“Central banks and some very smart people hold at least a small portion of their wealth in gold as a hedge. Should you?”

By Lorimer Wilson, editor of munKNEE.com – A Site For Sore Eyes & Inquisitive Minds

[This synopsis of edited excerpts* (570 words) from the original article (1491 words) by Logan Kane provides you with a 62% FASTER – and EASIER – read. Kane is receiving compensation from Seeking Alpha for pageviews of his original unedited article as posted there so please refer to it for more detail. Please note: This complete paragraph, and a link back to the original article, must be included in any article re-posting to avoid copyright infringement.]

“Gold is historically the world’s best store of liquid wealth and a defense against potential devaluation of fiat currencies but is gold still a viable investment? The answer depends on how you’re trying to invest and what your goals are. For many investors, gold is a good choice. A 5% – 7% allocation to gold has been shown to reduce volatility in difficult times and provide a countercyclical benefit to your portfolio.

The logic behind investing in gold

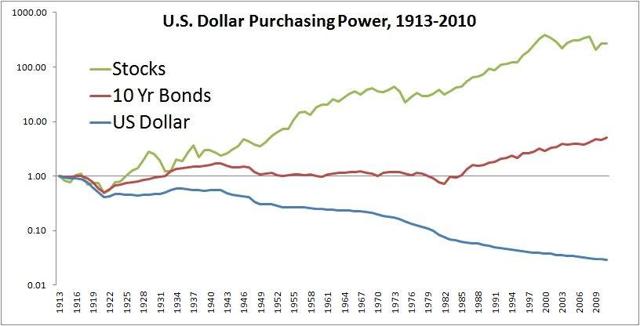

Since the creation of the Federal Reserve in 1913, the purchasing power of the U.S. dollar has steadily declined.

Source: Meb Faber Research

- …Bonds were pretty much a wash until yields started falling in the 1980s, which boosted bond prices.

- The U.S. dollar is down 98 percent against gold since FDR took the U.S. off the gold standard.

- Of course, if you’d invested in stocks, you’d have come out okay, but it would have been a bumpy ride.

…Owning stocks and bonds exposes you to the same systemic risk, [however,] which is the devaluation of the U.S. dollar, especially in the form of an inflationary shock.

The good news is that you don’t need a lot of gold to protect your portfolio…

- Since 1968 (when good market data begins again for gold – the US government banned gold investing for a few decades in the middle), the metal has held its value nicely, delivering a 7.1% annual return.

- In fact, since GLD was founded in 2004, it’s actually beaten equities on a price appreciation basis (equities edged out gold when you include dividends).

What efficient frontier models say about gold?

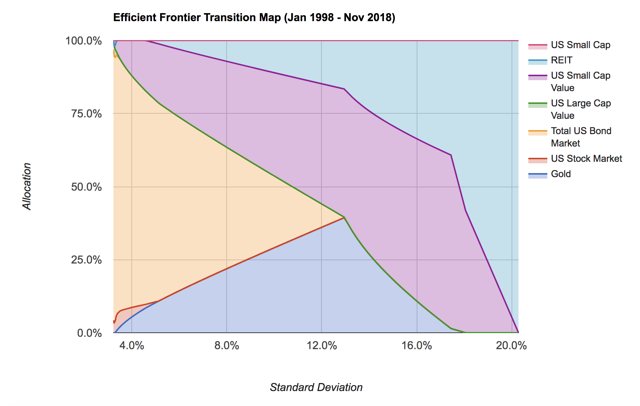

Over the last 20 years, gold has won an allocation of as high as 35 in the historically optimal portfolio across asset classes. In hindsight, very few people did this.

Source: Portfolio Visualizer

Source: Portfolio Visualizer

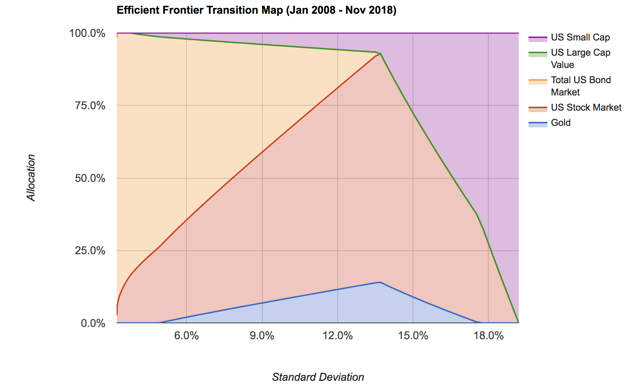

Over the last 10 years…gold still wins nice allocations across the board, with up to a 14% allocation in the model. Gold’s correlation with equities hovers around zero, and its correlation with bonds is around 0.3. This is likely due to the fact that both bonds and gold do well in times of economic stress.

