Sure, the market is getting more and more expensive, debt levels are still high around the globe, and the Drudge Report assures us daily that the world is going to hell in a handbasket, but does this signal the end is near for stocks and the economy? This article presents 4 “big picture” charts or indicators to help determine whether the markets and economy are topping out and ready to roll over. Let’s take a look.

around the globe, and the Drudge Report assures us daily that the world is going to hell in a handbasket, but does this signal the end is near for stocks and the economy? This article presents 4 “big picture” charts or indicators to help determine whether the markets and economy are topping out and ready to roll over. Let’s take a look.

The above introductory comments are edited excerpts from an article* by Cris Sheridan (FinancialSense.com) entitled Still No Sign Of A Bear Market – Here’s Why.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Sheridan goes on to say in further edited excerpts:

Although certain events can always take the markets by surprise and lead to a correction, in general, most major turning points and trend changes between bull and bear markets are associated with a meaningful and prolonged decline in:

- economic activity,

- a heightened level of financial stress and

- a rapid decline in corporate profits

Right now, as the charts below clearly show, we see none of these things currently taking place.

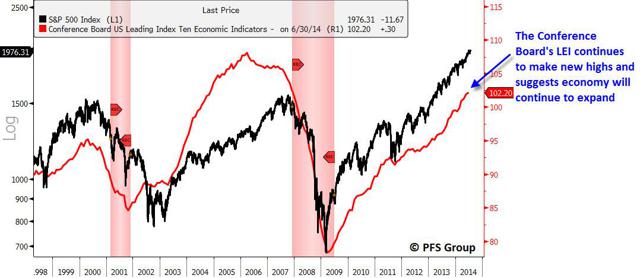

1. Economic Data

The Conference Board’s Leading Economic Index (in red), which we’ve shown numerous times before, measures a wide range of economic data across the U.S. and shows the main trend is still positive (S&P 500 in black). Until this and other LEIs begin to weaken and reverse trend, the overall economic backdrop is favorable.

(click to enlarge)

Source: Bloomberg

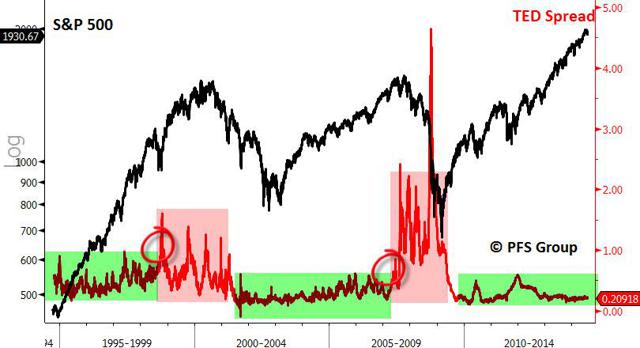

2. Financial Stress

The TED spread is a well-known way to measure the level of financial stress between large banks and, as you can see, highly correlates with major tops in the market as pressures begin to exert themselves within the economy and wider financial system. Current levels of financial stress are quite low and not showing the signs we’d expect to see near a top in the market.

(click to enlarge)

Source: Bloomberg

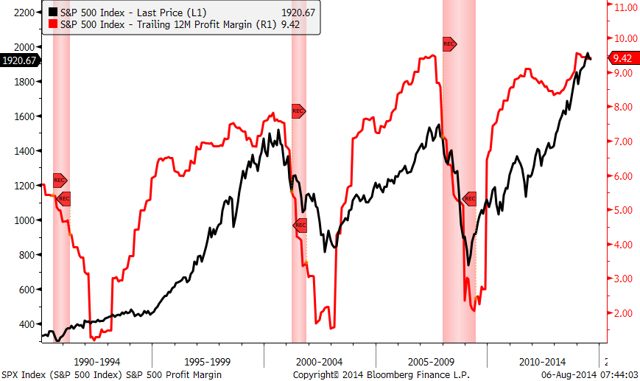

3. Corporate Profit Margins

The stock of a company rises and falls each quarter based on their earnings. The stock market is, of course, a market of stocks and so what happens when the majority of companies report better earnings? The stock market rises. However, as Investopedia says, “the earnings of a company often doesn’t tell the entire story.” For that, you have to look at profit margins, which take into account costs as well.

Here we provide a chart of the collective profit margins of S&P 500 companies. As you can see, profit margins peak along with the stock market and often signal the beginning of a bear market, something which hasn’t happened yet.

(click to enlarge)

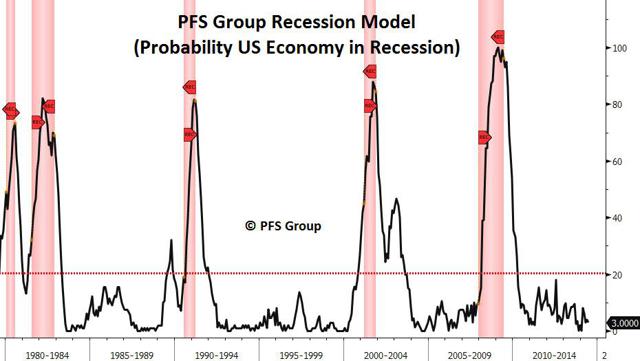

4. Probability of a Recession

Corroborating the message from the chart above is our own Recession Model, which shows the current probability of a U.S. recession at only 3% (Note: this model is optimized to spike once certain threshold levels are met to help delineate between a minor economic slowdown and the beginning of recession).

(click to enlarge)

Source: Bloomberg

Summary

When we look at the direction of U.S. economic data, the probability of a recession, levels of financial stress, and corporate profit margins the message is clear: we are not yet seeing any of the tell-tale signs associated with a major peak or beginning of a bear market in U.S. stocks.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

* http://www.financialsense.com/contributors/cris-sheridan/still-no-sign-bear-market (© 1997–2014 Financial Sense® All Rights Reserved.)

Follow the munKNEE!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

Related Articles:

1. Financial Asset Values Hang In Mid-air Like Wile E. Coyote – Here’s Why

The financial markets are drastically over-capitalizing earnings and over-valuing all asset classes so, as the Fed and its central bank confederates around the world increasingly run out of excuses for extending the radical monetary experiments of the present era, even the gamblers will come to recognize who is really the Wile E Coyote in the piece. Then they will panic. Read More »

2. NO Amount of Money Printing Can Cleanse the Rot of the U.S. Economy

The U.S. economy is on life support, graciously provided by Central Planners but no amount of money printing can cleanse the rot of the U.S. economy. In this Markets at a Glance, we investigate the U.S. consumer and show that for a large portion of the population, things are not anywhere close to being better, in fact they are worse than before the recession. Read More »

3. How Much Time Before “The 7 Bubbles of America” Start to Burst?

History has shown us that all financial bubbles eventually burst. It is not a question of “if” they will burst. It is only a question of “when” and when the 7 current financial bubbles in America burst, the pain is going to be absolutely enormous. That being said, how much time do you believe that we have before these bubbles start to burst? Read More »

4. No Recession Until These 6 Indicators Are Triggered

Despite a long list of major risks to the global economy, the trend for the stock market is still UP until proven otherwise. At this stage it is absolutely critical to be cautious and watch for signs of a market correction or peak, but it is our view that a recession won’t take hold until the following 6 key indicators are triggered. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money