…A lack of discipline, inability to delay gratification, failure to  understand basic mathematical concepts, materialistic envy, absence of critical thinking skills, and a delusionary view of the world have left the majority of Americans broke and in debt. [Let me explain further.]

understand basic mathematical concepts, materialistic envy, absence of critical thinking skills, and a delusionary view of the world have left the majority of Americans broke and in debt. [Let me explain further.]

The commentary above & below consists of edited excerpts from an article* by James Quinn (theburningplatform.com).

The monthly outflow exceeds the monthly inflow for the majority of Americans. That is why the average household has credit card debt of $7,500…on top of an average mortgage obligation of $155,000 and average student loan commitment of $32,000.

Every person has to accept personal responsibility for their own life. There is one sure fire way to accumulate savings and that is to spend less than you earn. It sounds simple, but the vast majority of Americans have chosen to live beyond their means by allowing themselves to be lured into debt by the Wall Street debt peddlers and their Madison Avenue media maggots selling dreams to willfully ignorant delusional consumers.

Consumer dependent corporations hawking autos, electronics, glittery baubles, fashionable attire, toxic processed sludge disguised as food, and other slave produced Chinese crap, require a vast unlimited supply of easy money debt to keep profits rolling in and the Federal Reserve has been willing and able to accommodate them.

The Wall Street hucksters are only too happy to help you finance a lifestyle well above your true means. They borrow from the Fed at .25% and charge you 10% to 20% for the use of credit created out of thin air. They always win. The willfully ignorant are thrilled they can now pay their IRS bill, property taxes, utilities, and just about every daily expense with a credit card. They fail to acknowledge the insanity of their chosen lifestyle path.

Millions have chosen to live lives of quiet desperation in order to keep up with the Joneses. They would rather portray themselves as successful and wealthy, rather than make the necessary sacrifices required to achieve success and wealth.

McMansion Envy

With a median household income of about $56,000 and median net wages per worker of $29,000 it is fairly easy to grasp the monthly inflow of a middle income household. In Median World, taxes will take about a 16% chunk out of those figures, so the median household ends up with about $4,000 of take home pay per month. If they own a median priced home of $189,000, their monthly mortgage payment would likely be about $850. Add another $200 to $300 per month for property taxes and you are on the hook for $1,100 per month. A median rent figure would be in the same ballpark, unless you live in SF, NYC or a few other overpriced markets. This is where many people go off course, allowing themselves to be lured into more house than they can really afford with low down payments guaranteed by the government, driving the monthly housing burden north of $1,500. McMansion envy has destroyed more lives in the last ten years than any other delusion.

The apologists for the non-saving masses often argue Americans were utilizing their homes as a store of wealth to be used in retirement. This is just another false story line, as the savings-poor public used their homes like an ATM machine from 2001 through 2008, extracting hundreds of billions to spend on granite counter tops, exotic Caribbean vacations, home theaters, BMWs, Olympic sized pools, bling, and new boobs for mommy. Equity in homes plunged from 60% to below 40% in the space of a few years and has only recovered to 55% after the Fed induced faux housing recovery. There are still millions of homeowners underwater, with the next leg down guaranteed to add millions more.

