The Global Economy is on the brink of a recession with 58% of 29 OECD countries experiencing business cycle contractions [although] the U.S. seems to be plodding along despite woes outside her borders . Whilst global recession is certainly an alarm bell for the U.S economy, it is just that – a shot across the bows and not a direct hit. [As such,] there is no reason to hit any panic buttons…[yet other than] to monitor the U.S. recession models ever more closely for any signs of weakness. [Let me explain why this is the case.] Words: 601

countries experiencing business cycle contractions [although] the U.S. seems to be plodding along despite woes outside her borders . Whilst global recession is certainly an alarm bell for the U.S economy, it is just that – a shot across the bows and not a direct hit. [As such,] there is no reason to hit any panic buttons…[yet other than] to monitor the U.S. recession models ever more closely for any signs of weakness. [Let me explain why this is the case.] Words: 601

So says Dwaine Van Vuuren (http://recessionalert.com) in edited excerpts from his article* entitled On the brink of Global Recession.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Van Vuuren goes on to say, in part:

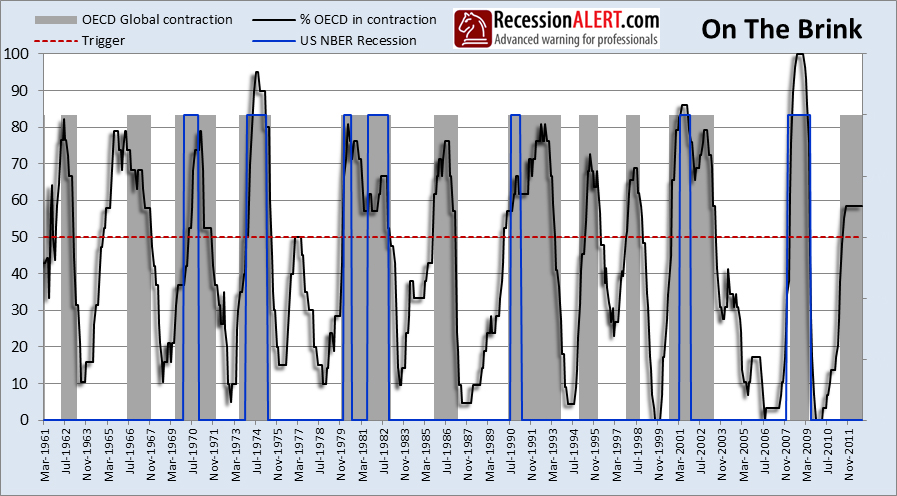

The chart below shows OECD defined global contractions (grey shaded areas) together with the percentage of 29 OECD member countries experiencing slowdowns. It is evident that whenever 50% or more of countries enter contraction (red dotted line) that the odds of global recession are very high.

The blue lines show NBER recessions for the U.S and we see that whilst every U.S recession occurred during an OECD-defined global recession, the converse is not always true….The question that comes to mind, [however,] is [whether] the world economies are plunging, muddling along or making soft landings. We need to take the above chart in that context. If 58% of countries are in recession and world economies are on steep downward trajectories then we have cause for concern as the odds of the U.S avoiding contagion will be slim indeed.

Who in the world is currently reading this article along with you? Click here

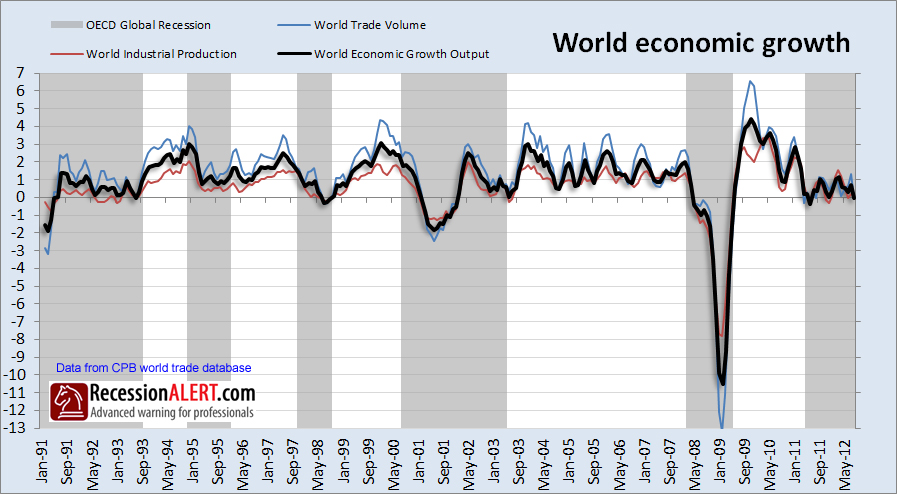

To find out how the world economies are doing, we took import/export trade data from 85 countries around the world (to calculate extent of world trade volume) and coupled this with industrial output to come up with a global 2-factor “economic growth index” shown below. The data is obtained from the CPB world trade database containing foreign trade value series of 23 OECD countries and around 60 emerging economies. Those 60 emerging economies cover approximately 90% of foreign trade of all emerging economies. With the almost 85 countries in the database, coverage of total world trade value is around 97%.

