carnage has created a substantial opportunity to buy healthy gold mining companies at their second-cheapest level in nearly 30 years compared to gold bullion. [Let me explain.] Words: 1265

10. 9 Things to Look for When Choosing a Junior Mining Company to Invest In

In mining exploration, an “anomaly” is a geological formation that might attract a prospector’s interest. However, one rule of thumb is that you have to look at 1,000 anomalies to find one prospect and fewer than one prospect in a thousand turns into a mine. In other words, finding a mine is a million-to-one shot and that is one reason why junior mining stocks are highly speculative. Another reason is that it’s much easier to launch and promote one of these stocks than it is to build a profitable business. So junior mines attract more than their share of unscrupulous operators and stock promoters. Words: 504

11. Best Hedge Against Inflation Is Owning Gold and Silver Mining Stocks

We are about to encounter major inflation and the absolute best hedge against such inflation is by investing in the companies that mine gold and silver. You often get leverage of 2 to 4 times the price appreciation of gold or silver. If gold goes up by 50%, your miners may very well double or triple in value. Words: 1426

12. Why Invest in Junior Miners?

Leverage is the simple answer. It is not uncommon for junior mining companies to experience huge gains (10x or more) very quickly as news of a discovery is made known to the public. Words: 893

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money