We now have the most bullish setup for silver that we have ever seen. After trading  sideways/down for over 20 months now, investors have completely lost interest in it, which is of course the perfect breeding ground for a huge rally that seems to come out of nowhere. both COTs and the silver to gold ratio are at record extremes that point to a major bull market in silver starting imminently.

sideways/down for over 20 months now, investors have completely lost interest in it, which is of course the perfect breeding ground for a huge rally that seems to come out of nowhere. both COTs and the silver to gold ratio are at record extremes that point to a major bull market in silver starting imminently.

The original article has been edited here for length (…) and clarity ([ ])

The 6-month Chart

The 6-month chart below looks dead boring, which is of course why those who are habitually wrong are making the dangerous mistake of shorting it. If you can stay awake for long enough looking at it, you will observe a dreary neutral trend and somewhat bearishly aligned moving averages – it certainly isn’t this chart that stirs our interest in silver.

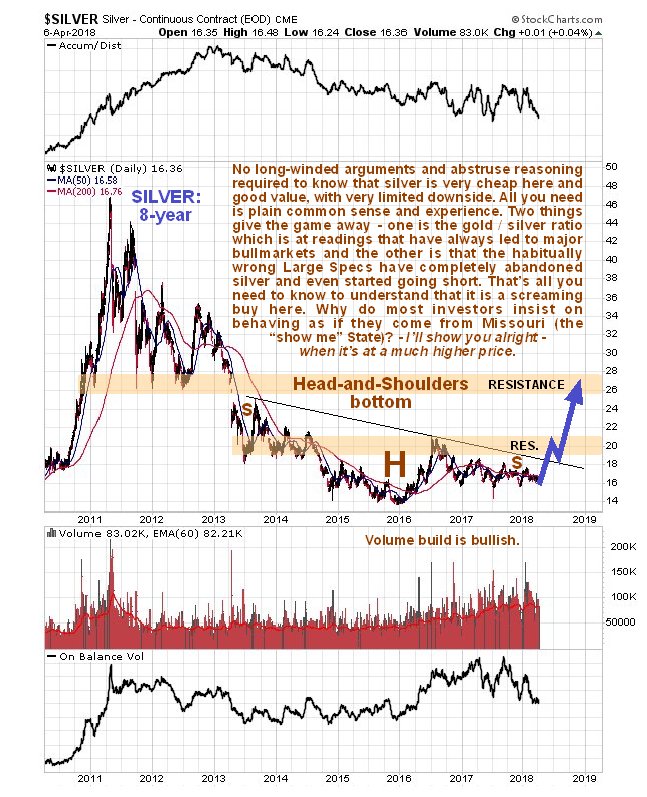

The 8-year chart below presents a much more encouraging picture. While this chart superficially looks boring and bearish too, at first sight, on closer inspection we realize that a down-sloping Head-and-Shoulders bottom is completing.

While down sloping Head-and-Shoulders bottoms don’t inspire much confidence, we should be mindful that the parallel one visible on gold’s 8-year chart is not down-sloping, it is flat-topped, i.e. relatively normal, and the down-slope on the silver H&S bottom pattern merely reflects the fact that silver always tends to underperform gold at the tail end of sector bear markets, which is the reason why the silver/gold ratio that we will soon look at is so important.

Here we should also note that the downslope of silver’s base pattern also serves to camouflage what is going on, so that the mob aren’t interested in it at all, which is great because it means that we can buy a range of silver investments off them at fire sale prices well before it starts higher, which is what we have been doing for weeks now.

