Jim Rogers is one of the most successful investors of all-time…and he buys value. Back in 1999, he predicted that a “supercycle” commodity bull market would see raw material prices advancing for longer than in any previous uptrend led by gold and silver. Gold was trading near its low at $252 and silver at $4 at the time but with gold up 650% from its lows and silver with an even greater gain – obviously Rogers was right. Rogers has now stopped buying gold moving, [instead,] towards a greater commodity opportunity that he thinks offers the same kind of values that gold and silver did a decade ago. Words: 909

in 1999, he predicted that a “supercycle” commodity bull market would see raw material prices advancing for longer than in any previous uptrend led by gold and silver. Gold was trading near its low at $252 and silver at $4 at the time but with gold up 650% from its lows and silver with an even greater gain – obviously Rogers was right. Rogers has now stopped buying gold moving, [instead,] towards a greater commodity opportunity that he thinks offers the same kind of values that gold and silver did a decade ago. Words: 909

So says Robert Zurrer (www.moneytalks.net) in edited excerpts from his original article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Zurrer goes on to say, in part:

Agriculture: The Next Big Bull Market

Consistent with his devotion to buying undervalued assets, Rogers now sees the same quality of values in agriculture that he saw in gold and silver. [While he] is not selling his gold and silver believing that “gold is certainly going to go to $2,000 over the years; it looks like it’s going to go much higher during the course of the bull market” and that “gold prices are not in a bubble because not everyone is buying yet”, he believes that “agriculture prices are still, on a historic basis, extremely depressed, and in my view I’ll probably make more money in agriculture than other things.”

Rogers thinks that the current commodities supercycle will last for 20 to 25 years, a view supported by the research of Chris Watling of Longview Economics who traced secular bull cycles back to 1750. As this commodity bull started in 2000, if Whatling and Rogers are correct, this bull will run higher until 2020-2025.

In short, if you missed buying gold and silver at extremely depressed levels, Rogers thinks you have another great chance to buy into an imminent bull market at great value because the fundamentals are [so much better than they have ever been].

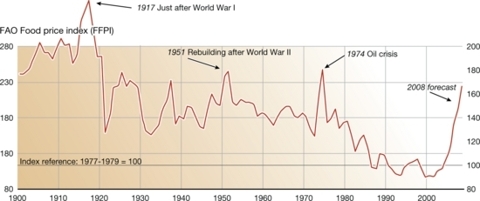

There is a powerful underlying demand for food. When food prices surged in 2007 millions went hungry with riots from Egypt to Haiti and Cameroon to Bangladesh. Rioting calmed down in 2008 when prices dropped, but starting at the beginning of 2009 they’ve been going up and Rogers expects “more turmoil, but I didn’t expect it to happen this quickly because food prices are somewhat depressed”. Clearly a bull market rise from current levels will cause even more starvation, riots and urgent demand [as the chart below shows].

The FAO Food Price Index measures the prices of Dairy, Oils & Fats, Cereals Sugar & Meat.

On the longer term chart [below it is evident that] real food prices were more expensive in 1917 than they are here today. Demand is there. Agriculture will be “wildly exciting” as global food shortages worsen, according to Rogers. “You pick an agriculture product and I’ll say buy it,” he said.

Shortages are showing up right now as the world population has more than doubled from 3 billion in 1960 while the amount of arable farmland has been decreasing. If the world population rises from its current 6.8 billion to 9.1 billion by 2050 as the United Nations forecasts, a lot of people are going to be scrambling for food.

Click on the 1900-2008 FAO Food Chart for a Larger Image

What to Invest in to Take Advantage

Good advice from Daniel Keirnan in his article “Farmland Investment, the Next Big Portfolio”:

The question is what are the best ways for making money from the agricultural sector? One way is to invest directly into agriculture stocks such as farm equipment maker John Deere (DE), global seed giant Monsanto (MON) or fertilizer company Potash Corp of Saskatchewan (POT).

Another method is to invest in agricultural futures through Exchange Traded Funds (ETFs) such as AIGA on the London Stock Exchange or DBC in the U.S. which tracks an entire basket of agricultural commodities including corn, soybeans, wheat, cotton, sugar, coffee, cattle and pigs. These commodities ETFs try to track the spot price of the various commodities they include.

The advantage of these stocks or ETFs is that they are easily trade-able by anyone who has an online brokerage account. The disadvantage, however, is that they are still financial instruments, and as such can fluctuate widely in price.

One option most individual investors tend to overlook is direct investment in farmland. In many ways, a farmland investment is more secure, stable and tangible then putting money into stocks.

Farmland investments for individuals will pay a regular yearly dividend from the sale of crops, and also provide the opportunity for long-term capital gains as farmland increases in value during a bull market in food.

Conclusion

Don’t buy gold now. Rogers says food and agriculture are great values and will be the next big demand driven bull market.

*http://www.moneytalks.net/daily-updates/5658-jim-rogers-stop-buying-gold-now-buy.html

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I don’t think he was literal when he said NOT to buy gold. It was for effect. He just really likes agricultural commodities. He understands the exponential function. Agriculture is the only stock that’s as sure as physics going to rise until there is the inevitable and sudden event of disease, genocide, or climate change that results in a lot of dead people, plants, places, and possibility. Gold is still valuable because of it’s cool color and luster. We’ve just made it mean so much more and as long as enough people are in agreement it will mean so much more and so then will it’s value. It is truly is no different than the fiat currency we use except that’s it’s non renewable. We NEED to eat and we NEED to drink. We don’t really NEED anything else. Ironically, it was the advent of agriculture that marked the beginning of the end for all living things, and that end is just one choice away from the same beginning. We will eventually understand that it is our body/ mind that is the most high tech thing of all, and as long as we continue to regard anything that prevents us from having to use our body and mind we’ll continue to be generally dissatisfied with ourselves and life – at best. When children are taught that there is no good or bad or right or wrong, and that it’s about workability – how well something works for us and how not and everything in between will be able to distinguish workable technology from unworkable. The use of the atom bomb was not a very workable way of using a technology that can also provide light for millions of children being read to at night. In the meanwhile, let’s make money and kick some ass. 😉 EVERYTHING IS PERFECT. -Adam Holck

Gold may go up to $2500 per ounce. I also agree with Jim Rogers about Agri Commodity stocks. Silver also will touch $100 in near future

I think Gold is a relatively mid termhold, i do see prices increasing but, along with Mr Rogers, I invest for the long term and in assets that will always be in demand. I know that in 30 years time with 9 billion people to feed, I would rather own farmland then a gold bar, i know which will hold more value and will generated an annual income as well as capture long term inflation in the value of the underlying asset.

don’t buy gold – give me a break, the bull market in gold/silver is far from over. Was Jim Rogers a participant in last gold craze? nope not realy. Yes food prices will go up – so will evrything else. But nothing beats a a gold mania! nothing!