Source: Portfolio Visualizer

Source: Portfolio Visualizer

I find the figures that the model gives to be rather high. Once you include factor driven equities and bonds, the ideal gold allocation drops to my recommended range of roughly 5 % – 7%…

My model) …works great for protecting your principal against equity bear markets and inflation:

- If you live off of your investments, periods of high inflation will hurt both stocks and bonds, potentially putting you in a tight spot. Gold gives you something that you can cash in if equities and bonds go down at the same time to sustain your lifestyle without having to sell equities or bonds at unfavorable prices.

Conclusion

I’m an optimistic person, but I feel that there is a strong historical and data-driven case for investors to put a little money in gold. How much you should invest in gold depends on how much wealth you have to protect. If you have a good job but little assets, I wouldn’t worry too much about it. However, if you have some serious wealth to protect, gold helps keep you safe from inflationary pressures…

Gold can be overhyped by its most die-hard proponents, but the case for owning a little in a diversified portfolio is hard to ignore.”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

Related Articles from the munKNEE Vault:

1. You Should Own Some Gold – Here Are 5 Sound Reasons Why

There are many risks right now that favor owning gold in your portfolio. Below I’ve selected 5 of the most compelling charts that highlight why I think you need gold in your portfolio now.

2. 6 Concrete Facts Why Smart Investors Own Gold

Be smart and add a gold position to your portfolio and sit back knowing you made a smart investment. This article highlights 6 concrete reasons why.

3. The Role of Gold in Your Portfolio

Physical gold is money in the most pure and basic form. It will stand when everything else (paper) falls. Not only will it still be standing, it will be standing tall because of fear and panic.

4. Gold Deserves A Place In Your Investment Portfolio – Here’s Why

While this year has been especially lackluster for gold with its price slumping 8% YTD and down 35% from its high.in 2011 this out-of-favor asset class now deserves a place in investment portfolios. Here’s why.

5. 5 Reasons Gold Should Be In Every Investor’s Portfolio Today

Given the negative real rates, a falling dollar, and heightened correlation between stock and bonds, gold should be an essential part of every investor’s portfolio today.

6. Why, Pray Tell, Would I Want to Own Gold??

Comments I have made that “when this [financial crisis] finally ends the big winners are apt to be the ones who have lost the least purchasing power. Keeping score in nominal dollars is likely to be meaningless. Gold tends to hold its purchasing power regardless of what happens to fiat currency” have prompted questions about a) how to achieve such purchasing power with physical gold when this stage is reached, b) how to go about buying things with gold coins and c) how gold would be utilized under the assumption that a barter system would develop when dollars become worthless. [Let me explain.] Words: 700

7. If You Don’t Think Gold IS a ‘Safe Haven’ Then You Don’t Know the Meaning of the Term!

It would seem that there is a considerable lack of understanding about what the term “safe haven” actually means when it comes to gold. Let me explain just what it means – and does not mean.

8. Should Gold Be In A Diversified Portfolio?

Gold is becoming more and more acceptable in the investment community and especially since interest rates have approached zero and in some countries even gone negative. Until recently no portfolio manager would have mentioned gold and even less recommended it but now the investment profession is starting to discover the liquidity trap and acknowledge the value of cash and, more specifically, gold and its place in a diversified portfolio.

9. The Ultimate Reasons To Own Gold

Work and invest to acquire currency but hold your wealth in gold. This is the fool-proof strategy that has worked for thousands of years.

10. Bull Market In Gold Won’t Begin Until We Have A Bear Market In Stocks – Here’s Why

History, as well as recent action, suggests that weakness in the stock market is more crucial to gold’s future than weakness in the US Dollar.

11. A Look Back at the Performance of Gold vs. Stocks in Times of Crisis

We are in the midst of turbulent times, and it seems inevitable that things can only get worse. Most investors are of the opinion that gold is one of a very few areas of safety…however, when we look at historical charts, it is obvious that gold doesn’t always behave in the way we would expect. [Let me explain.]

12. Careful! Gold’s Performance in Times of Crisis Often Not As Expected

We can devise logical scenarios as to what the price of gold should or should not do, but gold doesn’t always follow the plan. To paraphrase an old Jewish saying: “Man plans. Gold laughs.”

13. Does Gold Really Act As ‘Insurance’ In Times of Financial Market Stress?

This article takes a step back and looks at the bigger picture related to gold including long-term trends, and sets out some key characteristics of gold which are worth considering when (or if) allocating some part of an investment portfolio to the world’s favorite precious metal.

