…Today’s…[article outlines the] pros and cons of stock buybacks and how they impact dividend investors.

What Are Stock Buybacks?

…A Stock Buyback (also referred to as a Share Repurchase or a Share Buyback)…[is when] a company…purchases their stock from the open market from current shareholders. In turn, the company’s outstanding shares decrease by the amount of shares repurchased. A company is required to have Board approval for a specified dollar amount in order to repurchase its shares. For example, it is common to read in a company’s SEC filings that “the Board has authorized a Share Repurchase program up to $___ Billion of shares.”

This is for the fellow accounting nerds, like us, out there. A repurchase is recorded in an account called “Treasury Stock” on the balance sheet. Treasury Stock is a contra-equity account. Thus, an increase in Treasury Stock will then reduce the balance of equity. A typical entry debits Treasury Stock and credits Cash…(Here is an article discussing this in greater detail.)

Stock Buybacks – Pros and Cons

Pros:

- Tax-Efficient Way to Provide Value to Shareholders – To think about why a stock buyback is tax-efficient, lets compare this to receiving a dividend payment.

- When you receive a dividend, you are taxed on the dividend during the current year (unless it is in a Roth IRA of course).

- Unlike a dividend, the taxes are deferred for a stock buyback… An investor will not be taxed on stock price appreciation until the investment is sold. If you are also long-term investors like we are, then the taxes will be deferred for a long time.

- Flexible Option To Provide Value for Management – Similarly, we will compare this to a dividend…

- The company must authorize the repurchase of shares prior to repurchase but just because an authorization exists, it doesn’t mean that it has to be used.

- Each share repurchase program has an expiration date and there is no requirement to purchase all the shares prior to the expiration date. If management does not deem it a beneficial use of cash, then they have the flexibility to not do it!

- For comparison, once you increase a dividend, it is very difficult to reduce the dividend in the future if the company needs to use the cash for something else.

- Indicates a Company is Undervalued – …Typically, management will repurchase shares when they deem the company undervalued…

Cons:

- Use of Cash – To purchase the stock, the company must pay cash. That statement may seem obvious, but it is worth noting.

- This cash cannot be used to invest in the company, purchase another company, or increase their dividend.

- Once that cash is out the door, it is gone. It is important that a company has ample cash when performing a stock buyback for this reason.

- One-Time Benefit to Shareholders – …I would rather a company use the cash to increase their dividend than repurchase their shares…[because]

- the dividend increase will provide a benefit for many years to come [while]

- the stock buyback provides a one-time benefit at the time the cash flies out the door…

How Do Stock Buybacks Benefit Dividend Growth Investors?

In the cons section, I mentioned how I would prefer a dividend increase over a stock buyback. However, that doesn’t mean that a stock buyback does not provide any value to dividend investors…Due to the fact that stock buybacks reduce shares outstanding (assuming no change in earnings per share) the company’s EPS will increase as a result of the transaction. Since EPS is the denominator in the Dividend Payout Ratio calculation, the company’s dividend payout ratio decreases accordingly. With a lower dividend payout ratio, the company has more room to increase their dividend in future periods.

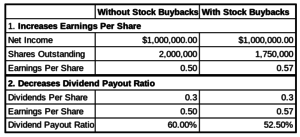

I created the following chart to demonstrate this. Let’s assume these are the financials for Company DD. This year, Company DD had $1,000,000 of Net income, paid a dividend of $.30/share, and repurchased 250,000 shares on the open market. Prior to the stock buyback, the company had 2,000,000 shares outstanding. The chart will show the companies metrics with and without the stock buybacks.

As you can see, this stock buyback reduced the company’s share count significantly, increased their EPS by $.07/share, and reduced their payout ratio from 60% to 52.50%. That’s some nice cushion for the company’s dividend payout ratio and future dividend increases.

Summary

…Stock buybacks (or share repurchases)…[are] a pretty common mechanism nowadays to provide value to shareholders so it is important to familiarize yourself with the terminology and understand the impact it may potentially have on your investments (especially if you are a dividend investor).

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money