…This article identified 39 fairly valued dividend growth stocks with above-average historical earnings growth over the past 5 years and a current dividend yield of 1% or better and, as such, is oriented to those retired, or close to retirement, investors that require above-average growth and/or above-average long-term total return.

The above introductory comments are edited excerpts from an article* by Chuck Carnevale (fastgraphs.com) entitled Equity Selections For Your Retirement Portfolios: 39 Dividend Growth Stocks For Total Return: Part 1.

Carnevale goes on to say in further edited excerpts:

As I screened the universe of dividend growth stocks looking for reasonably valued above-average growing dividend growth candidates, I uncovered 39 research candidates in 8 different sectors that I felt appeared worthy of a more comprehensive research and due diligence process.

Consequently, the following F.A.S.T. Graphs “Portfolio Review” is presented by sector. In each sector report, I include the company’s:

- current P/E ratio,

- normal P/E ratio,

- historical earnings per share growth [EPS] over the past five calendar years,

- current dividend yield,

- debt to capital ratio,

- sub-sector, and

- market cap.

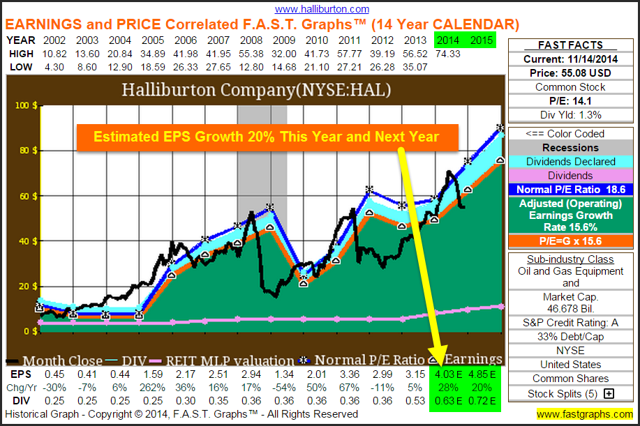

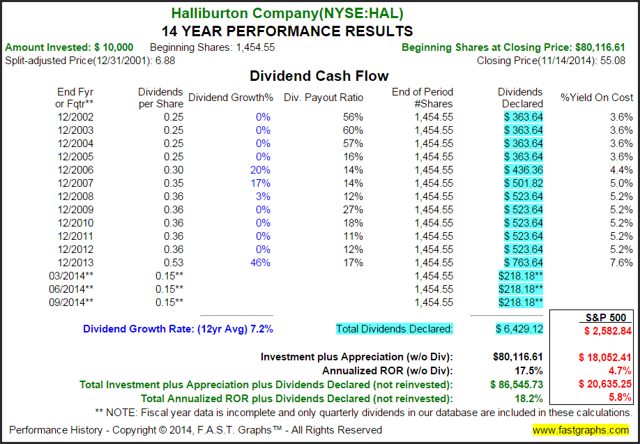

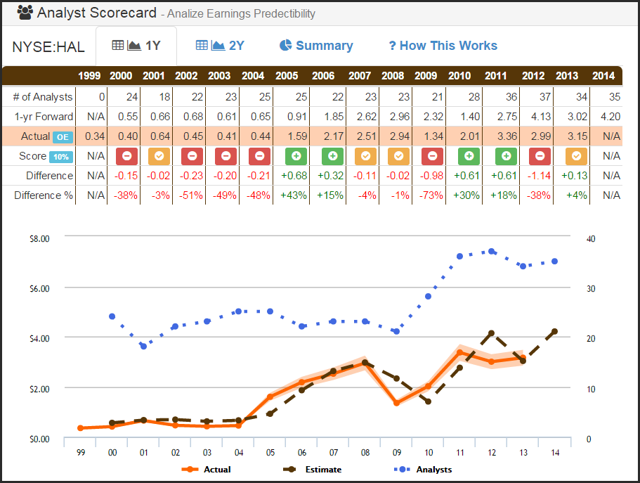

I selected one research candidate that I felt was most attractive from each sector and highlighted it with a long-term earnings and price correlated F.A.S.T. Graphs that includes consensus earnings forecasts for this fiscal year and next. For additional perspective, the associated performance results of the time period graphed for each company is included. The reader should further note that the time frames I selected to graph were based on periods in time when starting valuation was in reasonable alignment with intrinsic value. I believe this provides a perspective of how profitable these research candidates can be when they can be purchased at fair valuation.

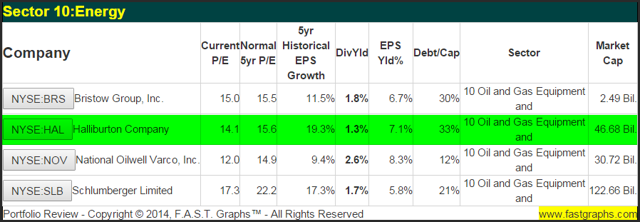

4 Fairly Valued Energy Sector Research Candidates

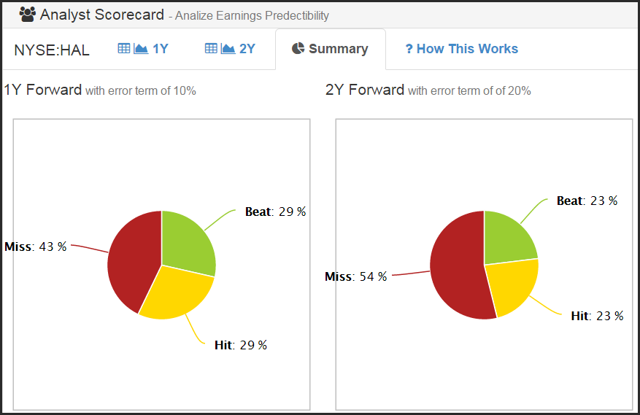

Halliburton Company: (NYSE:HAL)

The following short business description provided courtesy of S&P Capital IQ:

“Halliburton Company provides a range of services and products for the exploration, development, and production of oil and natural gas to the energy industry worldwide. The company operates in two segments, Completion and Production, and Drilling and Evaluation.

The Completion and Production segment offers production enhancement services, such as stimulation services and sand control services; and cementing services comprising bonding the well and well casing, and casing equipment. It also provides completion tools that provide downhole solutions and services, including well completion products and services, intelligent well completions, liner hanger systems, sand control systems, and service tools.

