…It took 6 long years for gold to break through resistance at $1,350…and I doubt that we’ll see $1,350 decisively broken on the downside in my lifetime. The 6 year resistance line has now become an extremely strong support line. [Unfortunately, however,] we must remember that the rising gold price is a warning signal for the coming economic crisis.

The Gold:Silver Ratio

… Gold has moved up $125 since May 30th but silver is lagging behind with the gold/silver ratio at over 92, a new high for this century…We could see the ratio going a bit higher before it turns but, once the turn comes, the silver price will explode and go up more than twice as fast as gold.

- If the ratio reaches the 30 level as in 2011, silver will go up 3x as fast as gold.

- When gold reaches $2,000, silver should reach $66.

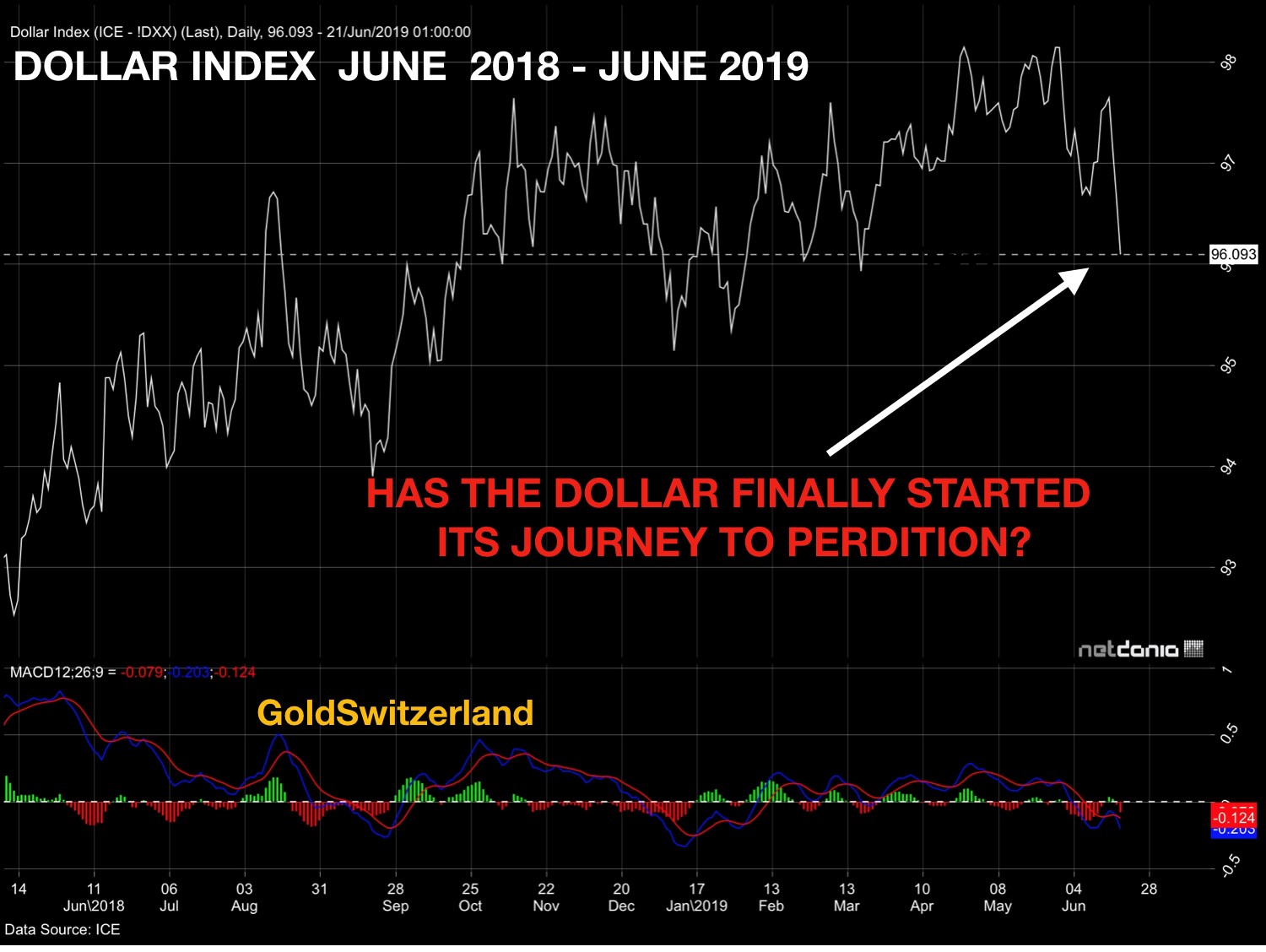

The U.S. Dollar

…[Conversely,] the dollar now seems to be starting the journey to zero. It clearly won’t happen overnight but it is guaranteed that we will see the end of the dollar and its reserve currency status in the next few years.

The Dark Years

…At the same time as many impatient holders of gold are now rejoicing over the price move, however, we must remember that the very strong rise of gold that we are about to see, is a warning signal of very difficult times ahead in the world…that we are in the next phase going to experience the Dark Years…the consequence of a world that for decades has lived above its means, in the belief that credit and printed money can bring prosperity. We will soon experience that this has all been an illusion which will painfully turn into a harsh reality. That means, an implosion of debt markets and also of all the bubble assets that have been financed by the debt…

The Derivative Market

The biggest risk is the $1.5 quadrillion derivatives market which at some point will evaporate in smoke. These derivatives only function in bull markets when there is liquidity in the system and, in the coming bear markets, there will be no liquidity and the derivatives bubble will implode as counterparty not only fails but also disappears. There will be no one on the other side of all these derivative trades which have been the most massive money spinner for the bankers…

What Happens Next?

…The markets will become extremely volatile.

- The U.S. stock market is still in its final hurrah stage when any news is good news.

- Potentially lower rates due to a slowing economy should be very bearish for stocks but not in this final euphoric phase.

- U.S. stocks as well as global markets are finishing their final moves up before a long term secular bear market starts.

- The fall could begin in the next few weeks or possibly take as long as 2-3 months.

- Before the decline is finished, we should see a fall of at least 90%, in real terms, just like in 1929-31.

When the bear market in stocks starts in earnest,

- investors will initially buy the dips but very soon…

- euphoria and optimism will turn to dysphoria and extreme pessimism…

The next crisis for the world is likely to start in the autumn of 2019. It will be a continuation of the 2006-9 crisis which was never solved but just postponed. This time the world is starting with a debt of $240 trillion, over twice the debt level of 2006 – and risk is exponentially higher than last time.

The catalyst for the coming cataclysm…[could] come from…Deutsche Bank, U.S. junk bonds or Japan or whatever and…it will lead to panic in the markets with confidence evaporating and fear setting in.

What Should An Investor Do?

Now is the time to prepare for this. It will soon be too late. Physical gold should be part of everyone’s wealth preservation strategy.

Editor’s Note: The above excerpts from the original article have been edited ([ ]) and abridged (…) for the sake of clarity and brevity. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money