History, as well as recent action, suggests that weakness in the stock market is more crucial to gold’s future than weakness in the US Dollar.

Read More »Future Gold Movement: Are Ups/Downs In Interest Rates the Best Predictor? (+2K Views)

Many investors believe that the rise of the federal funds rate is detrimental for gold prices but, although this relationship may often hold, investors should be skeptical about this rule of thumb. This article explains why that is the case.

Read More »Making Sense Of Stocks, Bonds, Currencies & Gold In This Mad, Mad World

To make sense of stocks, bonds and currencies, you need to discern some of the madness (convincingly irrational behavior by policy makers) that’s unfolding in front of our eyes. We assume no responsibility if you turn mad yourself in reading this analysis. Here it is.

Read More »Tips from TIPS on Prospects for Growth, Outlook for Inflation & Future for Gold

TIPS are telling us that the market is quite pessimistic about the prospects for real growth, but not concerned at all about the outlook for inflation.

Read More »Believe It or Not: Biggest Threat to U.S. Is Economic Growth

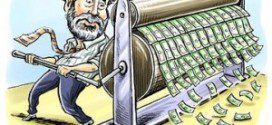

Fed Chair Bernanke vehemently denies that the Fed “monetizes the debt,” but our research shows the Fed may be increasingly doing so. We explain why and what the implications may be for the dollar, gold and currencies.

Read More »Ronald Stoeferle’s “In GOLD We TRUST”: A Summary Review (+2K Views)

Ronald Stoeferle takes an holistic view on the latest developments in the gold market laying out the fundamental arguments why the gold bull market remains intact and concluding, based on conservative assumptions, that the long-term price target for gold is $2,230.

Read More »My Point-by-Point Rebuttal of Roubini’s 7-point Analysis on the Bursting of the Gold Bubble

People ask me all the time where the price of gold is headed. I do not pretend to know, especially in the short-term. However, I understand the fundamentals and Roubini clearly doesn't, nor does he have a clue about money or what causes economic growth...In fact, having just read Nouriel Roubini's seven point analysis on the Bursting of the Gold Bubble, I am of the opinion that he doesn't get even one of the seven points correct. In this article I offer a point-by-point rebuttal.

Read More »Market Signals, Commodity Trends, Economic Indicators & Related News (+3K Views)

This infographic highlight changes in economic indicators, reports relevant news stories, reveals commodity and financial trends, provides technical analysis and looks at the recent price of gold and real interest rates with relevant charts.

Read More »QE3: Impact on Gold & Silver Returns Should Outshine Impact on Economic Growth – Here's Why

While the Fed’s third round of quantitative easing is fairly aggressive it is unlikely to have a significant impact on the economy – especially if policymakers in Washington lead us over the fiscal cliff. Where QE3 may have an impact, however, is in the commodities market, and in particular gold. Here’s why. Words: 400

Read More »Why Isn't Gold Hitting New Highs Given What's Going On In the World These Days?

...[Y]ou may be curious why, despite continued money-printing and abysmal US economic reports, gold hasn't been able to hit new highs. The answer is that gold is currently priced for collapse. Many investors believe the yellow metal has topped out and are selling into every rally. Treasuries have temporarily overtaken gold as the primary safe-haven asset [but, as I see it,] once that dynamic is broken the counterflow into gold will be tremendous. [Let me explain further.] Words: 797

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money