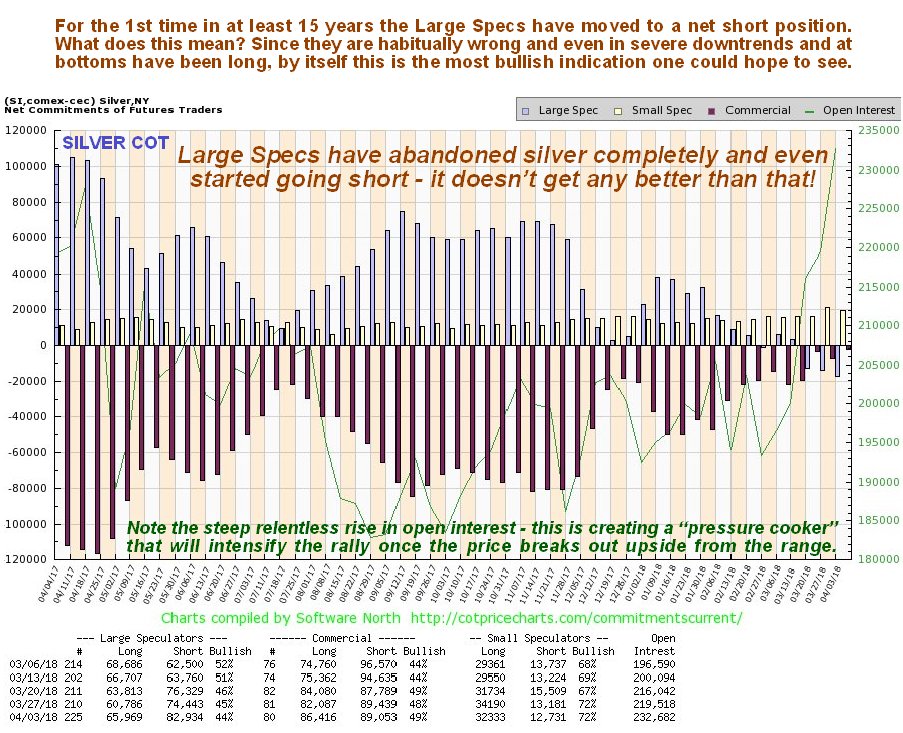

The latest COT chart below is very interesting as it provides compelling evidence that silver is getting very close to suddenly busting out upside, at which point it will likely spike dramatically as the legions of semi-conscious traders shorting it are instantly panic stricken and race to cover.

On the chart below we see that after banging their heads against a wall for years by being long silver, the habitually wrong Large Specs (blue bars) have finally given up on it and in recent weeks have even had the temerity to start shorting it. This is something we have never seen before in 15-plus years of following this market and is the surest indication you could hope to see that silver is about to take off higher. Making the situation even more explosively bullish is the steep rise in open interest of recent weeks, which means that there are more traders to be caught out who will need to cover if the price starts to rise.

This is an astoundingly bullish COT chart.

Click on chart to popup a larger clearer version

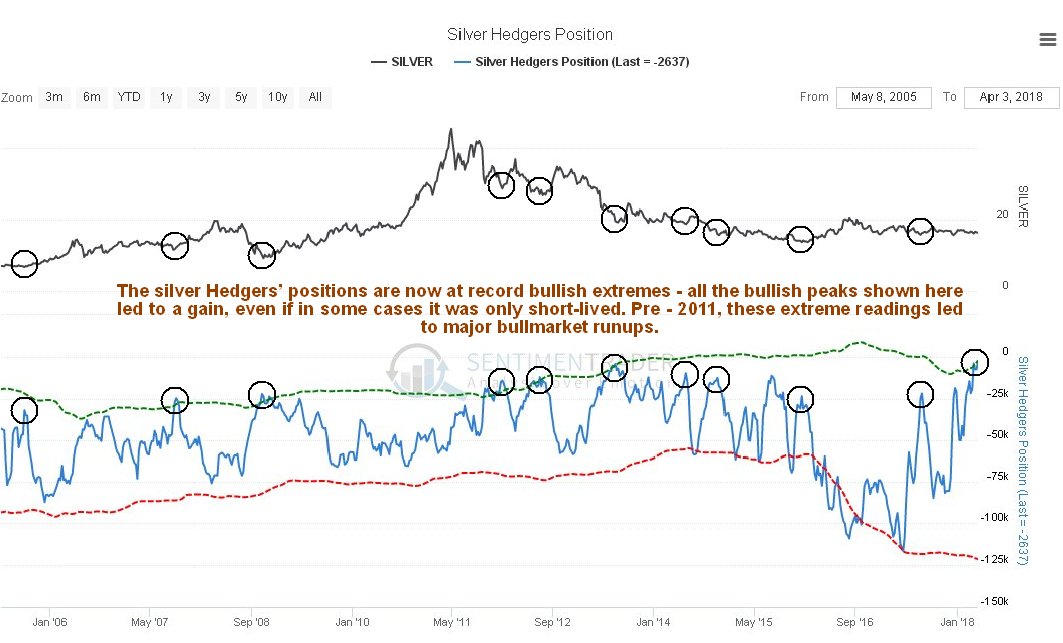

The Hedgers Chart

We also have record bullish extremes in the latest Hedgers chart [as illustrated below]. As we can see, high readings on this chart on the left side of it, when silver was in a bull market, led to major bull market advances, and even during the following bear market always led at least to a rally of sorts. Lest you make the mistake of thinking “Oh well, maybe it just means another bear market rally” don’t forget the completing Head-and-Shoulders bottom shown above and the fact that the Large Specs have given up and started to go short for the 1st time ever.