In addition, this segment offers well intervention services, pressure control, equipment rental tools and services, and pipeline and process services; oilfield production and completion chemicals and services that address production, processing, and transportation operations; electrical submersible pumps; and installation, maintenance, repair, and testing services.

The Drilling and Evaluation segment provides drill bits and services, such as roller cone rock bits, fixed cutter bits, hole enlargement, and related downhole tools and services, as well as coring equipment and services; wireline and perforating services, including open-hole logging, cased-hole and slickline, borehole seismic, and formation and reservoir solutions; and testing and subsea services comprising acquisition and analysis of reservoir information and optimization solutions.

This segment also offers drilling fluid systems, performance additives, completion fluids, solids control, specialized testing equipment, and waste management services; drilling systems and services; integrated exploration, drilling, and production software, and related professional and data management services; and oilfield project management and integrated solutions. The company was founded in 1919 and is based in Houston, Texas.”

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

3 Fairly Valued Materials Sector Research Candidates

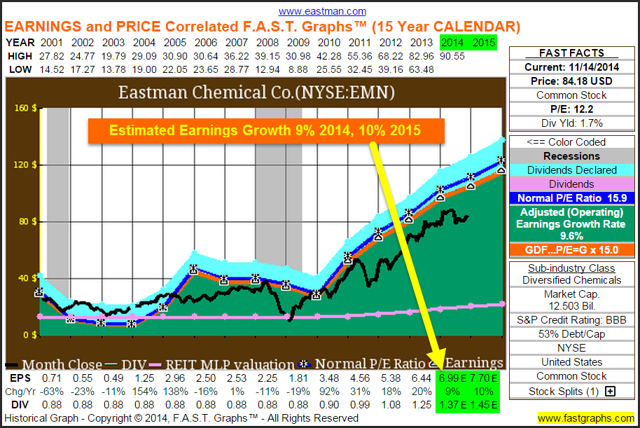

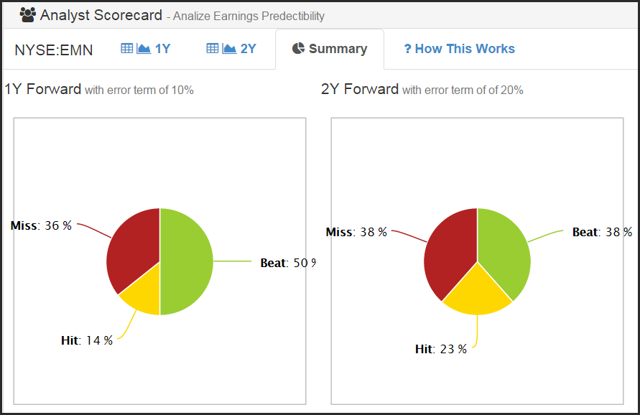

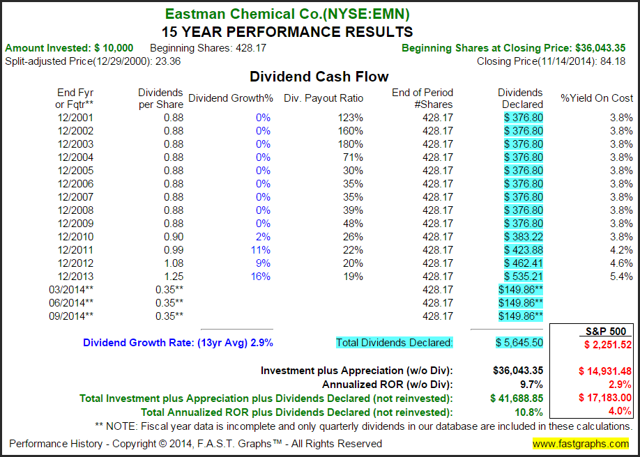

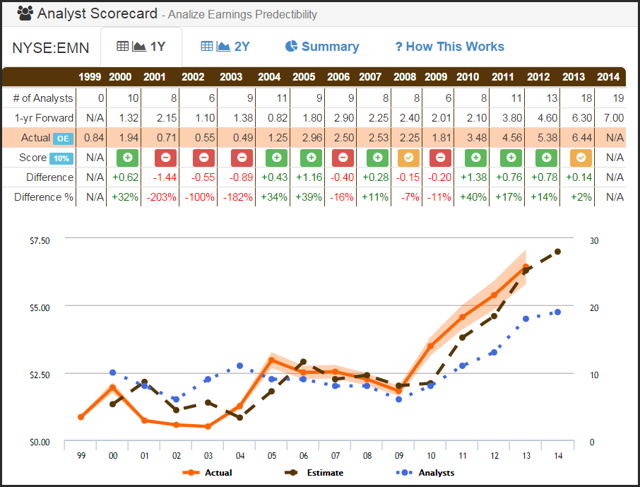

Eastman Chemical Company: (NYSE:EMN)

The following short business description provided courtesy of S&P Capital IQ:

“Eastman Chemical Company, a specialty chemical company, manufactures and sells chemicals, plastics, and fibers in the United States and internationally. The company’s Additives & Functional Products segment offers solvents that include specialty coalescents and ketones, esters, glycol ethers, and alcohol solvents; cellulose and polyester-based specialty polymers; insoluble sulfur products; antidegradant products; and hydrocarbon resins.

This segment’s products are used in coatings and tire industries in transportation, building and construction, durable goods, and consumables markets. Its Adhesives & Plasticizers segment manufactures resins and plasticizers, which are used in the consumables, building and construction, health and wellness, industrial chemicals and processing, and durable goods, markets.

The company’ Advanced Materials segment produces and markets specialty copolyesters, cellulose esters, interlayers, and aftermarket window film products that are used in transportation, consumables, building and construction, durable goods, and health and wellness products.

Its Fibers segment offers Estron acetate tow and Estrobond triacetin plasticizers for use in the manufacture of cigarette filters; Estron natural and Chromspun solutions dyed acetate yarns for use in apparel, home furnishings, and industrial fabrics; and cellulose acetate flake and acetyl raw materials for other acetate fiber producers.

The company’s products include acetate tow, acetate yarn, and acetyl chemical products. Its Specialty Fluids & Intermediates segment provides specialty fluids, acetyl chemical intermediates, and olefin derivatives that are used in industrial chemicals and processing, building and construction, health and wellness, and agriculture markets. The company also offers aviation turbine oil. Eastman Chemical Company was founded in 1920 and is headquartered in Kingsport, Tennessee.”

