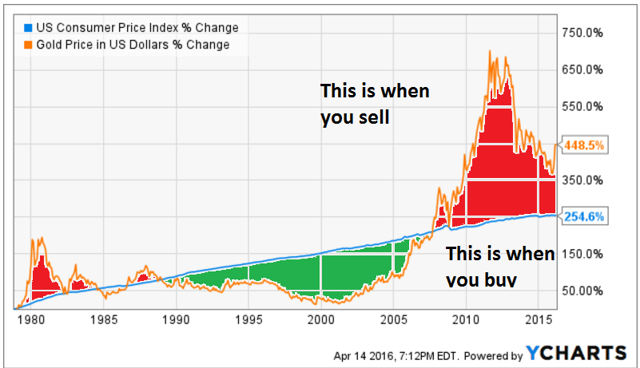

…The purpose of gold is to protect purchasing power and hedge against inflation…[but] gold is not immune from speculative bubbles and overvaluation… [and when the price of gold is compared to the CPI index it is clearly evident that] gold has become overvalued.

immune from speculative bubbles and overvaluation… [and when the price of gold is compared to the CPI index it is clearly evident that] gold has become overvalued.

…The purpose of gold is to protect purchasing power and hedge against inflation. Some will say the metal has little direct correlation to inflation, but this is not the point. The point is that gold is a readily available currency that is guaranteed to retain some value, even during an apocalyptic doomsday scenario – something no fiat currency can promise. Exchange traded gold products make this process easier than ever.

Nevertheless, gold is not immune from speculative bubbles and overvaluation. This concern is especially pertinent for products like the SPDR Gold Trust (NYSEARCA:GLD). Unlike physical gold, ETFs like are not designed to [be] kept forever. The point of these funds is to preserve wealth for a later date. If you buy GLD when gold is overvalued you are making a mistake and are no different from the people who bought houses at the peak of 2007 or investors who bought stocks during the tech bubble in 2001. The investment will not protect purchasing power in the long term.

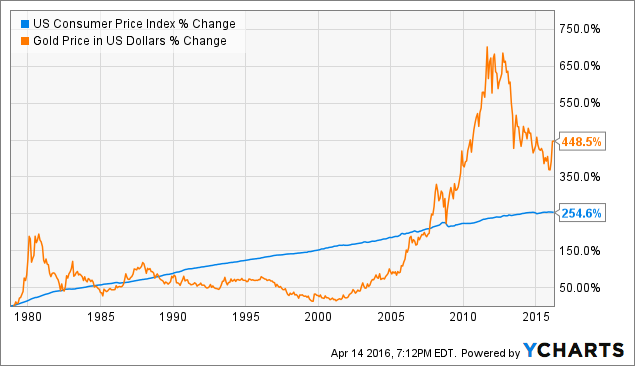

Gold vs the U.S CPI:

Purchasing power and inflation can be measured with the Consumer Price Index (NYSEARCA:CPI). The CPI is a measurement of the average change over time in a market basket of consumer goods and services. It can be used to measure purchasing power erosion and inflation in the U.S dollar. Comparing the CPI to gold lets us know how well gold is doing at protecting purchasing power. It also shows us when gold has become overvalued by speculation.

Stop clicking around! #Follow the munKNEE instead

What caused the bubble in gold?

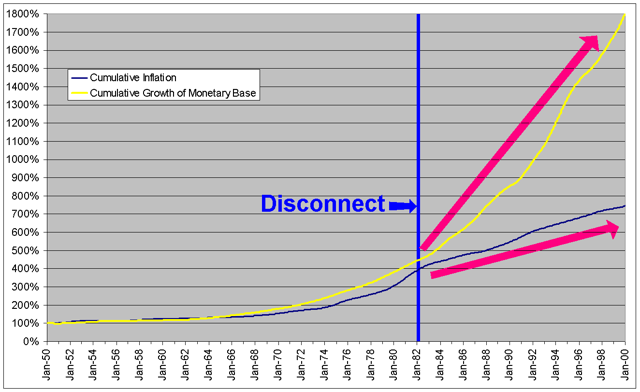

The bubble in gold was caused by the Federal Reserve’s quantitative easing policy. QE was done to, not only stimulate the economy, but to prevent deflation. Because of the vast amounts of money being printed many institutions expected that the U.S economy would experience “stagflation”- a situation of rising prices with zero economic growth [but] when stagflation didn’t materialize, the gold bubble lost its footing. This is why the metal is slowly unwinding to a more reasonable valuation. In the present, expect gold spikes after dovish Fed meetings and drops when the dollar strengthens or if the Fed tightens.

When to buy gold?

The best time to buy gold was from 1990 to 2005. The worst times to buy it was in the early 1980s and in 2011 to the present:

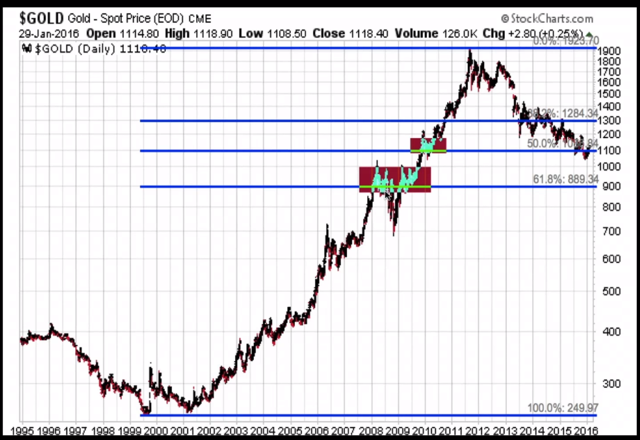

The chart above indicates that the fair value of gold is around $750, and this is in the ballpark of the metal’s profitable cost of production. The chart shows major resistance when gold started to hit the CPI in 1983 and 2009. In the years between 1990 to 2006 we had a major undervaluation of gold that was probably due to how attractive the equities markets were during that period.

Current holders of physical gold shouldn’t necessarily sell, but potential buyers might want to wait for a reliable indicator that prices have bottomed out before getting in. Paper gold products like GLD should simply be avoided right now.

My Price Target:

I do not think gold prices will go as low as $750, but that is the hard fundamental floor prices below which represent extreme undervaluation. However, I would expect this to occur in a full fledged deflationary period lasting more than 4 quarters. The dovish policies of the U.S Federal Reserve make this unlikely, [however,] and the probability of quantitative easing being used to prevent deflation during economic downturn should provide speculative resistance to price decreases below $1000.

The price of gold should bottom at around $850-950 as the CPI rises to meet it over a decade or so.

Disclosure: The original article, by “Gold Bug”, was edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money