From corrupt politicians and drug cartels to tax cheats and alimony deadbeats, more or less everybody’s laundering money these days. Let’s say you have a little spare cash and you would prefer to keep it out of the grubby hands of various tax authorities, or you don’t want your spouse to know about it, or your kids. Fear not. With a little financial detergent, your dirty money can be rendered more or less untraceable. Here’s how.

or less everybody’s laundering money these days. Let’s say you have a little spare cash and you would prefer to keep it out of the grubby hands of various tax authorities, or you don’t want your spouse to know about it, or your kids. Fear not. With a little financial detergent, your dirty money can be rendered more or less untraceable. Here’s how.

The above introductory comments are edited excerpts from an article by Diane Francis entitled A Beginner’s Guide To Laundering Money as posted* on BusinessInsider.com by Mike Nudelman. (Diane Francis is editor at large with The National Post and a professor at Ryerson University’s Ted Rogers School of Management in Toronto, Ontario, Canada)

Francis goes on to say in further edited excerpts:

..[T]he flow of illicit capital is distorting the global economy,

- draining wealth from emerging nations and

- inflating the cost of assets in the developed world

- $1.08 trillion departed China illegally, despite currency-control laws that require people to obtain a permit to exchange more than $50,000 a year worth of yuan into any foreign currency)…

- $880.96 billion was spirited out of Russia,

- $461.86 billion left Mexico,

- $370.38 billion left Malaysia,

- $343.93 billion left India,

- $266.43 billion left Saudi Arabia, and

- $192.69 billion left Brazil.

The total outflow, among 20 emerging economies, was $5.9 trillion, equivalent to $49 billion a month. From corrupt politicians and drug cartels to tax cheats and alimony deadbeats, more or less everybody’s doing it.

Americans wishing to spirit their cash offshore are increasingly finding their efforts thwarted by Washington’s 2010 Foreign Account Tax Compliance Act [FACTA], which requires foreign banks to turn over information about accounts held by U.S. citizens, but plenty of avenues remain for the dedicated money launderer — particularly if he or she is willing to violate the law.

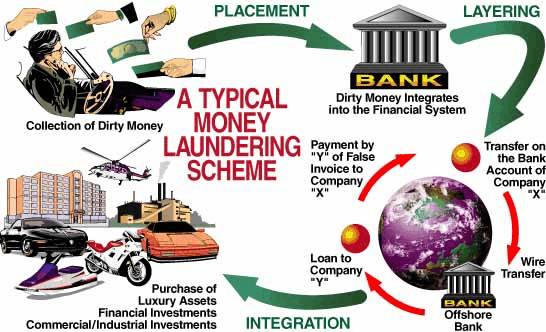

Here are the basics:

Mike Nudelman/Business Insider

Mike Nudelman/Business Insider

LESSON 1: THE PEOPLE’S REPUBLIC OF OFFSHORE

Macau and Hong Kong are considered Special Administrative Regions of the People’s Republic of China, and part of what makes them special is that they are great places to launder cash. Macau is the casino capital of the world, with seven times more gaming revenue than Las Vegas, and Hong Kong is home to plenty of compliant banks and other intermediaries willing to transfer funds anywhere in the world without asking too many questions, for a fee.

Here Are the Many Benefits of Having a Bank Account in Hong Kong

– Find Yourself A Junket

Let’s say you live or work in China and want to hide a massive bribe. First, you must convert it from yuan into another currency without the government knowing. The easiest way to do this is to contact a junket, an agent in mainland China who will give you casino chips for your cash, minus fees of up to 20%.

– Hit The Casino

Take the chips to a friendly, cooperative casino, where you can gamble with them, cash them in for Hong Kong or U.S. dollars to then spend as you see fit, or deposit in a Hong Kong bank branch or, for extra safety, take them to a lawyer specializing in offshore laundering. Meanwhile, the casino will mix your chips with those from legitimate gamblers, and its accountants will book your $1 million as paid-out winnings.

– A Whirlwind Tour

Your bank or lawyer must wire-transfer the funds in such a way that the money crosses multiple borders, to frustrate detection or confiscation. For instance, the money might end up in a US trust managed by a shell company in Grand Cayman, owned by another trust in Guernsey with an account in Luxembourg managed by a Swiss or Singaporean or Caribbean banker who doesn’t know who the owner is.

