A new financial policy initiative known by the label “Financial Repression” may soon become our worst nightmare. ‘Repression’ rhymes with ‘depression’ which could be what we have to look forward to as rampant price inflation and permanently lower living standards take hold. Get ready to be conscripted into a citizen army assembled for the greater cause of saving the nation from being swamped by a tsunami of debt. Let me explain. Words: 1585

Read More »The Future: How Best To Avert Disaster

The future will be determined by how global supply and global demand are brought back into balance. If, [on one hand,] the means are found to expand aggregate demand sufficiently and sustainably, then the global excess supply will be absorbed and the global economy will begin to grow again. If, on the other hand, equilibrium is restored by a collapse in supply – back to a point at which there is real demand, a point determined by the current income and purchasing power of the individuals who comprise the world’s population – then globalization will collapse and the world economy will plunge into depression. Should that occur, millions of people around the world could starve before the decade is out. The geopolitical repercussions of such a scenario would be beyond dire. Words: 1313

Read More »Williams: U.S. Can Not Avoid Coming Financial Armageddon (+3K Views)

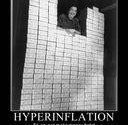

The U.S. economy is in an intensifying inflationary recession that eventually will evolve into a hyperinflationary great depression... [at which time] a $100 bill in the United States will become worth more as functional toilet paper/tissue than as currency. The U.S. government and Federal Reserve already have committed the system to this course through the easy politics of a bottomless pocketbook, the servicing of big-moneyed special interests, and gross mismanagement. The article is long but well worth the read. Words: 3565

Read More »Ian Gordon: LongWave Cycle of Winter to Drive Gold to $4,000/oz. (+2K Views)

Investors are beginning to understand that the U.S. dollar is not the safe haven they perceived it was a few years ago and concurrently, neither are U.S. Treasury notes and bonds. Given the American national debt and deficit problems, from both a fundamental and technical perspective, the U.S. greenback has the potential for considerable downside. Ergo and by axiom, gold bullion has significant upside potential to $1,500 per ounce over the short to mid-term time horizon of 1 – 2 years and $4,000 per ounce over the longer term. Words: 1104

Read More »Investors Should Prepare Now for Coming Inflationary Depression – Got Gold?

It is an old saying that the “road to hell is paved with good intentions”. Well, in recent years, that road has been changed to a super-highway! America was put on that super-highway a few years ago and right now we are traveling at break-neck speed toward the financial abyss. Words: 1132

Read More »More Quantitative Easing Would Have Frightening Side Effects

Like, ‘depression', ‘recession' has become an unacceptable word, because its use would drain confidence even more heavily. The housing market is already tipping into another negative slide with new house sales falling and mortgage rates at record lows. What can be done? We...see more quantitative easing as being unavoidable within three months, if the bad news continues. This time, [however,] we have to ask, can it be managed without frightening side effects? Words: 833

Read More »25 Warning Signs of HARD Economic Times Ahead (+2K Views)

At times like these, it is hardly going out on a limb to say that we are headed for hard economic times. In fact, it seems like almost everyone in the financial world is either declaring that a recession is coming or is busy preparing for one. The truth is that bad economic signs are everywhere. Words: 1171

Read More »Listen Up Washington! Here Are 5 Drastic Fixes For America's Financial Woes

I think we can all agree that the national economy and the global economy are both on slippery slopes. It's time to think outside of the box. We just need an effective leader who is willing to ... try some real solutions. If you don't like my solutions, come up with others but don't tell me America can't be fixed. It can be fixed ... you just have to be willing to do it. Words: 2371

Read More »The Latest Economic Data is Being Massaged and Sugar-coated

I believe that the worse things get, the better they will sound coming from our nation’s leaders/ pundits. Words: 1132

Read More »Magnitude of Current Credit Destruction is Deflationary

Periodically in history, the expansion of credit creates the illusion of prosperity which, regretfully, ends in the inevitable bust which seems to be the case today. The sheer magnitude of credit destruction occuring right now is depressionary. The return to growth will be a long and painful process. Words: 625

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money