…Life is like going the wrong way on a moving escalator. Walk and you stay put. Stand still and you go backwards. To get ahead, you have to hustle or, at least, your money has to hustle. You have to make your money make you money and dollar cost averaging [as an investment strategy] is like steroids for your money. The difference between doing it and not doing it is millions of dollars.

The original article has been edited here for length (…) and clarity ([ ]) by munKNEE.com – A Site For Sore Eyes & Inquisitive Minds – to provide a fast & easy read.

…Dollar cost averaging is a strategy that anyone anywhere can enact, without needing a financial advisor or a deep understanding of stocks. It’s a way for anyone to become a millionaire in their lifetime. Yes, anyone. It’s not as exciting as getting crypto-rich overnight but…[your] chances of success are substantially higher.

Dollar cost averaging does, however, have one fatal flaw: it takes time. A lot of time, but if you’re young, in your 20s or 30s, that shouldn’t be a problem for you because if you’re young and in good health, then you’re rich in time.

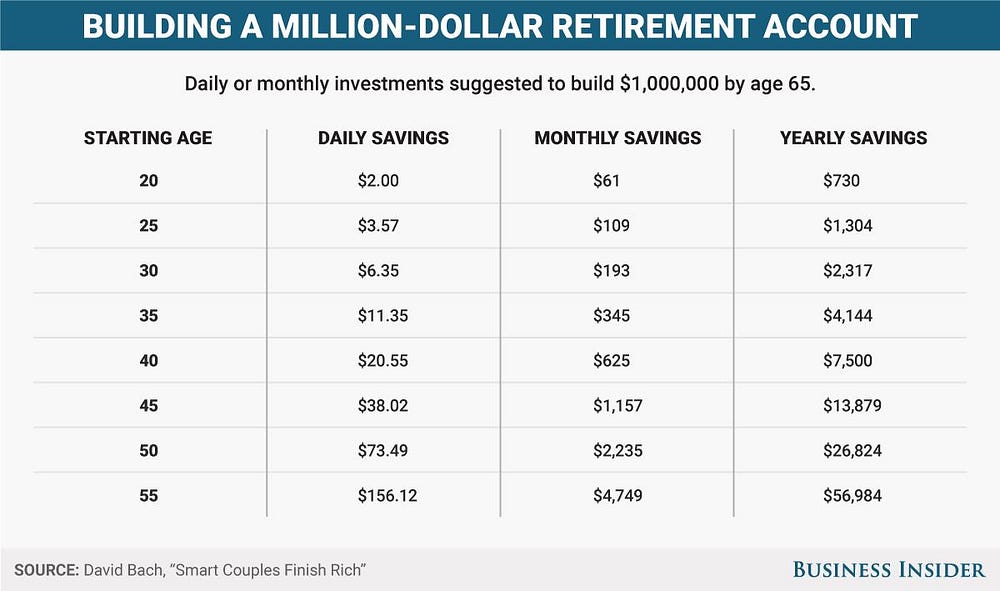

Based on your age, here’s how much you’d need to invest every day to end up with $1M when you turn 65, if you dollar cost average your way into stocks.

Dollar cost averaging is consistently transferring an amount of money from your earnings into an investment account so it can be put to productive use earning interest. You can invest a consistent amount of money into America’s top 500 public companies by putting your money into one single security: an S&P 500 index fund. These index funds can be purchased in any investment account under the ticker symbol SPY.

SPY is like steroids for your money. Here is a chart comparing an investment of $25 a week on steroids vs. that same $25 not on steroids:

With steroids, you weekly $25 investment becomes $1.31M over 45 years. Without them, your investment adds up to a measly $54k.

The bottom line: don’t do steroids. Have your money do steroids. Dollar cost average into SPY. The difference between doing it and not doing it is $1.26M.

Related Articles From the munKNEE Vault:

1. Averaging Down: Bad Strategy?

Whenever some financial “pundit” says that the best way to get into a stock is by averaging down, we sometimes cringe. Why? Because, at best, you’ll be getting into a stock at a lower average price…but more importantly, you can be getting into a stock that’s poised to sink much, much lower and that’s a risk no one wants to take.

2. Use Beta To Get the Level Of Risk In Your Portfolio Just Right For You – Here’s How

Using beta to build a portfolio is a smart and easy thing to do. All you have to do is make sure you understand your risk tolerance and not build a portfolio that is overweight in one sector of the stock market.

3. The Advance-Decline (A-D) Line Shows Market Action BEFORE Significant Declines – Check It Out

Many of us think Wall Street is using sophisticated tools to make money. It is…but big Wall Street firms also use simple tools to make money. One tool many large firms use is the advance-decline line.

4. Use Return on Equity (ROE) To Better Evaluate the Potential Returns Of A Company’s Stock

The ROE can be useful when deciding which company in an industry is the better investment. Let me explain.

5. Candle Charts Anticipate A Bounce Or Break In Price Allowing Us To Take Appropriate Action

People seem to think that since they hear that so few people are successful in trading, that there must be a complicated process to complete in order to make money. The truth is that the simpler we make trading, the more profitable it seems to be…so this week I decided to discuss a simple technique that is often overlooked when traders are reading charts, specifically candle charts.

6. 2 Surefire Ways to Make Loads of Money Investing In the Stock Market

The majority of individual investors base their investing decisions on two emotions that rule the market – fear and greed – and, as a result, end up losing money more often…[than making] money. That being said, if you can keep your emotions in check you can take advantage of other investors emotions – irrational exuberance – and make yourself some easy money. It’s a surefire way to make loads of money investing in the stock market.

7. Use the “Graham Formula” To Determine the Fair Price of a Stock – Here’s How

Knowing how to properly value a stock is probably the most important skill for a value investor to develop and over the last fifty years one of the most popular methods to discover the fair price of a stock has been the Benjamin Graham formula.

8. Improve Your Decision Making Process & Keep More of Your Money – Here’s How

You might be thinking what behavioral finance is and how you can improve your decision making process and use behavioral finance to your advantage. Well in this post I am going to show you how.

Exactly what is RSI and how is it calculated?

10. Dogs of the Dow: A Simple Strategy Using the Dividend Yield

Investing in the Dogs of the Dow, which refers to the 10 highest-yielding stocks in the Dow Jones Industrial Average at the end of the year, is a very simple strategy you can use in 2018 to beat the market. Here’s everything you need to know.

11. When To Choose Growth vs. Income Stocks For Your Portfolio

By being lured to growth stocks with high short-term returns, investors sometimes lose sight of their main investment goals. Re-orient your investment portfolio by assessing your investing goals and then choosing the appropriate growth vs. income investments.

12. Yes, You Can Time the Market – Use These Trend Indicators

Remember, the trend is your friend and now you have an arsenal of such indicators to make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it.

Buying on margin can mean potentially higher returns – but it can also lead to large losses very fast. [This article outlines 6 things to know about buying on margin and 3 key risks of doing so.]

14. Portfolio Diversification: Do You Need It?

Do you really need portfolio diversification?…Everyone assumes that broad asset class portfolio diversification is advantageous…[as it] reduces the risk associated with events that can trigger a decline in any one asset class…[and makes] financial planning more reliable and predictable by reducing the variations in portfolio performance from year to year. Simply put, portfolio diversification is a sound investment practice but, [that said,] exactly how much risk reduction, in actual numbers, is obtained through application of this philosophy? [Bottom line, is] asset class diversification all that it’s cracked up to be? This article…addresses…the benefits of diversification among various classes.

For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money