(click to enlarge) (click to enlarge)

(click to enlarge)

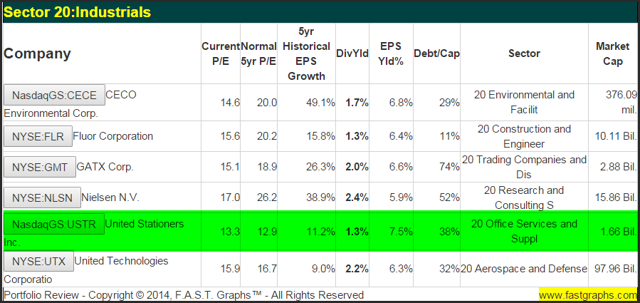

6 Fairly Valued Industrials Sector Research Candidates

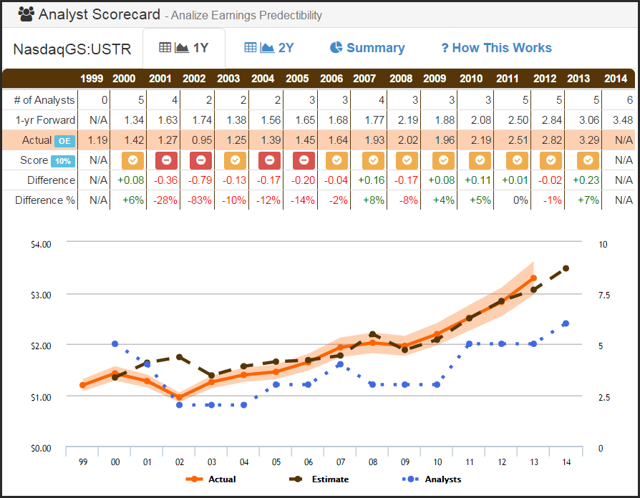

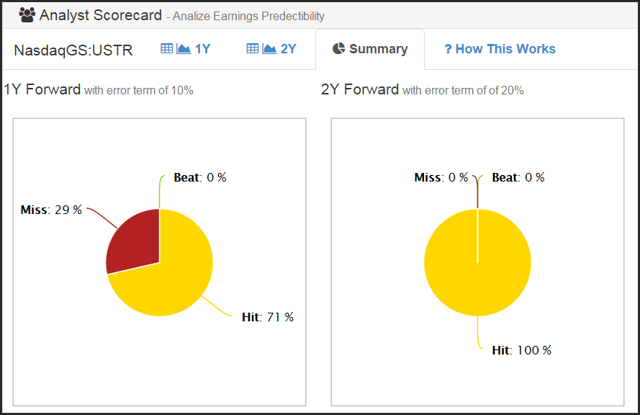

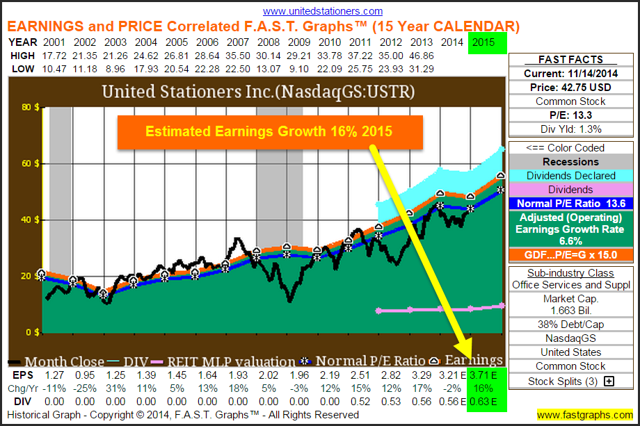

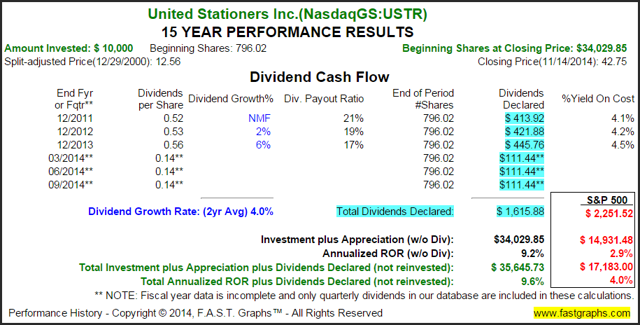

United Stationers Inc: (NASDAQ:USTR)

The following short business description provided courtesy of S&P Capital IQ:

“United Stationers Inc. operates as a wholesale distributor of business products in the United States and internationally. The company offers technology products, such as imaging supplies, data storage, digital cameras, and computer accessories; and computer hardware, including printers and other peripherals to value-added computer resellers, office products dealers, drug stores, grocery chains, and e-commerce merchants. It also provides traditional office products consisting of filing and record storage products, business machines, presentation products, writing instruments, paper products, shipping and mailing supplies, calendars, and general office accessories; and janitorial and breakroom supplies, foodservice consumables, safety and security items, and paper and packaging supplies.

In addition, the company offers industrial supplies, such as hand and power tools, safety and security supplies, janitorial equipment, and supplies; various industrial maintenance, repair, and operational items; and oil field and welding supplies.

Further, it provides office furniture, including desks, filing and storage solutions, seating and systems furniture, and various products for education, government, healthcare and professional services markets.

Additionally, the company develops, licenses, and implements business management software and e-commerce services for customers. It serves independent office products dealers; contract stationers; office products superstores; computer products resellers; office furniture dealers; mass merchandisers; mail order companies; sanitary supply, paper, and foodservice distributors; drug and grocery store chains; healthcare distributors; e-commerce merchants; oil field, welding supply, and industrial/MRO distributors; and other independent distributors through its 64 distribution centers and 46 re-distribution points. United Stationers Inc. was founded in 1922 and is headquartered in Deerfield, Illinois.”