Dining Out

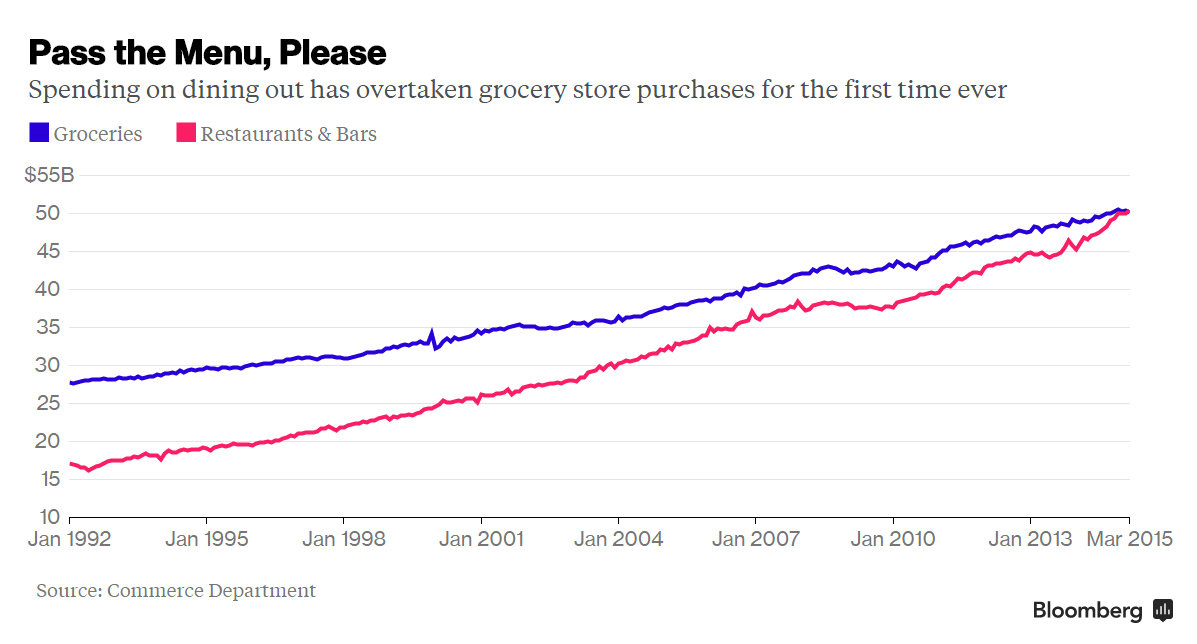

Dining out is the ultimate personal choice and a huge factor in the non-existent savings of American households.

Over the last two decades Americans have abandoned the frugality of buying food at the grocery store on sale, using coupons in favor of eating out at a hefty premium on a daily basis. The result has been a $10 billion gap in spending between groceries and dining out being obliterated by an army of “live for today for tomorrow we can make the minimum payment on our credit card” juveniles. Not only has this penchant for satiating their hunger contributed greatly to their lack of savings, but has been financed on their credit cards. That $25 Applebees dinner, financed at 18% interest over the next ten years ends up costing $54. Multiply this foolishness hundreds of times per year over decades and you understand why Boomers have less than $1,000 in savings accounts and $12,000 or less in retirement savings. It’s just math.

Possibly the largest squandering of resources occurs on a daily basis, as Americans spend money they don’t have on $5 lattes, toxic fast foodstuff, craft beers, and whatever else strikes their fancy. According to the most recent Bureau of Labor Statistics consumer expenditure surveys, the typical household spends $2,625 each year, or around $219 per month, on food away from home…Dining out is viewed as a social event, and consumers choose fun and frivolity over finances. The concept of brown bagging a lunch for $1 rather than spending $10 at Paneras, or brewing a pot of coffee for 25 cents rather than paying $5 at Starbucks is inconceivable to the “live for today” credit card cowboys and cowgirls.

