There is a plethora of information available in all sorts of media that is negative about gold – gold is risky, volatile, a barbarous relic, and so on – but these arguments miss the point entirely, because they treat gold as an investment. To fully understand gold’s role in an investment portfolio, we need a new mindset—a gold mindset – [and HERE it is].

The above edited excerpts, and the copy below, are from an article* by Nick Barisheff (bmgbullionbars.com) originally entitled Is Gold a Bad Investment?.

Simply put, gold is not a good investment or a bad investment. Gold is not an investment at all: Gold is money. Once we understand this, we can see gold as the portfolio-diversifying, wealth-preserving asset that it actually is.

Three things tell us that gold is money, and not just a commodity:

- Gold (as well as silver and platinum) is traded on the currency desks of the major banks and brokerage houses, not the commodity desks;

- the world’s central banks hold gold as reserves, and they have been net buyers since 2009;

- and the turnover rate between LBMA members is more than US$20.2 billion per day.

Counterparty Risk

The definition of “investment” is the commitment of money or capital to purchase financial instruments or other assets in order to gain profitable returns in the form of interest, income or appreciation of the value of the investment. Through this transfer of capital, in the expectation of a profit, an investor gives up their capital and puts it at risk. In return, the investor receives dividends or interest as compensation because their capital is at risk; they may get back less than they invested, or they may get back nothing at all.

In contrast, physical gold bullion or physical paper currencies locked in a vault are not invested; they are simply being stored. Since neither is invested, they don’t earn interest or dividends, but gold doesn’t have any counterparty risk.

- Paper gold certificates,

- unallocated bullion accounts,

- ETFs,

- shares in gold mining companies

- and futures contracts.

All the above have counterparty risk, and are either someone else’s promise of performance or someone else’s liability. They may have their place in a portfolio, but they are not bullion and they are not money. We hold physical gold for the benefits it offers as money.

Holding bullion in a vault means:

- there is no investment, so there is no risk of getting back less gold than was initially deposited, and there is no risk of the gold’s value falling to zero;

- there is no need to be compensated by way of interest or dividends, as there is no risk to capital and

- there is also no long-term risk of losing purchasing power.

Both gold and currencies can easily be taken out of the vault and given to someone else in return for dividends or interest but the investor who gives up their gold or currency risks not getting it back. Since gold maintains and even increases in purchasing power over time, there is no need to put it at risk in order to earn a minimal amount in interest or dividends.

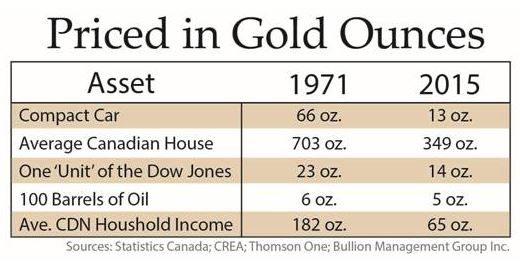

Figure 1 demonstrates how gold has not only preserved but also increased its purchasing power from 1971, when the gold standard was cut, to 2015.

Fiat (paper) currency held in a safe, however, loses purchasing power every day, because its value is eroded through inflation. Currency, then, must be invested in an attempt to offset this depreciation.

Fiat currency held in a bank account is also an investment, as it is more accurately described as a loan to the bank in return for marginal interest. This rate of interest never matches the rate of decline of the currency’s purchasing power. Furthermore, cash stored in a bank account is highly leveraged by the bank, which keeps only a small percentage on reserve while lending the majority out. This is the foundation of modern commercial banking.

Cash Is NOT Money – Gold IS Money

We need to define what role money serves, and why cash is not money.

Money must be:

- a medium of exchange,

- a unit of account

- and a store of value.

Cash satisfies the first two requirements, but fails to satisfy the third.

- Gold is a medium of exchange.

- Gold is a unit of account.

- Gold is a store of value.

- Gold IS money.

We hold physical gold for the benefits it offers as money.

*>> Click to read more (http://bmgbullionbars.com/is-gold-a-bad-investment/)

Related Articles from the munKNEE Vault:

April 30, 2015

Only about 2% of ‘investors’ actually have gold in their portfolios and those that have done so have insufficient quantities to offset the future impact of inflation and to maximize their portfolio returns. New research, however, has determined a specific percentage to accomplish such objectives. Words: 1063

April 30, 2015

June 29, 2015

Many in the investment community swear by the old myths about gold, but is there any truth in them? If investors examined the facts, they would find that the most commonly held anti-gold beliefs do not hold water and, once the general public realizes that these beliefs are not valid, the price of gold will be much higher.

June 29, 2015

Hundreds of articles seem to be posted every day on why the prices of gold and silver are going north of $5,000 & $100 ozt. respectively, or conversely to below $1,000 and $15, respectively. Unfortunately most of what is written is self-serving and/or wishful thinking. Some is what I call nothing more than financial entertainment devoid of substance. Occasionally a thought provoking article is posted and when that happens munKNEE.com is there with it. Below are some such articles that are currently in the munKNEE.com vault.

5. A Sneak Preview Of 10 Charts From the World’s Most Read Gold Report

June 20, 2015

On Wednesday, June 24th, Ronald Stoeferle’s 9th edition of the “In Gold We Trust Report – 2015″, with a global reach of some 1 million readers, will be released to the public at large. THIS ARTICLE highlights 10 interesting charts from said report.

6. Noonan: Why Buy Gold & Silver? Here’s Why

June 18, 2015

Here’s the best reason to buy and hold gold and silver, at any price, and especially at these artificially suppressed prices.

April 4, 2015

You have no doubt read countless articles on the price of gold costing x dollars per “troy ounce” or perhaps just x dollars per “ounce” but the difference between the two measurements is significant. For that matter, what’s the difference between a 24 karat gold ring and an 18 karat gold ring? Let me explain.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I’d like to add that I believe that the value of PM’s are being affected by very large investors and/or Governments shorting PM using flat money which they can print as needed. When physical PM’s are required to sell PM’s (aka shorting), then we will see the values of PM’s zoom upward as all those without physical PM’s scramble to acquire them as their values climbs skyward.

Hopefully now China will change how their stock market functions and perhaps they will be the first Major market to limit naked shorting, which would actually benefit their economy since they also hold massive amounts of PM’s, whose value would rise.

Parts of the above were posted before at:

https://munknee.com/red-alert-a-major-financial-collapse-is-coming-by-end-of-year/#comment-161321

And

From 12/14/13: https://munknee.com/noonan-heres-why-silver-is-so-low-what-to-do-about-it/

Naked Shorts Exposed!

Yes, I agree that the PM market is being manipulated by the Central Banks and their close friends the Big Banks; sooner or later all the things they are juggling to keep the lid on this can of fiscal worms is going to end and then we will se PM’s suddenly restored to there rightful value as everyone scrambles to “fill” the paper trades, which will cause the values of PM’s to skyrocket!

A good example of what may happen very soon is what happened to VW stock when investors were using naked shorts to drive VW stock downward. Then suddenly there was none to be had, (since VW was quietly buying up as much of it as they could get on the quiet) and those not holding physical shares had to pay what was then enormous amounts to settle their accounts, which made VW stock very valuable!