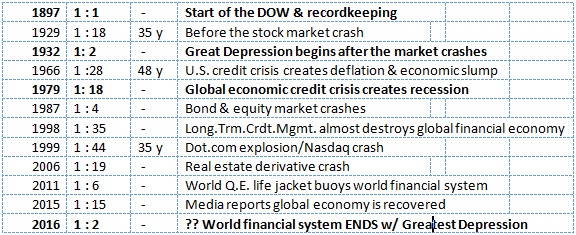

Those in control will not allow the gold price to reach $18,000 an ounce where the 18,000 DOW sits today, but the DOW could drop 90%, as it did in 1929, to 1800 and gold rise to $1,800 an ounce! Could one accept the very real possibility that the DOW will unhinge by 50%…and gold rise to $9,000 an ounce? Look at these historical DOW to GOLD ratios.

The above edited excerpts come from an article* by Roxanne Lewis (whynotgold.com) entitled An Ounce Of Gold Will Again Buy The DOW! which can be read in its entirety HERE.

..Are you going to wait and discover what gold’s new value will be when the market stumbles to 9,000 and gold reverses to a new bull market?

…[Or, on the other hand, are you going to be proactive?]

- What if the DOW doesn’t fall as it did in 1929 but rises as it did during the recessions of the 60’s and 70’s, and the gold price rises to $18,000 to meets the market!

- What if stock prices begin to decline in September and by mid month October panic sets in?

- What if…leading bankers were to attempt to stabilize the markets by buying up great blocks of stock, producing a moderate rally before giving up as markets went into a free fall wiping out trillions of dollars and hundreds of thousands of investors.

- What if...prices continued to drop as the world’s markets plummeted mankind into the Greatest Depression of the world.

- What if…nearly half of America’s banks failed while worldwide that number was closer to 90%.

- What if…unemployment in the U.S. rose to 30% or 108 million people while worldwide numbers were even worse.

What happens on your main street when the whole house of cards finally collapses?

“What If” Scenarios

The worst case scenario would see the DOW crashing and losing 90% of its value landing at 1,800 and the DOW/GOLD ratio prices for gold:

- at 1:0.5 resetting to $3,600,

- at 1:1 resetting at $1,800,

- at 1:1.3 resetting at $1,200 and

- at 1:2 resetting at $900.

Most investors dismiss the likelihood of the Dow Jones losing 90% of its value and replicated the 1929 crash, as this was largely affected by WWl debt…but WWl debt is but a drop in the bucket compared to the debt accumulated by our government today.

A more realistic scenario would see the DOW dropping in half settling at 9,000 and the DOW/GOLD ratio prices for gold:

- at 1:0.05 resetting at $18,000,

- at 1:1 $9,000,

- at 1:1.3 $6,000 and

- at 1:2 $4,500.

The most positive scenario would see the DOW staying at 18,000 points and the DOW/GOLD ratio for gold rocketing to:

- 1:0.05 causing gold to resettle at $36,000,

- at 1:1 to $18,000,

- at 1:1.3 to $12,000 and

- at 1:2 to $9,000.

Whatever DOW/GOLD ratio you choose, gold prices should be significantly higher over the coming years from $900 to $36,000! Are you willing to bet that nothing is going to happen?

Let me recommend to you, as the market continues to stay buoyed, that you:

- Take at the least 30-40% of your money off the equity market table!

- Hold some cash and buy real assets of gold and silver!

- Place close stops at 25-30% off your stocks current value as insurance, so you won’t get hurt too bad when the market abruptly reverses.

- Look at some energy sector stocks or miners that are some 50-90% down and value priced and potentially set to double in the coming years.

Protect your family before it’s too late!

*http://www.whynotgold.com/archives/

Related Articles from the munKNEE Vault:

1. Silver:Gold Ratio Suggests +$200/ozt Silver Quite Plausible! Here’s Why

Given the fact that a) the historical movement of silver is 90 – 98% correlated with gold-silver gold, b) silver is currently greatly undervalued relative to its average long-term historical relationship with gold and c) many analysts predict a parabolic rise in the price of gold over the next 5 years it is realistic to expect that silver will also escalate dramatically in price – but by how much? This article applies the historical silver to gold ratios to come up with a range of prices based on specific price levels for gold being reached.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money