The U.S. public sector pensions situation…is a looming disaster that could trigger the next great financial crisis…spreading from pensions to currencies…student loans, emerging markets, and European failed states.

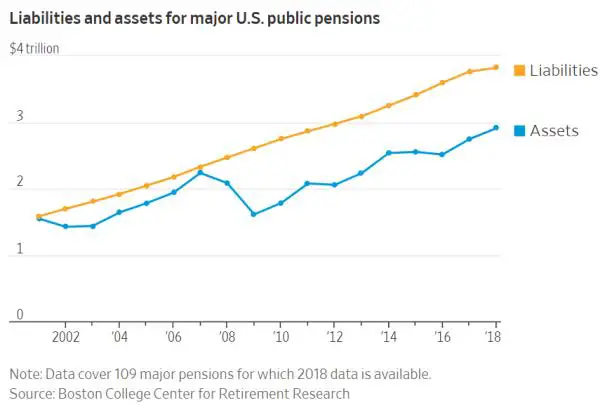

State and local politicians underfund pensions and then lie about it, pushing the eventual reckoning onto their successors. As baby boomer teachers, police and firefighters retire, the required pension payouts are soaring. Combine this with inadequate contributions, and the liabilities of major U.S. public pensions are up 64% since 2007 while assets are up only 30%. This math is simple enough for even a politician or fund trustee to grasp, but because there’s no immediate penalty for underfunding a pension system, it has become normal practice in a long list of places.

Another related problem is also mathematical, but it’s harder to manage in a boom-and-bust world: When pension plans suffer a big loss, as they tend to do in bear markets, the next few years’ returns have to go towards making up that loss before plan assets can start growing again.

The following chart, from a recent Wall Street Journal article, shows pension fund assets falling behind in the past two bear markets and having increasing trouble catching up with steadily-growing liabilities. In some cases this puts funds permanently behind the curve and can only be fixed with massive infusions of taxpayer cash or draconian benefit cuts, neither of which are feasible in a system that punishes hard choices.

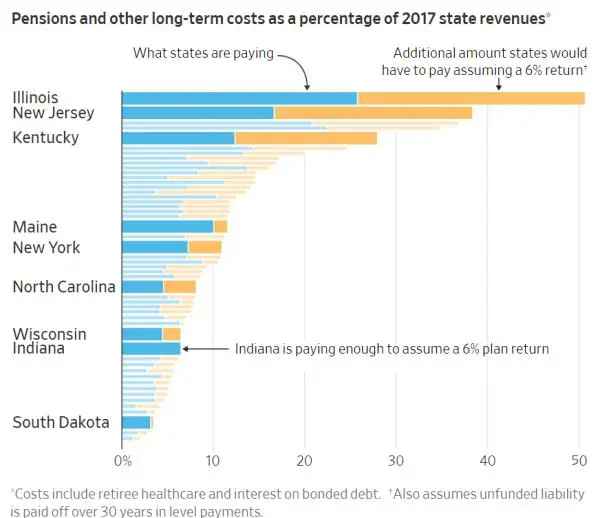

The next chart shows how much more the worst offenders would have to contribute to their plans to get by with honest future return assumptions. For Illinois, Kentucky and New Jersey this will never happen which means that In the next bear market, the pension funds that are already wildly underfunded will fall into a financial black hole from which they’ll never be able to escape.

Those states and cities – many of which are issuing bonds to cover their day-to-day expenses – will be exposed as junk credits (as Chicago was recently) and will have to either pay way up to borrow or enact some combination of tax increases (politically almost impossible) or pension benefit cuts (legally impossible in many places) which will cause chaos without fixing the underlying problem. The weakest cities and the states in which they reside will be forced to default on some of their obligations, stiffing suppliers, creditors, and/or employees. This will throw the municipal bond market into chaos as investors, worried that the next Chicago is lurking in their portfolios, dump the whole muni sector.

Faced with a cascade failure of a crucial part of the fixed income universe, the federal government will react the way it did when the mortgage market imploded in 2008, with a massive taxpayer-funded bailout at which point there is a good chance of the crisis spreading from pensions to currencies, as the world finally realizes that the bailouts are just beginning, with U.S. states and cities soon to be followed by student loans, emerging markets, and European failed states.

Keep an eye on Chicago and be ready to bail when that ship starts sinking.

Editor’s Note: The above excerpts* from the original article have been edited ([ ]) and abridged (…) for the sake of clarity and brevity. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

Related Articles From the munKNEE Vault:

1. The Day of Gold-Plated Public Sector Pensions are Numbered

The ‘workforce elite’ in America today are public sector employees and they, led by state and municipal unionized workers, are now in open revolt to preserve their special status, and the status quo. Wisconsin is the current case study in what happens when the government, a monopoly service provider, confronts the fact that the taxpayer is tapped out and can’t take it anymore – and there simply isn’t enough money anymore. Those realities are going to result in major adjustments in worker incomes, future pensions and benefits and their overall standard of living. Let me explain. Words: 2137

3. It’s As Clear As Day: America’s Public Employee Pensions Are A Ticking Time Bomb

4. When the Stock Market Inevitably Crashes, It Will Wipe Out Pensions! Got Gold?

Pensions are run like Ponzi schemes; as long as the cash coming in to the fund is equal to or exceeds beneficiary payouts, the scheme can continue but it’s a catastrophe when economic conditions deteriorate and tax revenue flattens or declines, as is occurring now. When the stock market inevitably cracks, it will wipe pensions out.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money