Calling a top is difficult at best, and I’m much less interested in being right about a top than I am in generating grounded analysis and presenting it well to readers. In this case, it’s hard to see the current spike in equities as anything other than a blow-off move into a final top. It’s the only description for what the equity markets are doing. Let me explain further.

than I am in generating grounded analysis and presenting it well to readers. In this case, it’s hard to see the current spike in equities as anything other than a blow-off move into a final top. It’s the only description for what the equity markets are doing. Let me explain further.

The above introductory comments are edited excerpts from an article* by Bob Loukas (TheFinancialTap.com) entitled Reminiscent of Pompeii.

Loukas goes on to say in further edited excerpts:

…The idea behind current central bank actions, that higher asset prices create a “wealth effect” that will become self-sustaining and spur economic growth, ignores two key facts:

- world economies are laden with high, non-performing debt, and

- the economies’ problems are structural in nature.

These structural problems can’t be fixed with liquidity, so pumping additional cheap money into economies is not a solution. Money can be created through cheap credit, but money velocity cannot. Until we see a real business cycle downturn, one in which non-performing debt is finally expunged from the system, we will never have a foundation for organic economic growth and an expansion of GDP. In short, the world needs to experience a fair amount of pain before it has the potential for real gain.

Given the world’s poor economic fundamentals, equity markets at current levels are both artificial and unsustainable. They are far from reflecting the current economic state and, more importantly, are completely misaligned with future risks.

Once the business cycle turns lower again – as it inevitably will – the market will collapse on itself and will be seen to have been hugely, woefully overpriced. The market re-pricing which occurs during these periods is always severe and generally swift. It’s the market’s mechanism for closing the imbalance between prices at the peak of speculative fever, and the market’s intrinsic value. However, since pricing imbalances often work both ways, during true secular bear markets, prices (valuation) typically fall well below a market’s true value.

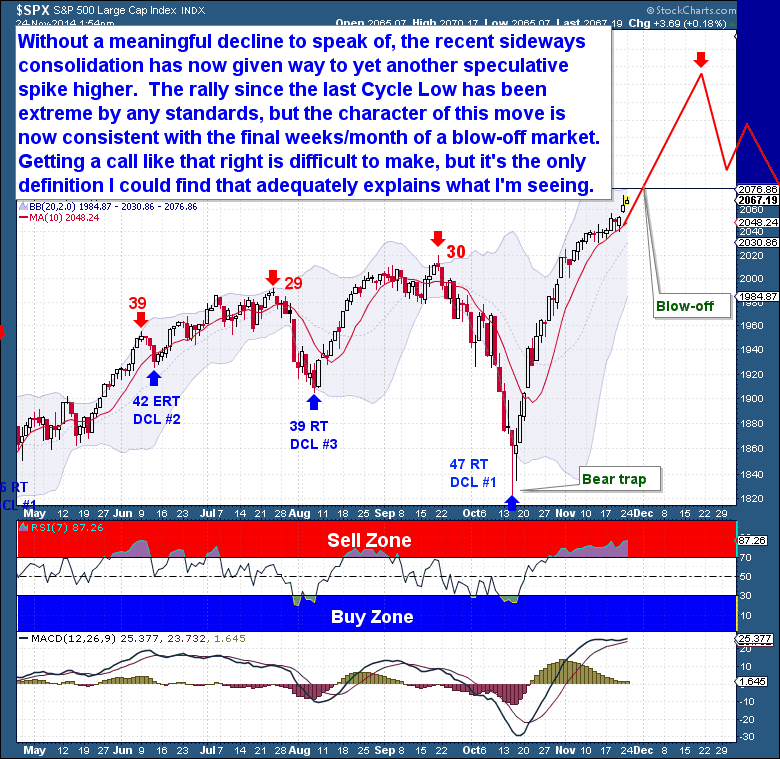

Markets are often ignorant of what lies directly ahead, and I believe that’s the case with equities today. After a relentless move higher, the recent sideways consolidation has given way to yet another speculative spike higher. The rally since the last Daily Cycle Low has been extreme by any standard, but the character of the current move is now consistent with the final weeks of a blow-off top.

