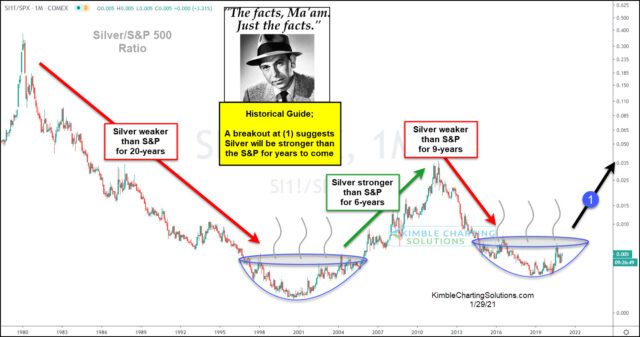

The chart below looks at the Silver/S&P 500 ratio over the past 40-years, highlighting several long-term trends and it suggests that silver is on course to outperform the S&P 500 for years to come.

- Silver

- was weaker than the S&P 500 from 1980 until 2000

- was then in a bullish bottoming pattern for almost 6 years (2005/6)

- was stronger than the S&P 500 for the next 6-years (2012)

- was weaker than the S&P for the following 9-years (2020)

- has been forming another bullish bottoming pattern since 2016/7

A break out of the top of this bullish pattern at (1) would suggest that Silver outperforms the S&P 500 for years to come.

Related Articles from the munKNEE Vault:

1. These 5 Articles On SILVER Got 163,200 Page Views In 2020 On munKNEE.com – Take A Look!

2. Silver Forecasts: (November Update) 22 Analysts Now See Silver Going As High As $5,300

Some analysts are forecasting as high as $5,300/ozt. – but a few are suggesting that silver could go considerably lower in price – as low as $5/ozt.. Below are their projections and …

Editor’s Note: The original article by Chris Kimble has been edited ([ ]) and abridged (…) for the sake of clarity and brevity to ensure a fast and easy read. The authors’ views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us provide more articles of interest to you.

- Comment below to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Lorimer, love the graphic showing higher lows and the cycle duration cut in half. Things are looking UP!

I’m wondering what a chart would look like that measures inflation-corrected dollars required to purchase

1 ounce of silver and gold over the same 40-year period.