Click on chart to popup a larger clearer version. Chart courtesy of sentimentrader.com

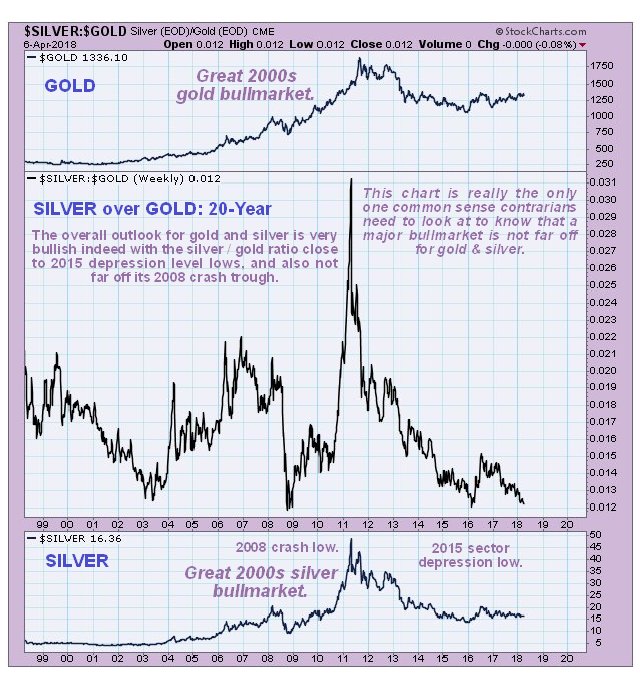

The Silver/Gold Ratio Chart

Finally, if all the above presented evidence isn’t enough to convince you that silver is drawing close to a new bull market, see what you make of our last chart, for the silver/gold ratio going back 20 years. As mentioned above, gold is favored more and more over silver as sector bear markets continue, because it is viewed as more solid and safer, so that silver gets cheaper and cheaper relative to gold, until an extreme is reached and the pendulum starts to swing back the other way with a new sector bull market. There were only 3 other occasions in the past 20 years that this ratio sank to the sort of levels it is at now

- back in 2003 as the sector bull market was just getting started,

- then at the lows associated with the 2008 market crash,

- and finally in the depths of the PM sector depression at the end of 2015 and early 2016.

After the 1st two occasions of these low readings, silver entered into a major uptrend that took it much higher, and on the 3rd occasion early in 2016 a significant rally followed, and now the ratio appears to be double bottoming with that low as gold and silver complete their base patterns. It is therefore logical to expect this setup to birth another major silver bull market, especially given the additional supportive factors that we looked at above.

Conclusion:

A major new silver bull market looks imminent and is expected to kick off with a dramatic spike due to a wave of panic short covering.

Related Articles From the munKNEE Vault:

1. Silver Prices: How High Will They Go? $100? $300? $500?

Silver prices have risen exponentially for the past 90 years as the dollar has been consistently devalued. Expect continued silver price rises.

2. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher!

The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached.

3. Are You A Silver Bug? Take This 10-question Quiz To Find Out

If you’re a silver believer like us, check out our 10-question quiz to see if you can call yourself a silver bug.

4. Gold/Silver Ratio Suggests You Have Until April 1 To Buy Silver While It’s Still Cheap – Here’s Why

The gold/silver ratio (the price of gold divided by the price of silver) has touched 80 a few times over the past 25 years but the number of days one has been able to buy silver while the ratio is above 80 has been few and this is calendar days, not trading days. This is highly actionable information.

5. Silver Is In A Massive Bull Market – Here’s Why

It’s Economics 101. Price works to balance supply and demand. Limited supply causes higher prices; higher prices help curb demand…[and] that equation is playing out right now in the silver market. Mined silver supplies have been drying up over the past few years, while silver prices have climbed 20% in the same time frame…

6. Silver Is A “Must Own” – Here’s Why

Silver has often rebounded nearly 100% within 12-15 months after bad and long bear markets. History says Silver is ripe for a similar move over the next 12 to 18 months.

7. Silver is Now Even More Precious Than Gold! Do You Own Any?

Silver is now rarer than gold and will be for all of eternity. From this point forth we work from current silver production alone and, from this point forth, demand will outstrip production without exception. Can you imagine what that means for the future price of this, indeed, precious metal? Forget about the popular expression: ‘Got gold?’ The much more important – and potentially more profitable – question to ask these days is, ‘Got silver?’

8. Silver Is THE Antidote to Bubble Craziness – Here’s Why

Silver in early 2018 is inexpensive compared to M3, National Debt, government expenditures, the Dow and gold.

9. Could Gold:Silver Ratio Be Sending A Bullish Message?

Could the long-term trend in metals be about to change?

For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money