Mike Nudelman/Business Insider

Mike Nudelman/Business Insider

LESSON 2: LITTLE BLUE MEN

You remember the Smurfs, those adorable little blue creatures? In financial circles, “smurfs” aren’t so innocent. They’re everyday folks who help the big guys launder their cash by making tons of tiny bank deposits and transfers in order to move money without detection.

– Find Yourself A Smurf

After arranging a smurf deal by phone or email, you’ll be asked to have the cash couriered to a smurf’s residence (probably not a mushroom in the forest, but you never know). The smurf will then deposit small amounts of your cash into an account every day for weeks or months — or years — avoiding watchful eyes by keeping the numbers small.

– Make A Withdrawal

Along the way, you can ask your smurf to withdraw some cash — which has since been rendered untraceable — but don’t go crazy. [It would be] better to have a bank wire-transfer the money to your offshore accomplices or your shell companies.

– Beware Of Cocky Smurfs

Smurfs are supposed to stay under the radar. That’s what makes them smurfs but the rise of internet banking had made smurfing even more lucrative, and some top practitioners became so big they began to draw attention. For years, Hong Kong’s most prolific money launderer was a teenager named Luo Juncheng, who originally opened a Bank of China account with a $500 deposit. During the next eight months, he made nearly 5,000 deposits, and more than 3,500 withdrawals electronically, moving $1.67 billion offshore before attracting notice. He was sentenced to 10 years in prison in 2013 — bad news for the smurf, and his clients.

Other smurfs come to attention of authorities through their flamboyant lifestyles. In March, another Hong Kong resident, Carson Yeung, was sentenced to six years for laundering $91.27 million through his bank accounts between 2001 and 2007. A former hairdresser who’d since bought the UK’s Birmingham City football team, he claimed he had accumulated hundreds of millions of dollars in profits from stock trades, a hair salon, and gambling.

Mike Nudelman/Business Insider

Mike Nudelman/Business Insider

LESSON 3: GOING CORPORATE

The real big shots don’t bother with casinos, crooked bank managers, junkets, or smurfs. They manage to transfer millions, or billions, without handling cash or involving banks at all, instead funneling their money through corporate deals (bribes, kickbacks, and embezzlement schemes), which are exempt from currency controls.

– How To Over-Invoice

Let’s say you’re a government official or corporate executive, and you want to receive a $1 million bribe or kickback for giving a lucrative and excessively priced contract to a foreign or local business. You approve the contract, and its payment, and pad the consideration by a few million, which includes $1 million for yourself.

The client puts your $1 million overpayment into a shell company in an offshore jurisdiction, where your ownership can remain anonymous. You are then free to invest or spend the money. The business writes it off as an expense, paid out to an offshore consultant.

Or perhaps you’d prefer that your $1 million be used to buy an asset offshore for you, or that it be paid out gradually in salaries or fees to family members. Either way, you’re good to go.

– How To Under-Invoice

It’s the same thing in reverse. Simply sell your goods or services to a business at a price that is less than the goods or services are worth. Then, out of the embezzled funds, you get $1 million directly from the company that got the bargain. These funds can be placed directly into anonymous offshore account or into an asset of your choice.

Mike Nudelman/Business Insider

Mike Nudelman/Business Insider

LESSON 4: SAY IT WITH DIAMONDS

They are a girl’s best friend and a government regulator’s worst nightmare.

– Tartar Control

Let’s say you want to bring $1 million into the U.S. without detection by tax authorities. One UBS whistleblower testified that clients were urged to buy diamonds for cash, then smuggle them overseas in toothpaste tubes to fool authorities. The gems can then be sold for cash, to private dealers, once you rinse off the Colgate.

– Stamps And Plastic

Another technique is to transfer your funds to anonymous debit cards and, if you want to go old-school, collectible stamps still have their fans.

In May, Credit Suisse admitted guilt to such activities and others — such as shredding documents and keeping transactions below the US $10,000 reportable limit — to help American clients avoid taxes, paying a fine of $2.6 billion – but nobody really thinks they’re the only ones.

Taxes & Tax Cheats, Tax Fraud & Tax Avoidance In America

Mike Nudelman/Business Insider

Mike Nudelman/Business Insider

LESSON 5: TROUBLE AHEAD?

