Is it possible to pin down an exact number on what it takes to be wealthy? Today’s graphic looks at data from the 2023 Modern Wealth Survey by Charles Schwab, which asks respondents what net worth is required to be considered wealthy in America.

This post is an abridged version of the original article originally posted on VisualCapitalist.com

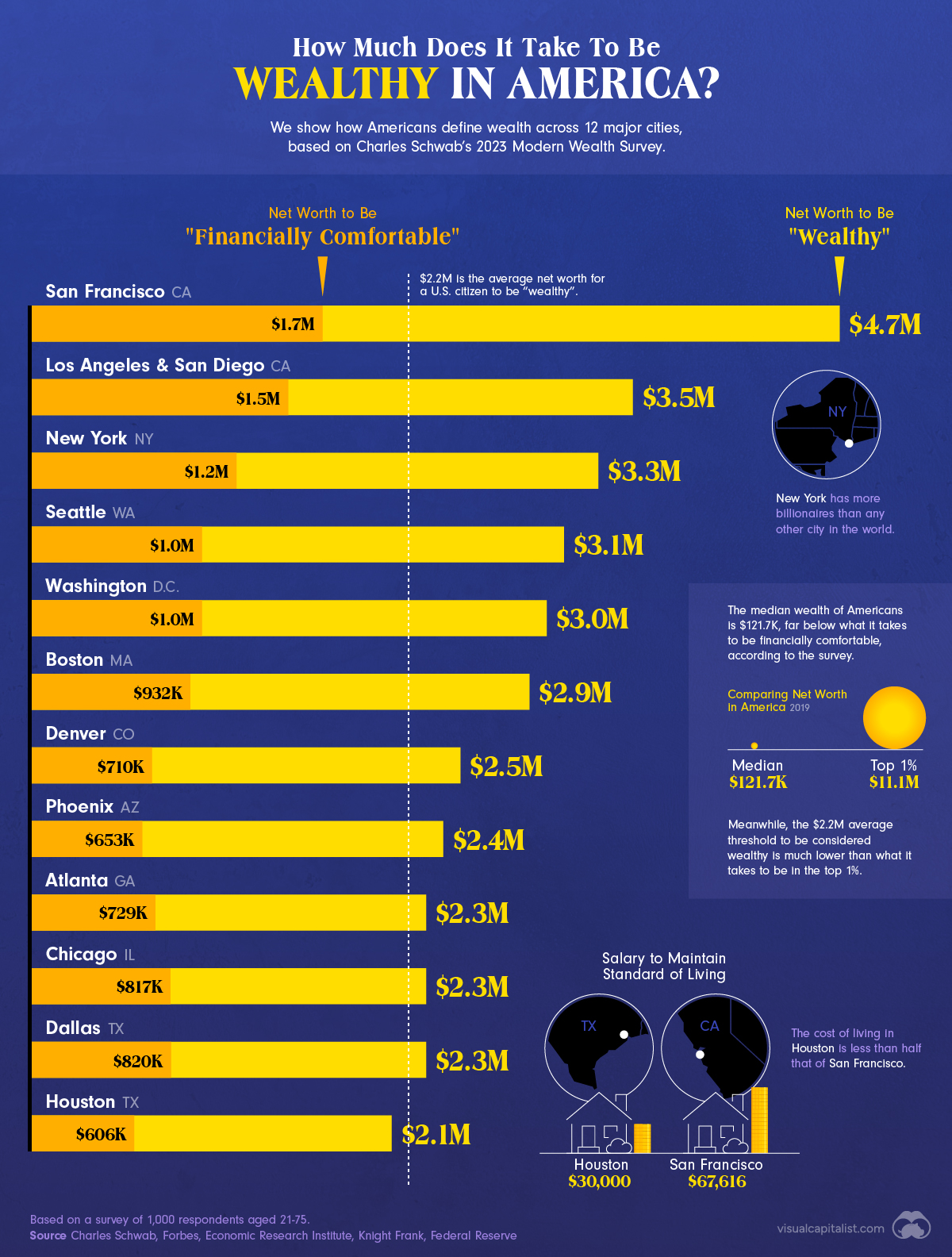

Overall, the net worth that Americans say that is needed to be “wealthy” in the United States is $2.2 million in 2023. Below are the average wealth numbers indicated by respondents across 12 major U.S. cities, based on a survey of 1,000 people between 21 and 75:

The Wealth Paradox

Separately, the survey asked whether respondents “feel wealthy” themselves and, overall, 48% of all respondents said they feel wealthy, and those people had an average net worth of $560,000. This is a considerable divergence from the $2.2 million benchmark they said was needed to be wealthy. Below is the breakdown for major cities, illustrating the paradox:

Here’s the breakdown for major cities, illustrating the paradox:

Millennials were most likely to feel wealthy, at 57% of respondents, while 40% of boomers felt wealthy, the lowest across generations surveyed.

Explaining the Divergence

When digging deeper, it becomes clear that wealth is not simply a number. In fact, the survey indicates that many Americans place greater importance on non-monetary assets over monetary assets when they think of wealth. For instance:

- 72% said having a fulfilling personal life was a better descriptor of wealth than working on a career,

- only 28% chose working on a career

- 70% said enjoying experiences was a better reflection of wealth

- 61% said time was very important

- only 39% said money was a descriptor of wealth while

- only 30% felt owning many nice things was.

Conclusion

Beyond monetary figures, these findings illustrate the layers that influence what it means to feel financially healthy today, and how this affects an individual’s overall quality of life.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money