Frankly, we cannot conceive of a more cataclysmic set of circumstances for both the global economy in general, and the gold Cartel specifically, than currently exist. Act now, before “traders” return from summer vacations next week or you may be locked out of the most important “protection trade” of all time!

Read More »Japan’s Nikkei Index Levels: Past, Present & Likely Future

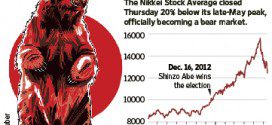

The Tokyo Nikkei Average rose +82% in just six months in a parabolic move that was doomed from the start. They almost always are. When a parabolic move breaks, as it did in May, the speed of the decline can be catastrophic and has fallen 22% to date. The downside expectation is for prices to return to the level of the basing pattern that preceded it. In this case between 8300 to 9100. That is not a prediction, just the level we at which we might expect to start looking for a tradable bottom.

Read More »8 Key Dynamics Which Will Impact Us Over the Next 2-3 Years & Their Eventual Consequences (+2K Views)

Risk is inevitably mispriced when unprecedented intervention suppresses risk [and, as such, the] policies that appear to have been successful for the past four years may continue to appear successful for a year or two longer but that very success comes at a steep, and as yet unpaid, price in suppressed systemic risk, cost, and consequence. [This article identifies 8] key dynamics that will continue to play out over the next two to three years [and an] understanding of the eventual consequence of such influential trends - that risk is inevitably mispriced when unprecedented intervention suppresses risk. Words: 1299

Read More »5 Asia-Centric but Non-Chinese ETFs (+2K Views)

Since the economic recovery began, many investors have looked to Asia to drive growth and stimulate global demand. China has grabbed most of the headlines, as tremendous growth in the world’s most populous nation has essentially pulled this emerging market into a tie with Japan as the world’s second-largest economy. While China’s growth has been impressive, however, recent data releases have shown that Asia isn’t a one-trick pony. Words: 781

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money