(click to enlarge)

(click to enlarge)

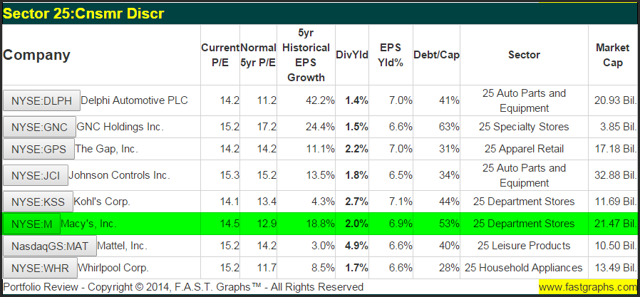

8 Fairly Valued Consumer Discretionary Sector Research Candidates

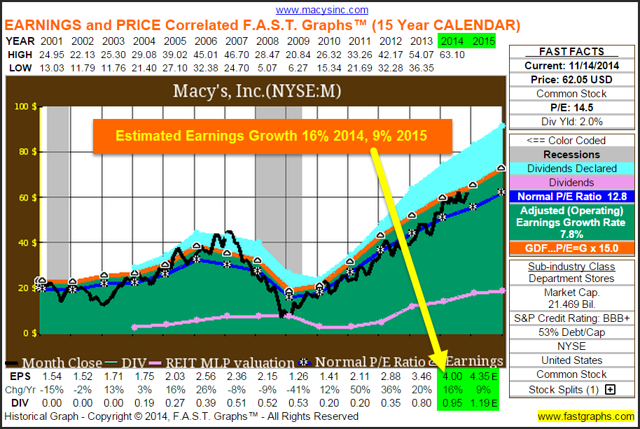

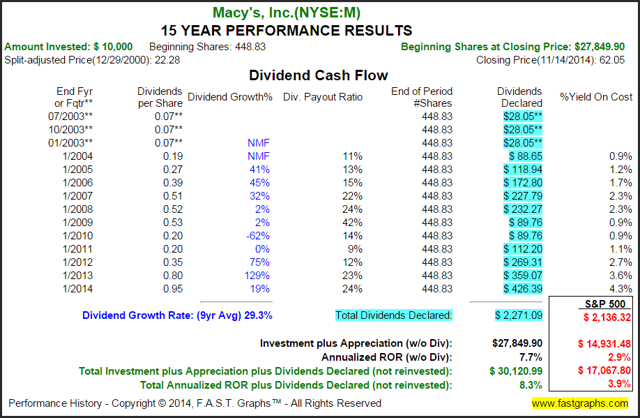

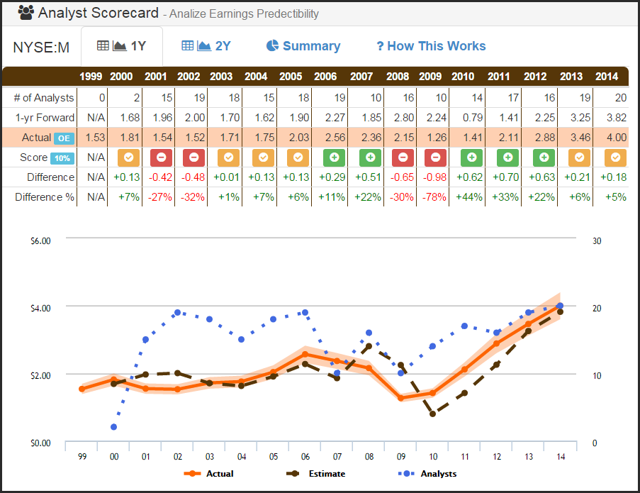

Macy’s Inc. (NYSE:M)

The following short business description provided courtesy of S&P Capital IQ:

“Macy’s, Inc., together with its subsidiaries, operates stores and Internet Websites in the United States. Its stores and Websites sell a range of merchandise, including apparel and accessories for men, women, and children; cosmetics; home furnishings; and other consumer goods.

The company also operates Bloomingdale’s Outlet stores that offer a range of apparel and accessories, including women’s ready-to-wear, fashion accessories, jewelry, handbags, and intimate apparel, as well as men’s, children’s, and women’s shoes.

As of October 28, 2014, it operated approximately 840 stores under the Macy’s and Bloomingdale’s names in 45 states of the United States, the District of Columbia, Guam, and Puerto Rico, as well as the macys.com and bloomingdales.com Websites; and 13 Bloomingdale’s Outlet stores.

The company was formerly known as Federated Department Stores, Inc. and changed its name to Macy’s, Inc. in June 2007. Macy’s, Inc. was founded in 1830 and is headquartered in Cincinnati, Ohio.”

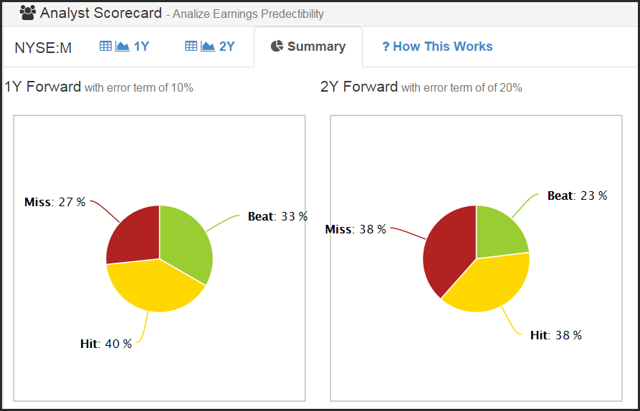

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

2 Fairly Valued Consumer Staples Sector Research Candidates

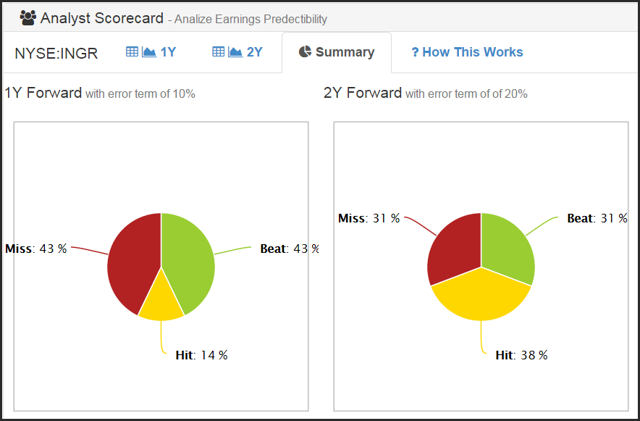

Ingredion Incorporated: (NYSE:INGR)

The following short business description provided courtesy of S&P Capital IQ:

“Ingredion Incorporated, together with its subsidiaries, manufactures and sells starch, sweetener, and nutrition ingredients to various industries. The company offers sweetener products comprising glucose syrups, high maltose syrups, high fructose corn syrups, caramel colors, dextrose, polyols, maltodextrins and glucose, and syrup solids, as well as food grade and industrial starches.