New Cars

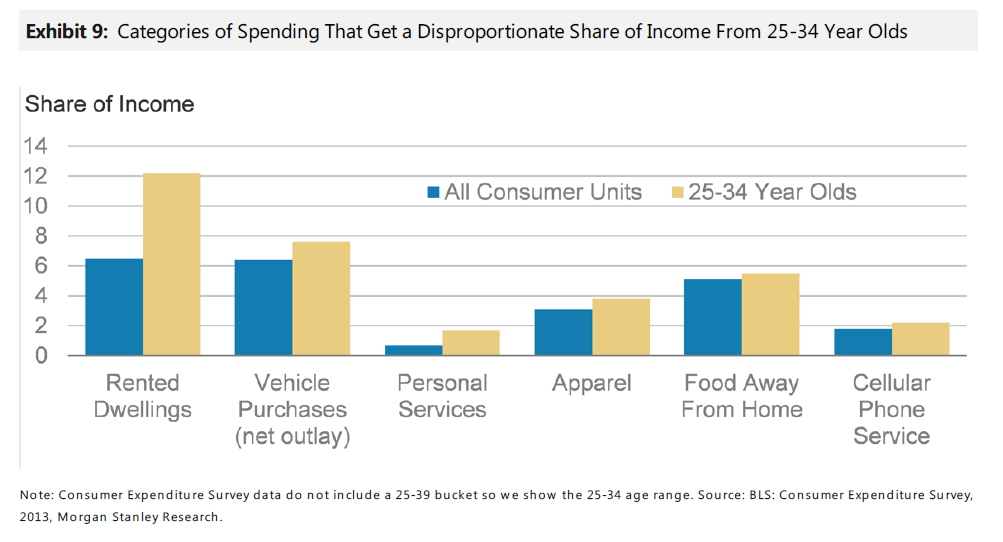

…[With] their neighbors and coworkers all driving new cars…[most Americans] can’t be seen driving a used 10 year old clunker. People will think they’re poor. Shallow appearances are all that matter to a vast swath of America. According to Edmunds.com, the average monthly payment on a new vehicle is $479. We can’t have one spouse driving a new car, while the other slums it on public transportation, so two newer cars will add another $900 or so of expenses to the monthly budget…

Annual auto sales have soared from 10 million in 2009 to almost 18 million today.

I’m on the road every day and it is mind boggling to see the number of newer $30,000 to $50,000 vehicles cruising the highways and byways of America. Virtually none of these vehicles are owned outright.

Americans are essentially renting their luxury wheels so they can appear successful but the way to become financially successful on a modest income is to buy used cars and drive them for ten or more years. The years of no car payment can be directed into savings. Very few people chose this path. That is why auto loan debt has now exceeded $1 trillion, up 40% since 2010.

Wall Street wants you in perpetual debt and millions have bought it hook line and sinker – but at least they appear prosperous to their neighbors, while they’re really in debt up to their eyeballs.

Mobile Phones & Cable TV

…The average American…can’t go 20 seconds without checking their phone and they are paying through the nose for the privilege of staying terminally connected. We have smart phones for dumb people. Even welfare recipients without jobs, living in low income housing and dependent on food stamps, somehow find the funds to have a smartphone in their hand 24/7. Maybe directing those funds towards books might give them a better chance of exiting poverty. In one survey, 46% of Americans with mobile phones said their monthly bill was $100 or more and 13% said their monthly bill topped $200 per month. The average individual’s cell phone bill was $73 per month last year, a 33% increase since 2009, according to J.D. Power & Associates.

When they aren’t texting, tweeting, or Facebooking on their iGadgets, they are watching basic cable boob TV at average price of $100 per month, up 39% since 2010. Our connoisseurs of crapola need the NFL Package, HBO, Showtime, Netflix, and on demand porno.

Tricked out smart phones and cable packages are not necessities. They are wants. Wasting $200 to $300 per month on narcissistic compulsions is a choice.

The expenditures detailed above don’t include healthcare, entertainment, vacations, government extractions (tolls, fees, fines, taxes) and assorted other miscellaneous wastes of money. It is pretty clear the monthly outflow exceeds the monthly inflow for the majority of Americans.

Since 1980 the U.S. population has gone up by a factor of 1.42, GDP has expanded by a factor of 6.3, and consumer debt has exploded by a factor of 10. The amount of consumer debt per person in 1980 was $9,300. Today, the total is an astounding $65,200 per person, a 700% increase in 35 years. We owe $21 trillion of mortgage, credit card, student loan and other debt to the felonious Wall Street bankers. This nation has gone insane. “In individuals, insanity is rare; but in groups, parties, nations and epochs, it is the rule.” – Friedrich Nietzsche

Final Words

The millions of American households living on the edge and headed for a poverty stricken old age have a million excuses for why they never saved a dime. These are the same people who will demand the government save them from their own foolishness and irrational life choices. They will demand the rich (anyone who worked hard, saved, and planned for their future) be taxed more, so they don’t have to live with the consequences of their reckless disregard for common sense and self-discipline. These people should have read some Shakespeare in high school, and maybe they wouldn’t be in this predicament. “The fault, dear Brutus, is not in our stars, but in ourselves.” – William Shakespeare, Julius Caesar

What separates us from animals is our ability to think and act in a rational manner, rather than just on instincts and urges. Based on what has occurred in this country over the last 35 years, however, I’m starting to question the rational part. It’s almost as if a mental illness has befallen a majority of Americans. The Deep State and their minions on Wall Street and the corporate media certainly attempt to mold and manipulate the minds of the masses, but at the end of the day people are free to disregard those messages and live meaningful lives on their own terms.