Conclusion

Blow-offs end with a final exhaustive peak and we’re not there yet. To be perfectly honest, I’m not sure exactly when it will peak, only that it’s likely to be in the coming month. A possible clue is the length of the typical Daily Cycle, roughly 40 to 45 trading days in total.

If this breathless trajectory continues, then this Cycle is likely to mark that peak. As it’s already on Day 27, that Cycle top is just another 13 to 20 sessions away, just in time for the holidays.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://thefinancialtap.com/public/reminiscent-of-pompeii (Copyright © 2014 thefinancialtap.com. All rights reserved.)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. These 5 Things Could Prevent Economy from Slumping & Allow Equities to Continue Climbing

This article examines 5 fairly exciting things going on which, at the very least, could keep the U.S. economy from slumping, and enable equities to continue to climb. Read More »

2. Bursting of S&P 500 Bubble Fast Approaching! Here’s Proof

Huge growth patterns in markets — more commonly known as “bubbles” — have a remarkable timing signature common to every single one of them – they all have lasted 64 or 65 months from initial growth to blow-off top. Read More »

3. Will Stock Markets Continue to Out-perform Now That Fed Monetary Heroin Has Been Withdrawn?

Mark this day on your calendars. The Dow is at 16974, the S&P 500 is at 1982 and the NASDAQ is at 4549. From this day forward, we will be looking to see how the stock market performs without the monetary heroin that the Federal Reserve has been providing to it. Read More »

4. I Love – Absolutely Love – This Bull Stock Market! Yeah, Sure!

I have seen the light. I have seen the error of my ways. At long last, I understand. This stock market is a great investment. Stocks are just going to keep going up and up and up and up. Anyone who doesn’t buy now is a fool. I have learned to love the bull market. Yeah, sure! Read More »

5. The Stock Market Needs A 1987-like Crash – Here’s Why

If you’re in the business of fear-mongering, one of the go-to moves to try to scare investors is to predict that the markets are looking eerily similar to October of 1987. That being said, you could actually argue that the 1987 crash was a good thing for the markets. It knocked some of the wind out of its sails after more than doubling from 1982-1986 so it begs the question “Would a Repeat of the 1987 Crash Really Be That Bad?”. Read More »

6. “Is the Stock Market Sitting On A Trap Door?” These 2 Indicators Say “Yes”

The Russell 3000, a broad equity index representing 98% of the investable U.S. stock market, is up 9.3% for 2014 on a total-return basis…[but] the median total return for Russell 3000 constituents is just 1.5% reflecting the fact that small- and mid-cap stocks are under-performing… This current alarming deterioration in breadth, a term that refers to how much of the market is participating in the advance, begs the question: “Is the stock market sitting on a trap door?” This article looks at 2 trap door indicators that suggest that that might, indeed, be the case. Read More »

7. Take Note Because Those Investors Who Ignore These Observations Do So At Their Great Peril

Is a major top at hand? It is often said that bells do not ring to signal the end of a bull market but if the broad averages were in fact to plummet in the weeks ahead, never forget that bells did indeed ring. This article contains the opinions of three heavyweights in the guru world which are so insightful that any investors who ignore their observations do so at their great peril. Read More »

8. What Does the 10-year Yield’s Death Cross Mean For Stocks?

The 10-year yield’s Death Cross has proven to be a pretty significant risk-off shot across the bow over the last decade and this matters today because the 10-year yield put in a Death Cross back in early April of this year. So what does the 10-Year’s Death Cross mean for stocks this time? Read More »

9. Financial Asset Values Hang In Mid-air Like Wile E. Coyote – Here’s Why

The financial markets are drastically over-capitalizing earnings and over-valuing all asset classes so, as the Fed and its central bank confederates around the world increasingly run out of excuses for extending the radical monetary experiments of the present era, even the gamblers will come to recognize who is really the Wile E Coyote in the piece. Then they will panic. Read More »

10. Look Out Below? Buffett Market Indicator Has Now Surpassed 2007 Level

Market Cap to GDP is a long-term valuation indicator that has become popular in recent years, thanks to Warren Buffett and it is now at the second highest level in the past 60 years – even surpassing the levels reached in 2007. Read More »