It also offers science-based collaboration and problem-solving for customers, including consumer insights, applied research, applications knowhow, and process technology. The company’s products are derived primarily from processing corn and other starch-based materials, such as tapioca, potato, and rice.

In addition, it provides refined corn oil to packers of cooking oil, as well as to producers of margarine, salad dressings, shortening, mayonnaise, and other foods; and corn gluten feed that is used as protein feed for chickens, pet food, and aquaculture.

The company serves the food, beverage, brewing, pharmaceutical, paper and corrugated products, textile, and personal care industries, as well as the animal feed and corn oil markets. It operates in North America, South America, the Asia Pacific, Europe, the Middle East, and Africa.

The company was formerly known as Corn Products International, Inc. and changed its name to Ingredion Incorporated in June 2012. Ingredion Incorporated was founded in 1906 and is headquartered in Westchester, Illinois.”

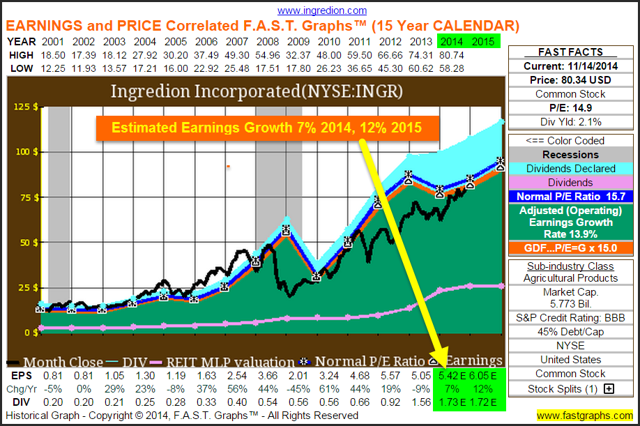

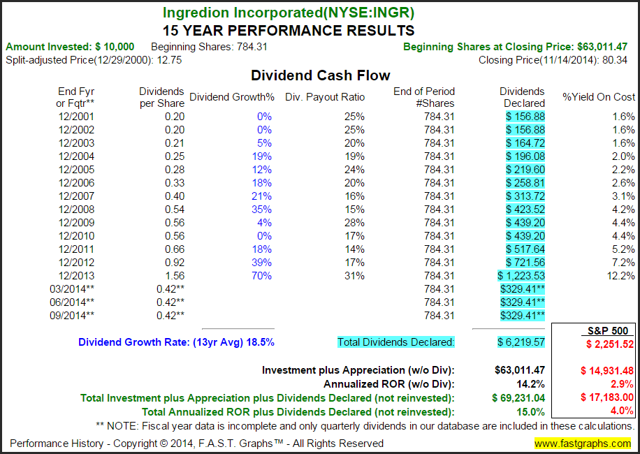

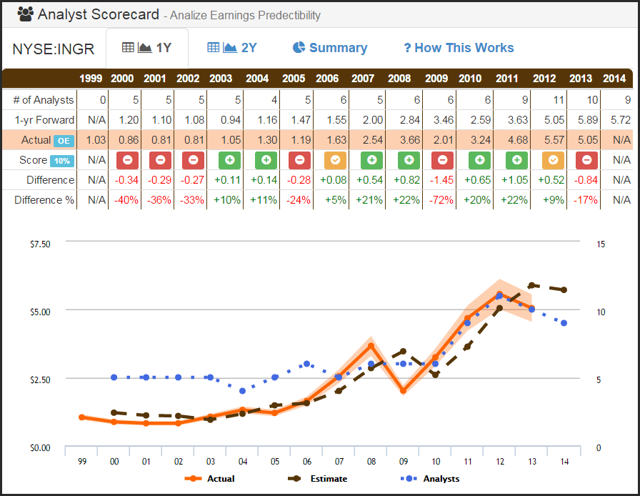

(click to enlarge)

(click to enlarge)

(click to enlarge)