Even though living above your means has become “normal”, it is only normal in relation to our profoundly abnormal society. Telling people the truth today is meaningless, as they don’t want their illusions destroyed, but destroyed they will be, when this teetering edifice of debt comes crashing down on their heads.

Want more such articles? Just “follow the munKNEE” on Twitter; visit our Facebook page and “like” an article; or subscribe to our free newsletter – see sample here.

*http://www.theburningplatform.com/2015/10/20/confusion-delusions-illusions/ (© The Burning Platform – All rights reserved)

The above post has been edited by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – register here) for the sake of clarity ([ ]) and brevity (…) to provide a fast and easy read.

Related Articles from the munKNEE Vault:

-

Don’t Obsess About “Keeping Up With the Joneses” – Outsmart Them Instead! Here’s How!

If you are hoping to live a happier, fulfilled life without money stress, you may not want to obsess with the Joneses. You can outsmart them by making better choices. HERE are several ways you can likely beat the Joneses and improve your financial health.

2. A Comparison Of Household Spending – By Country – For Different Expenses

The Economist infographic below shows how much people in households around the world allocate to different expenses such as food, housing, recreation, transportation, and education.

3. Credit Card Debt Binge Making Americans Debt Slaves Again

The final effort in the debt-fueled “recovery” of the U.S. economy from the Great Recession – the increase in consumer credit card debt – is seen by Equifax as that of “American consumers…getting on with their lives.” Yes, indeed, their lives as debt slaves!

4. 8 Signs You’re Flirting With Financial Ruin

Are you heading for a financial fall? The line between a future of financial solvency and one of distress is thinner than you might think. Bankrate offers eight signs you’re flirting with financial ruin. If four or more of these signs sound familiar, it’s time to seek help. [Take a look.] Words: 1697

5. 10 Money Ideas That WILL Change Your Life

Personal finance isn’t nuclear physics – just spend less than you earn, save and invest the rest – but knowing what should be done and actually doing it, however, are two different things. Here are 10 money lessons I wish I had known when I was 20 which have the power to change your life if you are willing to embrace them. Words: 1340

6. Welcome to the New Retirement Model – NO Retirement! Here’s Why

Welcome to the new model of retirement. No retirement. In 1983 sixty two percent (62%) of American workers had some kind of defined-benefit plan. Today less than 20% have access to a plan. The majority of retired Americans largely rely on Social Security as their de facto retirement plan [and the 35 and younger cohort are not able to save, or save enough, to eventually retire. True retirement is now a thing of the past except for a privileged few. Let me support this claim.] Words: 1091

7. Financially Most Americans Are Totally Unprepared – What About You?

It’s up to the concerned and critical-thinking among us to look at the math, the hard data underlying the headlines, and construct what we can best calculate to be true about our current personal financial level of (un)readiness for the future and the truth is that there are 3 adult generations in the U.S. are experiencing a squeeze that is making it harder to create value, save capital, and pursue happiness than at any point since WWII. Let’s walk through the numbers.

8. Secure Your Retirement Starting Now – Here’s How

With people living longer and spending as much as 30 years in retirement, if you want to maintain a moderate standard of living, it is essential to plan your retirement well in advance to secure your golden years. This article outlines 6 ways to do just that. Words: 665

9. U.S.A.: United States of Addiction – Our Insatiable Appetite for Debt

16 point 7 trillion dollars. That is our current national debt. 12 point 8 trillion dollars. That is the amount households carry in mortgage and consumer debt. We are now addicted to debt to lubricate the wheels of our financial system. There is nothing wrong with debt per se, but it is safe to say that too much debt relative to how much revenue is being produced is a sign of economic problems. At the core of our current financial mess is how we use debt as a parachute for any problem. [Unfortunately,] addictions are never easily cured and we have yet to come to terms with our insatiable appetite for debt. Words: 850

10. 75% of Americans are in Deep —t!

Rising education and medical costs, on-going credit card interest payments, well used personal lines of credit and large mortgage debt and home equity loans – most a penchant for living beyond their means – is keeping 75% of American households in some degree of debt. Take a look and then pass it on to your friends, neighbors and co-workers.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money