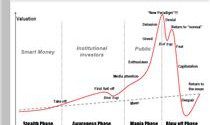

What phase are we in today? We are in the middle to late stages of Phase IV and Phase V — monetary reform to inflate away mountains of debt — is right around the corner! Words: 1864

Read More »Don’t Be A Victim! Buy Unloved & Undervalued Assets Today – Here’s Why (+2K Views)

Anyone who is not prepared to take a contrarian view today, risks to be a real victim in the next 5-7 years.

Read More »Biggest Speculative Bubble Ever Will Begin To Implode This Autumn. Got Gold? (+3K Views)

This coming autumn we are likely to experience the beginning of the end to the biggest speculative bubble in world history. All bubble assets will implode and the financial system will come under massive pressure

Read More »Roubini: Liquidity Time Bomb Will Eventually Trigger A Bust & Collapse

Nouriel Roubini, who has been dubbed "Dr. Doom" for his dark predictions, has joined a growing number of observers who warn that a "liquidity time bomb" could eventually "trigger a bust and a collapse."

Read More »What’s An Investor To Do Given the Current Bubble Environment? Here’s What!

These days anything with a sustained gain is called a bubble that’s just about to burst so what’s an investor to do?

Read More »Stock Market Bubble to “POP” and Cause Global Depression (+3K Views)

In their infinite wisdom the Fed thinks they have rescued the economy by inflating asset prices and creating a so called "wealth affect". In reality they have created the conditions for the next Great Depression and now it's just a matter of time...[until] the forces of regression collapse this parabolic structure. When they do it will drag the global economy into the next depression. Let me explain further.

Read More »Bubbles: Doing NOTHING Is Often the BEST Response – Here’s Why (+2K Views)

The benefits of being able to detect a bubble, when you are in its midst, rather than after it bursts, is that you may be able to protect yourself from its consequences. [Below are possible] mechanisms to detect bubbles, how well they work and what to do when you think a particular asset is in one.

Read More »These Indicators Should Scare the Hell Out of Anyone With A Stock Portfolio (+2K Views)

...For US stocks — and by implication most other equity markets — the danger signals are piling up to the point where a case can be made that the end is, at last, near. Take a look at these examples of indicators that should scare the hell out of anyone with a big stock portfolio.

Read More »6 Bull Market Sectors at Risk of Becoming the Next Big Bubbles

As those familiar with the basics of Austrian economics can attest, an increase in the supply of money and credit [often leads to] asset bubbles in whatever sector(s) the new money and credit find their way into. With the U.S. economy so robust it will not go down easily and, as such, there is still the possibility that the Fed's radical inflationary policies will not break the dollar, but just kick the can down the road one more time, and unleash one more bubble before the bill for 40+ years of monetary madness is finally due. What sectors are most likely to be the recipient of a bubble? [Let's look at the possibilities.] Words: 1212

Read More »Return OF Capital vs. Return ON Capital – What's in Store for 2010?

When Bernanke announced back in 2009 that he saw "green shoots" in the U.S. economy, it was a green light for global investors to start dipping their toes back in the water. Gradually investors started feeling better about the world and as they felt better, they started taking on more risk. It was a shift in focus, away from the mandate of "return OF capital" back toward one of "return ON capital." So, what's in store for 2010? Will it be risk-aversion or risk-taking? Words: 794

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money