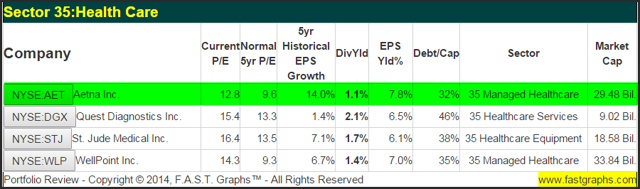

4 Fairly Valued Health Care Sector Research Candidates

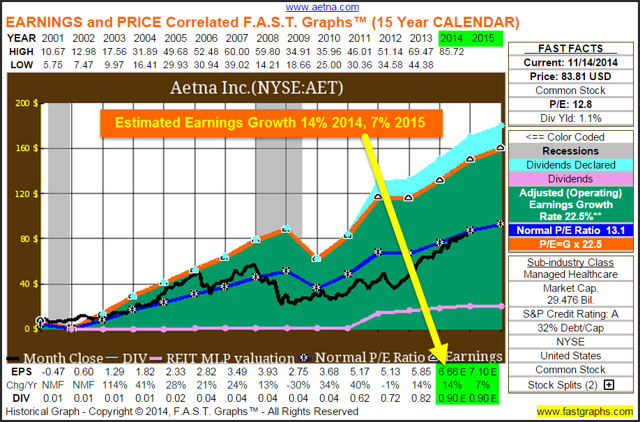

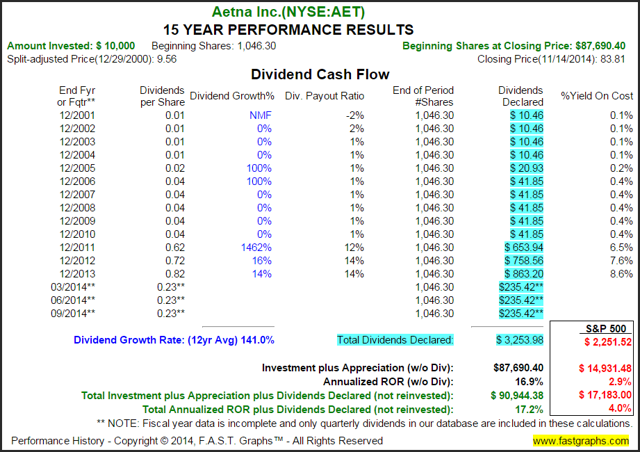

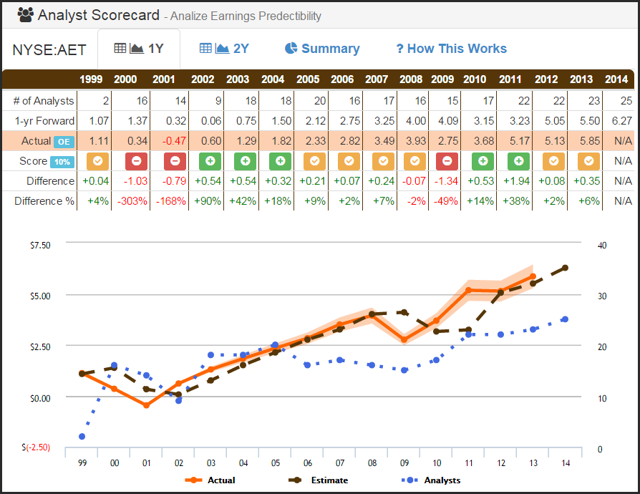

Aetna, Inc.: (NYSE:AET)

The following short business description provided courtesy of S&P Capital IQ:

“Aetna Inc. operates as a diversified health care benefits company in the United States. The company operates in three segments: Health Care, Group Insurance, and Large Case Pensions.

The Health Care segment provides medical, pharmacy benefit management, dental, behavioral health, and vision plans on an insured basis, and an employer-funded or administrative basis. This segment also provides Medicare and Medicaid products and services, as well as other medical products, such as medical management and data analytics services, medical stop loss insurance, workers’ compensation administrative services, and products that provide access to its provider networks in select markets. This segment offers its products and services to multi-site national, mid-sized, and small employers, as well as individual customers.

The Group Insurance segment provides life insurance products comprising group term life insurance, voluntary spouse and dependent term life insurance, group universal life, and accidental death and dismemberment insurance; disability insurance products; and long-term care insurance products, which offer benefits to cover the cost of care in private home settings, adult day care, assisted living, or nursing facilities. This segment provides insurance products principally to employers that sponsor its products for the benefit of their employees and their employees’ dependents.

The Large Case Pensions segment manages various retirement products, including pension and annuity products for tax-qualified pension plans. The company’s customers include employer groups, individuals, college students, part-time and hourly workers, health plans, health care providers, governmental units, government-sponsored plans, labor groups, and expatriates. Aetna Inc. was founded in 1853 and is headquartered in Hartford, Connecticut.”

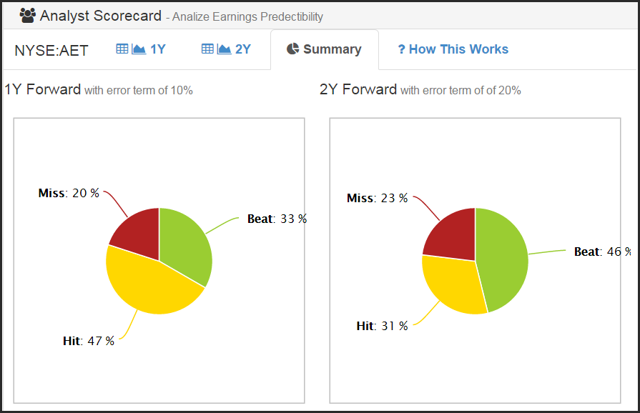

(click to enlarge) (click to enlarge)

(click to enlarge)

