We are in an environment where gold bugs boldly proclaim that gold is going to the moon, and gold bears strongly protest that gold is in a bubble. At such a heated stage, this article attempts to answer the question, “What is a prudent investor to do now?” Words: 575

So says Nigam Arora (blog.thearorareport.com) in an article* which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Arora goes on to say:

The modern portfolio theory describes five main risk measures: Alpha, beta, r-squared, standard deviation and Sharpe ratio. Our research has shown that all five of these measures have significant drawbacks so here at The Arora Report we have developed our own proprietary risk measures that are more suited to today’s markets.

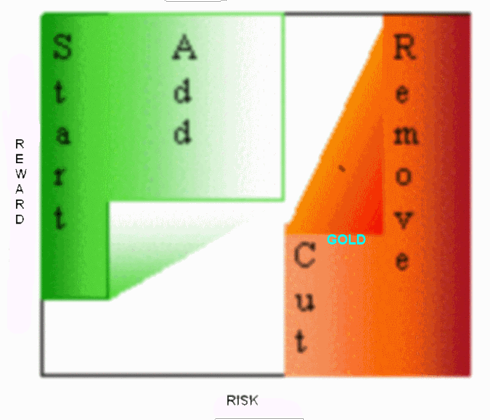

The Risk-Reward Matrix for Gold

Those familiar with our report are familiar with the risk-reward matrix shown below:

The risk-reward matrix combines fundamental analysis, quantitative analysis, and technical analysis. There is heavy emphasis on sentiment and money flows. Moreover, the models are adaptive, i.e., they automatically change based on market conditions. As the risk-reward matrix shows, gold is now in the “cut area” and rapidly moving toward “remove.” The reward in gold is not proportional to the risk at this point…based on a short-term (six months) view.

Who in the world is currently reading this article along with you? Click here to find out.

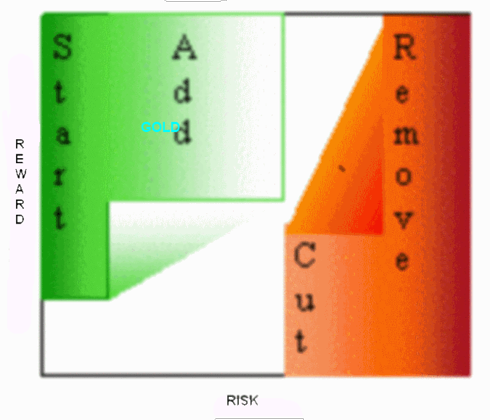

Following is the risk-reward matrix from a very long-term (+3 years) view…

Sentiment as a Buy/Sell Indicator for Gold

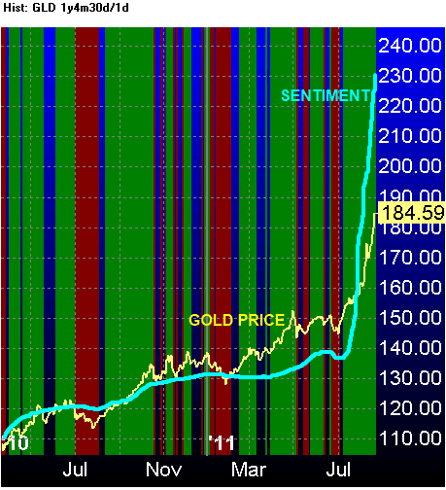

The chart below shows proprietary sentiment indicator plotted over the price of GLD.

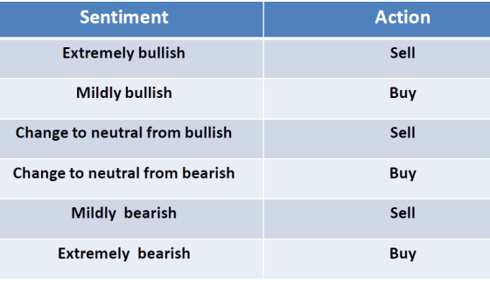

Ideally we like to see sentiment curve significantly below the price level as it was at the end of June. The readers will readily notice that the sentiment as of the close of August 22 is way above the gold price. The chart below shows how we interpret sentiment

(Please do not extrapolate the charts and the risk-reward matrix on GLD to SLV.)

Conclusion

While we currently do not hold a position in physical gold or gold ETFs we recommend the following course of action for those who do:

- Aggressive investors should consider taking profits on 25% of the position right here, putting a tight trailing stop on another 25%, and holding the rest.

- Conservative investors should consider taking profits on 50% of the position right here.

- Those not invested should not enter at this point but patiently wait for a pull back.

*http://blog.thearorareport.com/2011/08/23/gold-what-to-do-now-gldslv/

Related Articles:

- Update: These 90 Analysts Believe Gold Will Go to $5,000/ozt. – or More!

- $325/ozt. Silver and $6,800 Gold Quite Possible – Here’s Why

- How Much Gold Should You have in Your Portfolio

- Gold Could Reach $25,000/ozt.! Here’s Why

- $1,700 – $1,800 Still Not Too Much to Pay for Gold! Here’s Why

- Gold is Not an Investment – Gold is Money – and Here’s Why

- Richard Russell: Get Prepared – A Gold Tsunami is Coming

- Gold to Repeat?

- Gold & Silver: the Ideal ‘Buy and Hold’ Investments – Here’s Why

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money