The would-be launderer should take note: Crime still pays, but the costs are on the rise. A gigantic crackdown in the West, and a similar one against corruption in China, will abate illicit money flows in the long run. In the short term, however, both crusades appear to have escalated the exodus of cash.

According to the UN, the largest recipient of FDI (Foreign Direct Investment) in 2013 was the British Virgin Islands, an archipelago with 23,000 residents. About $92 billion in foreign cash washed up there, more than India and Brazil combined. Other havens receiving massive “investments” included the Cayman Islands, Liechtenstein, Monaco, Andorra, and Vanuatu. (The laundered money doesn’t necessarily stay in such havens. It is used to purchase yachts, securities, art, and luxury estates around the world.) By 2012, tax havens held about 29% of the total foreign investment (corporate, bonds, stocks) in the U.S..

The hard reality for launderers is that “good” banks are harder to find every day, and so are jurisdictions providing complete anonymity. As a result, some very big fish are starting to get caught in the dragnet…[The above practices are totally illegal and are presented on munKNEE.com for your financial entertainment only.]

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.businessinsider.com/beginners-guide-to-money-laundering-2014-10#ixzz3FkovtRDZ

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. How Best To Protect Your Wealth From Desperate Governments & Collapsing Economies

Many governments of the world are now hopelessly in debt and on the verge of economic collapse. As their leaders become more desperate, they will resort to more desperate measures. In the next few years, we shall see the leaders of the most “respected” countries throw out the rule book and resort to a final grab of their citizens’ wealth. This article identifies which assets would be the best to own under such circumstances, where they should be held, and why.] Read More »

2. Capital Controls: How & Why They’re Implemented; What Harm They Cause; How to Protect Yourself

It’s crucially important to your financial future that you understand what capital controls are, how and why they are implemented, the harm they can cause, and what you can do to protect yourself. [This article does just that. Read on!] Read More »

3. Country Comparison Of Highest Personal Income Taxes Paid By Individuals

The best way to compare countries based on taxes is using the highest personal income tax rate paid by individuals so this excludes countries that do not have personal income taxes. Let’s see how select countries compare: Read More »

4. Here Are the Many Benefits of Having a Bank Account in Hong Kong

Hong Kong is an excellent place to bank. One of the best in the world, in my opinion. Why? Because the banks are strong, stable, innovative, and well-capitalized [and account holders] are free to choose what currency to accept (and save), whether HK dollars, US dollars, Chinese Yuan, gold, or anything else. Read More »

5. Stash Some Cash In a Foreign Bank! Here’s Why, Where and How

Where abroad? In Scandinavia. Why? To seek refuge from currencies like EUR, USD, CHF, and GBP and diversify your political risk and secure your savings. How? Read on. This article explains why countries and specific banks in Scandinavia deserve your consideration as safe and reliable places to stash some cash abroad. Read More »

6. Don’t Forget China When Formulating A Diversified Secure Financial Strategy

It is well known that holding uncorrelated asset classes in our investment portfolio gives diversification benefits. In the same sense, diversifying among competing or rival countries or jurisdictions helps to maximize freedom by mitigating political risk. This article discuss the merits, and ease of, diversifying in a country that virtually all have never given a second thought, let alone an initial one. Read More »

7. Bitcoin’s Days Are Numbered: New IRS Rulings Make Mainstream Adoption Impossible

Essentially, Bitcoin transactions are going to be tracked and traced by the government. So much for that anonymity that early Bitcoin adopters touted to encourage adoption, huh? Thanks to the IRS, any involvement with Bitcoins has just become so complicated I remain convinced its days are numbered. Read More »

8. Taxes & Tax Cheats, Tax Fraud & Tax Avoidance In America

It is estimated that the collective cost of tax evasion over the last decade in the U.S. is $3.09 trillion and that $5 billion a year is lost from fraudulent tax refund claims. Below are more eye-popping numbers in infographic form. Read More »

9. The 10 Strongest Banks In the World Are….

Below is a list of the 10 strongest banks around the world according to Bloomberg Markets magazine. One country has 4 such banks. Another has 3. Then there are three countries with one bank each in the top ten. Guess which countries are on the list and with the strongest banking systems overall? Read More »

10. Become a PT: Live the “5 Flags of Freedom” – Here’s How

If you truly seek freedom in this un-free world you must not be in the clutches of any one government. You must legally limit your exposure so that no one government has control over your person and your freedom of being. Let me show you how. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money