11. World’s Stock Markets Are Saying “Let’s Get Ready to Tumble!”

To ignore all the compelling charts and data below would be irresponsible and, as such, will NOT go unnoticed by institutional investors. Such bearish barometers for stocks worldwide will, unfortunately, be ignored by the ignorant and gullible hoi pollo causing them severe financial loss as investor complacency in the past has nearly always led to a stock market crash. Read More »

12. Stock Market Bubble to “POP” and Cause Global Depression

In their infinite wisdom the Fed thinks they have rescued the economy by inflating asset prices and creating a so called “wealth affect”. In reality they have created the conditions for the next Great Depression and now it’s just a matter of time…[until] the forces of regression collapse this parabolic structure. When they do it will drag the global economy into the next depression. Let me explain further. Read More »

13. It’s Just A Matter Of Time Before the Stock Market Bubble Is Pricked! Here’s Why

Once again the stock market is in full bubble mode. The market was already overvalued earlier this year and the froth continues to build. Valuations are off the chart and euphoria is setting in while, at the same time, you have inflation eroding the purchasing power of regular Americans not participating in this casino. All the signs of a bubble top are there – massive speculation, unexplainable valuations, and blind optimism – even though the fundamentals don’t make any sense. This article substantiates that contention. Read More »

14. Coming Stock Market Enema Will Be A VERY Messy Occasion!

Who knows how long before the Dow Jones Index finally receives a well overdue market enema, but I can assure you of this, when it arrives it will be a VERY messy occasion! Read More »

15. History Says “Expect An Economic Crash AGAIN In 2015″ – Here’s Why

Large numbers of people believe that an economic crash is coming next year based on a 7-year cycle of economic crashes that goes all the way back to the Great Depression. Such a premise is very controversial – some of you will love it, and some of you will think that it is utter rubbish – so I just present the bare bone facts below for you decide for yourself if it is something to seriously consider protecting yourself from in 2015. Read More »

16. This Weekend’s Financial Entertainment: “A Stock Market Crash IS Coming!”

Our financial system is in far worse shape than it was just prior to the financial crash of 2008. The truth is that we are right on schedule for the next great financial crash. You can choose to ignore the warnings if you would like but, ultimately, time will reveal who was right and who was wrong and, unfortunately, I think I will be proven to have been right. Read More »

17. Present Bull Rally In Stocks Dangerously “Beyond the Pale” – Here’s Why

It is frighteningly clear to any objective analyst and/or intelligent investor that the present bull market rally in stocks (2006-2014) is “beyond the pale” (outside the bounds of acceptable behavior) i.e. the excess valuation is dangerously above the market excesses of the 1920s. Read More »

18. We’re All Cued Up For A Bear! Here’s Why

When taking a step back and viewing longer-term gauges, we see warning signs flashing. Many of these readings are in extreme territories, and historically bear markets have occurred from such overbought positioning. We are all cued up for a bear! Read More »

19. SELL! U.S. Stock Market Is An Investor’s Nightmare – Here’s Why

The stock market is presently a roulette wheel with dimes on black and dynamite on red. We continue to have extreme concerns about the extent of potential market losses over the completion of the present market cycle. Read More »

20. Harry Dent: Get Into Cash – Stock Market Will Crash to 5,500-6,000 By 2017!

You have to get out of stocks. Stocks have bubbled again and when they go down they’re going to go down hard. Read More »

21. Coming Bear Market Could Turn Into A Historic Crash – Here’s Why

Amazingly, we are on the verge of a global deflationary downturn and what could be a historic bear market, yet Wall Street prognosticators remain focused on the inflationary risks of excessive monetary stimulus. Their focus could not be more wrong. Let me explain further. Read More »

22. Take Note: A Bubble Isn’t Necessary To Have A Sharp Decline In Stocks

With valuations stretched, investors seem to be justifying their stock purchases here with the argument that we have yet to reach the mania of 1999-2000 but history has shown us that there doesn’t have to be a bubble for there to be a sharp decline in stocks. As we saw in 2007, it doesn’t mean there is no risk of a significant market decline or that valuations are compelling and that investors should be expecting above average long-term returns from here. They should not. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money