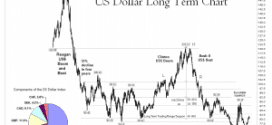

This summer we are nearing a possible inflection point in terms of Fed actions. The mere suggestion from the Fed that something is going to change is enough to supercharge markets, either up or down….Will markets go to 20,000 or to 5,000? That depends upon the Fed and how much they debauch the currency…….Stay tuned, this story has hardly begun.

mere suggestion from the Fed that something is going to change is enough to supercharge markets, either up or down….Will markets go to 20,000 or to 5,000? That depends upon the Fed and how much they debauch the currency…….Stay tuned, this story has hardly begun.

So writes Monty Pelerin (www.economicnoise.com) in edited excerpts from his original article entitled Market Madness.

[The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Pelerin goes on to say in further edited excerpts:

It is hard to continue an economic policy based on smoke and mirrors but that is all the Fed has to work with. What they do and how well they do it will determine how high or low markets go. Nothing they do, however, has anything to do with healing the economy.

The Fed’s charter never included keeping markets levitating beyond where they should be. Now, at least de facto, it does. The Fed surrendered whatever independence it supposedly had.

- It is now just another tool of the political class. Like all government agencies, it exists to benefit the political class.

- Its ability to effect positive change in the economy is over.

- Its role now is to keep financial markets levitating so as make some believe the economy is recovery.

The Fed is not [independent] and there is nothing that the Fed can do to alter that fact.

[The fact is that the Fed] can not stop liquidity infusions [because if they were to do so:- financial markets would collapse and

- government checks would stop going out.

The Federal government has no means of financing its spending levels without resorting to its own captive counterfeiter.

Will markets go to 20,000 or to 5,000? That depends upon the Fed and how much they debauch the currency…

Stay tuned, this story has hardly begun.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://www.economicnoise.com/2013/07/10/market-madness/ (© 2013 Monty Pelerin’s World. All rights reserved. )

Related Articles:

1. Fed’s Tapering Plans Will Be Delayed For These 5 Reasons

The financial markets were in distress lately because of Fed Chairman Ben Bernanke’s suggestion that the Fed might taper off its quantitative easing programs starting at the end of this year and ending in 2015. Here are five reasons why markets shouldn’t worry too much about the Fed leaving the stage: Read More »

Just the mere suggestion that this round of quantitative easing will eventually end if the economy improves is enough to severely rattle Wall Street. U.S. financial markets have become completely and totally addicted to easy money, and nobody is quite sure what is going to happen when the Fed takes the “smack” away. When that day comes, will the largest bond bubble in the history of the world burst? Will interest rates rise dramatically? Will it throw the U.S. economy into another deep recession? Can the Fed fix this mess without it totally blowing up? Read More »

3. Rising Interest Rates Could Plunge Financial System Into a Crisis Worse Than 2008 – Here’s Why

If yields on U.S. Treasury bonds keep rising, things are going to get very messy. What we are ultimately looking at is a sell-off very similar to 2008, only this time we will have to deal with rising interest rates at the same time. The conditions for a “perfect storm” are rapidly developing, and if something is not done we could eventually have a credit crunch unlike anything that we have ever seen before in modern times. Let me explain. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money