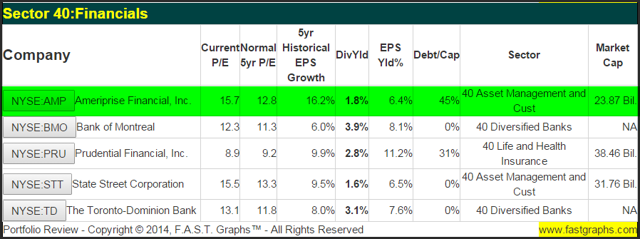

5 Fairly Valued Financials Sector Research Candidates

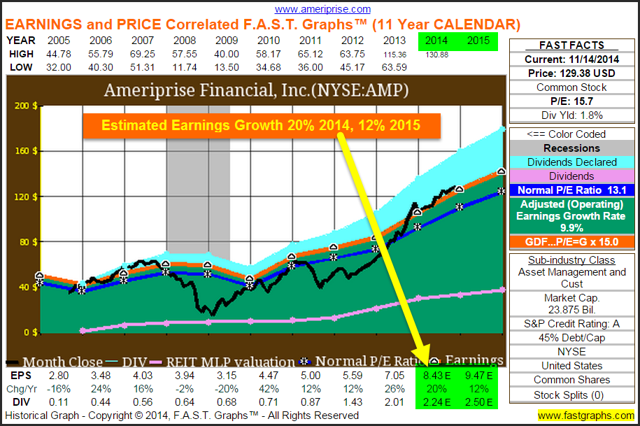

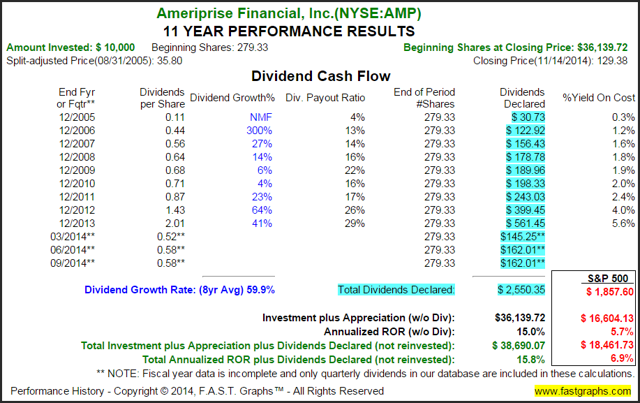

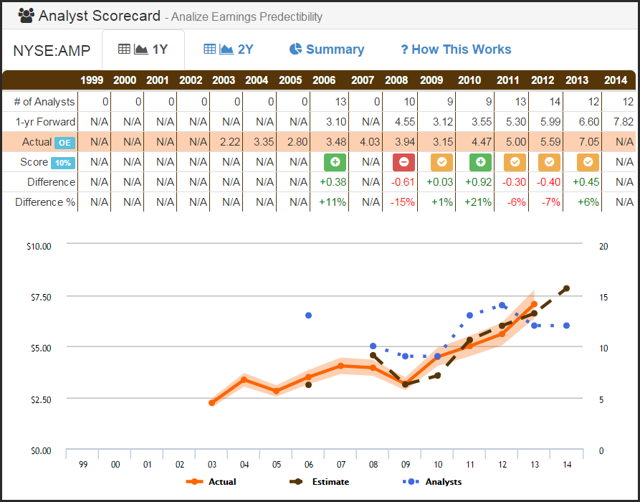

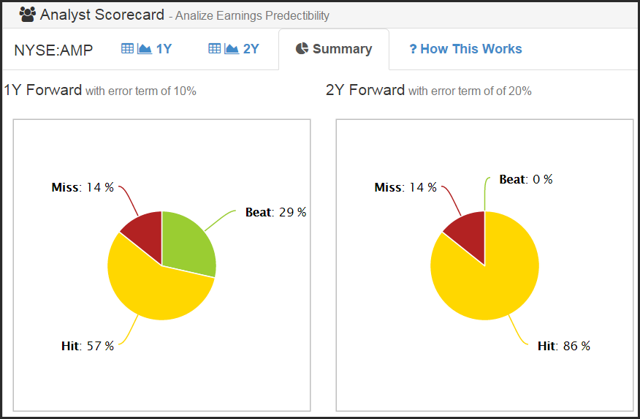

Ameriprise Financial, Inc.: (NYSE:AMP)

The following short business description provided courtesy of S&P Capital IQ:

“Ameriprise Financial, Inc., through its subsidiaries, provides a range of financial products and services in the United States and internationally.

The company’s Advice & Wealth Management segment offers financial planning and advice, as well as brokerage services primarily to retail clients through its advisors.

Its Asset Management segment provides investment advice and investment products to retail, high net worth, and institutional clients through unaffiliated third party financial institutions and institutional sales force. This segment offers products for individuals include the U.S. mutual funds and their non-U.S. equivalents, exchange-traded funds, and variable product funds underlying insurance and annuity separate accounts; and institutional asset management services focus on traditional asset classes, separately managed accounts, individually managed accounts, collateralized loan obligations, hedge funds, collective funds, and property funds.

The company’s Annuities segment offers variable and fixed annuity products to individual clients through affiliated and unaffiliated advisors, and financial institutions. Its Protection segment provides various protection products through advisors and affinity relationships to address the protection and risk management needs of retail clients, including life, disability income, and property-casualty insurance.

The company was formerly known as American Express Financial Corporation and changed its name to Ameriprise Financial, Inc. in September 2005. Ameriprise Financial, Inc. was founded in 1894 and is headquartered in Minneapolis, Minnesota.”

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

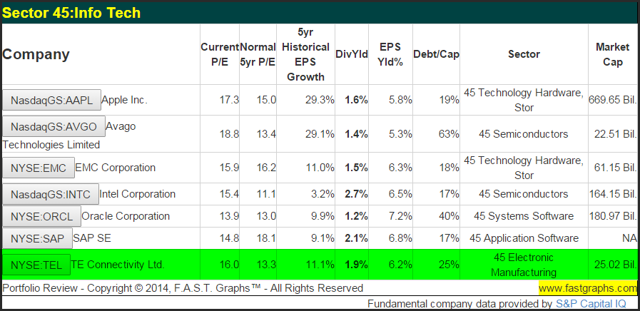

7 Fairly Valued Information Technology Sector Research Candidates

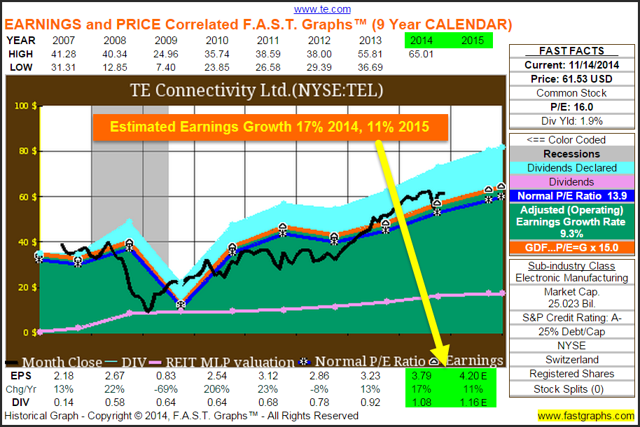

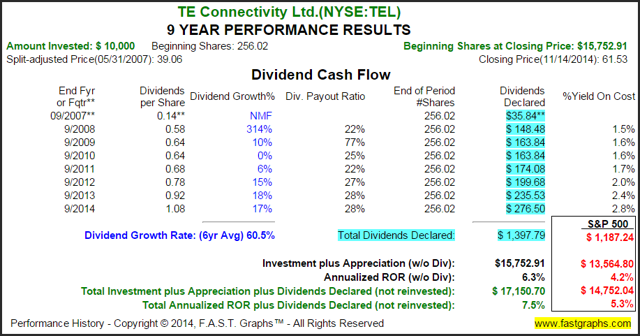

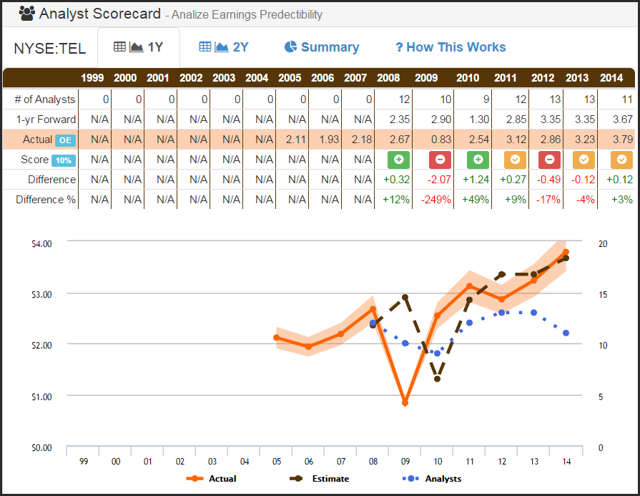

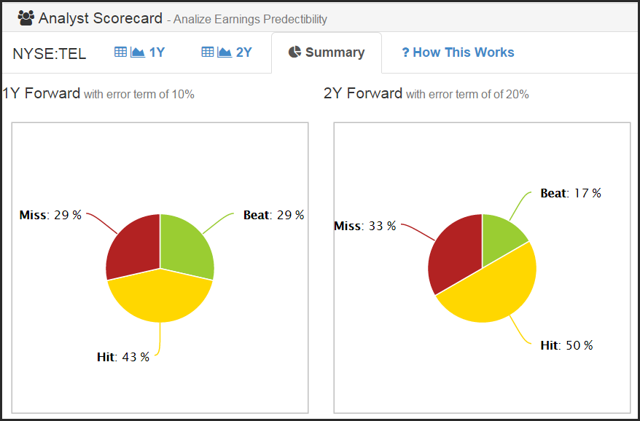

TE Connectivity Ltd.: (NYSE:TEL)

