I can't predict the future, and neither can you. That's why I created the Gone Fishin' Portfolio. It's breathtakingly simple, works like a charm and has beaten the S&P 500 every year, while taking much less risk than being fully invested in stocks.

Read More »Don’t Invest in Mutual Funds! Here’s Why (+4K Views)

The amount of evidence stacking up that mutual funds do not provide value for their investors is just staggering so what is an investor to do?

Read More »Which 2 Investment Behaviors Are Most Associated With Negative Returns & to What Degree?

Which types of investment behavior are most associated with negative returns and to what degree? This article isolates 2 specific bad behaviors that hurt investor returns most and recommends how such shortcomings can easily be avoided.

Read More »What % of Your Portfolio’s Return Is Due to Skill & How Much to Luck?

An annualized average of 56% of all actively managed domestic equity funds, 59% of active U.S. large-cap equity funds, and 64% of active mid-cap equity funds underperformed broad-market indexes. [Index funds anyone? Let's review.] Words: 895

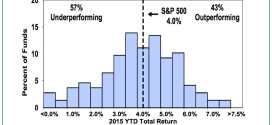

Read More »57% of Mutual Funds Have UNDER-performed the S&P 500 So Far In 2015 – Here’s Why

While 36% of mutual funds, on average, have outperformed their benchmarks (after fees) over the past 10 years, the truth of the matter is that only 43% of mutual funds have outperformed the S&P 500 so far in 2015. In other words, 57% of funds are still underperforming the market this year. Here's why.

Read More »"The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between" – A Book By William Bernstein

Bernstein's attitude regarding the financial services industry is downright hostile: he suggests more than once that retail investors won't go too far wrong by considering any stock broker, financial advisor or insurance salesperson a "hardened criminal." That's with respect to evaluating whether their interests are more aligned with their own retirements or that of their clients. Words: 576

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money