14. Is Gold A Good Portfolio Diversifier and/or Inflation Hedge?

While gold has traditionally been seen as a tactical way to help preserve wealth during market corrections, times of geopolitical stress or persistent dollar weakness, we think there is a case to be made for gold as a core diversifying asset with a long-term strategic role in multi-asset portfolios…as gold’s historically low or negative correlation with most other asset classes argues in its favor…This article looks at how gold-backed assets have behaved over time as a portfolio diversifier, tail risk hedge and inflation hedge.

15. What the Progression of Inflation Means For the Price of Gold

Inflationary periods are highly unjust. They undermine the ethics of hard work and thrift. They destroy solidarity, lead to widespread hardship and often to social unrest. Gold, in contrast, has been the best hedge as investors seek to protect themselves against the large purchasing power losses of inflated currencies.

16. Does gold really serve as an inflation hedge?

The traditional motive behind investing in gold is as a hedge against inflation but the hedge properties of gold are increasingly questioned. In fact, its role as an inflation hedge is perhaps the most debated and ambiguous issue in the financial press and academic literature. This article analyzes all the research and puts forth a convincing conclusion.

17. Gold: A Perfect Hedge Against Today’s Bubbly Stock Market – Here’s Why

All signs point to a recession, which, Rosenberg predicts, is a year away. As such, he suggests de-risking your portfolio. That means raising cash and investing in asset classes that are not correlated to the stock market.

18. How Much Gold Bullion Should You Have In Your Portfolio?

We are reading a lot of hype these days about gold and the necessity to own it but only about 2% of ‘investors’ actually have gold in their portfolios and those that have done so have insufficient quantities to offset the future impact of inflation and to maximize their portfolio returns. New research, however, has determined a specific percentage to accomplish such objectives. Words: 1158

19. Physical Gold – Does It Belong In Your Portfolio?

Every investor should have a minimum of 10% of their portfolio in physical gold – coins or bars. Here’s why.

20. What Is Gold’s Role In An Investment Portfolio – If Any?

There is a plethora of information available in all sorts of media that is negative about gold – gold is risky, volatile, a barbarous relic, and so on – but these arguments miss the point entirely, because they treat gold as an investment. To fully understand gold’s role in an investment portfolio, we need a new mindset—a gold mindset – [and HERE it is].

21. How Many People Do You Know Who Own Gold? Do You? If Not, Here’s Why You Should

If there is a business sector or financial asset class that has outperformed gold in the last 16 years, I can’t think of one yet how many people do you know who understand the necessity for owning gold and have actually acted on that knowledge?

22. Protect Your Portfolio By Including 15% Gold Bullion – Here’s Why

Only about 2% of ‘investors’ actually have gold in their portfolios and those that have done so have insufficient quantities to offset the future impact of inflation and to maximize their portfolio returns. New research, however, has determined a specific percentage to accomplish such objectives. Words: 1063

23. Your Portfolio Should Have 2-9% Physical Gold In It – Here’s Why

Because investment professionals are generally well informed, competing in an industry in which performance is king, one would assume any asset class deserving of rightful consideration would enjoy a fair hearing so it begs the question “Why Doesn’t Gold Get The Respect It Deserves?”

24. Recent Research Concludes: Ideal Portfolio Should Have 27% to 30% Allocated to Gold

In the early part of the 1980s there were many seminal gold price studies that showed 5% to 10% of an investment portfolio could have been optimally allocated to gold from 1968 to 1980 to maximize a risk return allocation based on performance. Even today many high profile and alternative financial experts…say a 10% gold allocation makes sense but a closer look at the facts show that they may be a little understated in percentage terms. Let’s take a closer look as to why this may be the case.

25. Your Portfolio Isn’t Adequately Diversified Without 7-15% in Precious Metals – Here’s Why

The traditional view of portfolio management is that three asset classes, stocks, bonds and cash, are sufficient to achieve diversification. This view is, quite simply, wrong because over the past 10 years gold, silver and platinum have singularly outperformed virtually all major widely accepted investment indexes. Precious metals should be considered an independent asset class and an allocation to precious metals, as the most uncorrelated asset group, is essential for proper portfolio diversification.

26. Which Gold and Silver Assets (and How Much) Should You Own?

It is no longer a matter of whether or not you should buy gold and/or silver but, rather, which type of investment(s) and how much. You don’t need a lot but you do need some – and here’s a primer on just what type of investment vehicles are available and recommendations on just how much you should buy. Words: 1086

27. Be Happy! Don’t Worry! No Need to Own Gold! Here’s Why

Central bankers are managing paper currencies for the benefit of the people, not the financial and political elite. Consequently consumer prices are stable and there is no reason to own gold as protection from currency devaluations.

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money