The following short business description provided courtesy of S&P Capital IQ:

“TE Connectivity Ltd., together with its subsidiaries, designs and manufactures connectivity and sensors solutions. It operates through four segments: Transportation Solutions, Industrial Solutions, Network Solutions, and Consumer Solutions. The Transportation Solutions segment offers electronic components, including terminals and connectors, relays, and sensors, as well as application tooling, wire and heat shrink tubing, and other custom-engineered solutions for the automotive market, such as industrial and commercial vehicle, and hybrid and electric vehicle markets.

The Industrial Solutions segment supplies products that connect and distribute power and data, which consists of connectors, heat shrink tubing, relays, and wire and cable, as well as custom-engineered solutions used primarily in the industrial equipment; aerospace, defense, marine, oil, and gas; and energy markets.

The Network Solutions segment supplies infrastructure components and systems for the telecommunications market and electronic components for the data communications market. This segment’s products include connectors, fiber optics, wire and cable, racks and panels, and wireless products. It also develops, manufactures, installs, and maintains subsea fiber optic communications systems.

The Consumer Solutions segment supplies electronic components, including connectors, circuit protection devices, relays, antennas, and heat shrink tubing for the consumer devices and appliances markets.

TE Connectivity Ltd. sells its products in approximately 150 countries primarily through direct sales to manufacturers, as well as indirectly via third-party distributors. The company was formerly known as Tyco Electronics Ltd. and changed its name to TE Connectivity Ltd. in March 2011. TE Connectivity Ltd. is based in Schaffhausen, Switzerland.”

(click to enlarge)

(click to enlarge)

(click to enlarge) (click to enlarge)

(click to enlarge)

Summary and Conclusions

…Although I believe that each candidate presented above appears to be fairly valued currently, and possesses the opportunity for above-average earnings and dividend growth, this list was built upon a preliminary screening process. Therefore, I am not recommending any of these candidates for current investment. Instead, I believe these candidates are worthy of conducting a more comprehensive research and due diligence effort upon.

Consequently, this list of research candidates may be most appropriate for those investors in retirement, and for those investors approaching retirement, in need of building a larger asset base to support them…

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/2691045-equity-selections-for-your-retirement-portfolios-39-dividend-growth-stocks-for-total-return-part-1?ifp=0 (© 2014 Seeking Alpha) & http://www.fastgraphs.com/_blog/Research_Articles (© F.A.S.T. Graphs™. All rights reserved. Disclosure: Long AAPL, INTC, ORCL, NOV ,SLB, JCI, KSS, AMP, INGR at the time of writing.)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. I’m Hooked on Dividends – Here’s Why

Dividends aren’t just for Warren Buffett and retirees. Dividends have the power to support your goals of becoming independently wealthy. Here are 3 reasons why. Words: 586 Read More »

2. Market -Timing Pays BIG Dividends for Income Investors – Here’s Why

Many income investors have been taught to believe that “market-timing” is anathema to their investment objectives and/or that it can’t be done successfully… I will argue that this piece of conventional wisdom is false – dangerously false. In a three-part series of essays, I will argue that market-timing needs to be incorporated as a fundamental component of income investing. I will demonstrate why market-timing is important, when it should be applied and how it should be implemented. [Read on!] Words: 1956 Read More »

The dividend approach isn’t likely to make you a mint overnight – and holding dividend stocks can be about as exciting as watching grass grow – but if you’ve ever gone on vacation, you’ve likely been amazed by just how much your grass can grow in a week. In the end, I can assure you, the effort will be well worth it. Words: 1395 Read More »

4. How to Make a Rich Retirement Your Reality

Since WWII, we have enjoyed one of the most productive economies the world has ever seen, yet many seniors are broke. When you reach retirement age, you don’t have to be one of them. Below is some straight talk on how to make a rich retirement your reality. Read More »

…The Employee Benefit Research Institute surveys workers each year concerning their retirement confidence. Despite an uptrend, the latest report shows that 82% of workers feel less than “very confident” about having enough money to retire comfortably. With that statistic in mind, this article looks at three different 40-year retirement scenarios. Read More »

6. Here’s How To Set Up A Risk Averse Retirement Plan

One of the most difficult challenges of transitioning to retirement from the working world is a complete change in mindset with regards to an investment portfolio. You go from being a saver to a spender. There’s no future income or nearly as much time to soften the blow from bear markets. Growth is still necessary but you have to be cognizant of the fact that you’ll need to protect some of your assets for spending purposes. Here’s an interesting case study in how to approach this change in mindset. Read More »

7. Stock Market Volatility Could Ruin Your Retirement – Here’s Why

With markets so calm, it’s easy to become complacent about the corrosive effects that volatility can have on long-term investment success. If you don’t need the money for a long time, you can ride out the inevitable market squalls but if you’re close to or already drawing from those funds, volatility can be costly…Let me explain further. Read More »

8. How Much Investment Income Do You Need to Retire? Here Are Some Guidelines

Here’s an interesting rule of thumb that most retirees and would-be retirees would do well to adopt. Read More »

9. 10 Ways To Improve Your Odds Of Not Running Out Of Money During Retirement

A big financial challenge retirees face is ensuring their savings last the rest of their lives. It’s a daunting task for those making the transition into retirement as well as for those already in retirement. While saving as much as possible during your working years is important, the decisions you make in retirement are also very important. Fortunately, there are steps you can take to improve your odds of financial success. Here are 10 of them. Read More »

10. Retiring Soon? Check Out These Best-of-the-Best Locations

In your 50s or 60s and thinking about retiring and moving to somewhere less expensive and with great weather, great food and friendly people? Look no further. We have the best-of-the-best right here! Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money