This growth series is obviously weighted according to size of countries exports/imports (for trade volume) and size of industrial base (for production) and therefore is less synchronized with the OECD global recession periods than the % of countries in recession (which acts more like a diffusion index). It is however telling us that:

- some large countries (like the U.S and China) are propping up the world economy output despite a high percentage of OECD countries in recession and that

- economic growth is “bouncing along a bottom” rather than plunging precariously over a cliff.

- In fact, the world output growth currently looks very similar to the US Coincident Economic growth model [below] taken from our “NBER Recession Model of last resort”

Conclusion

The conclusion is that:

- the world economies are in a precarious state but many are making soft landings and the % of countries in recession seems to have peaked.

- there is cause for concern for contagion to the U.S which means we must watch world economy status and the U.S recession models from our Recession Forecast Ensemble even closer for faintest signs of weakness.

A fall into recession in the U.S is likely to be a very rapid one if it occurs against the current world backdrop. Getting out the stock market too soon can be very costly, as has been the case over the last 13 months since ECRI’s first recession call. For this reason we are not hitting any panic buttons on our side just yet.

*http://recessionalert.com/on-the-brink-of-global-recession/

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. This Indicator at a Crossroads As to Direction of Future Global Growth

The Shanghai Stock Exchange Composite (SSEC) index is at a crucial crossroads with serious implications as to whether or not slower global growth is at hand. Take a look at where it currently is and continue to watch closely in the days ahead.

2. Are You Doing What Needs to be Done to Protect Yourself From the Coming Global Financial Crisis?

The primary driver of stock prices over the last three years has been the anticipation of more monetary stimulus from Central Banks…[and if one] were to remove the market moves that occurred around Fed FOMC meetings (the times when the Fed announced new programs or hinted at doing so), the S&P 500 would be at 600 today. [As such,] by announcing a program that will be on going in nature, the Fed has removed the anticipation of future Central Bank intervention from investors’ psychologies. This could become highly problematic, especially if these latest announcements turn out to be duds. [Are you doing what needs to be done to protect yourself?] Words: 682

3. These 25 Videos Warn of Impending Economic Collapse & Chaos

The internet is awash (drowning?) in hundreds of doom and gloom videos providing dire warnings of coming world depression, food shortages, rioting in the streets, rampant (hyper) inflation, deepening banking crisis, economic apocalypse, financial Armageddon, the demise of America – well, you get the idea. Below is a small sample of such videos with a hyperlink to each.

“The end of the world as we know it” is what David Korowicz predicts is coming sometime this decade – an “ultimate” crash that will be irreversible – TEOTWAWKI! Words: 1395

5. Are Preparations Being Made For Worldwide Financial Collapse?

Something really strange appears to be happening. All over the globe, governments and big banks are acting as if they are anticipating an imminent financial collapse. Here’s some of what is being said and is apparently happening. Words: 1200

6. Don’t Ignore the Coming Financial Storm – It IS Coming and Here’s How to Get Prepared

Many people refer to me as a “doom and gloomer” because I run a website called “The Economic Collapse”. [Just because] I am constantly pointing out that the entire world is heading for a complete and total financial nightmare, [however,] I don’t think that it does any good to stick your head in the sand. I believe that there is hope in understanding what is happening and I believe that there is hope in getting prepared. [This article does just that.] Words: 2432

7. Nothing Can Be Done to Avoid Coming World-wide Depression! Here’s Why

Governments everywhere are becoming more distressed and desperate as economic realities dominate the political doublespeak. The world is at a dangerous point. Much of what we thought we knew and assumed regarding governmental behavior and economics is beginning to be reassessed. Governments of the world are out of money and out of ideas. The ponzi scam that has been perpetrated for over fifty years is collapsing under its own weight. There are not enough suckers and capital left to sustain the fraud. [Let me explain further.] Words: 999

8. The Doomsday Cycle: There are More, and Worse, Crises to Come! Here’s Why

Industrialised countries today face serious risks – for their financial sectors, for their public finances, and for their growth prospects. This column explains how, through our financial systems, we have created enormous, complex financial structures that can inflict tragic consequences with failure and yet are inherently difficult to regulate and control. It explains how this has happened and why there are more and worse crises to come. Words: 2434

9. Collapse of Our Financial System is Inevitable! Here’s Why & How to Protect Yourself

There is a clear link between our system of fiat (paper) money, the supply of money and credit in an economy, and the 30-year boom that came to a dramatic end in 2008. It’s only by understanding this link that investors (and anyone with wealth) can appreciate just how fragile our financial system is, and what to do to protect themselves from its inevitable collapse. [Let me explain.] Words: 961

10. The “Great Crisis” Is Well On Its Way and Will Make 2008 Look Like a Joke!

For over two years now, I’ve been warning that the 2008 Crash was just a warm up and that the REAL Crisis would occur when the stock market realized that the Central Banks, lead by the US Federal Reserve could NOT actually hold the financial system together. Well, the Crisis I’ve been warning about is here. [Let me explain.] Words: 306

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money