Although the U.S. economy is currently expanding, we cannot rule out the possibility of a significant slowdown in the next few years [and] some analysts argue that the Fed would be out of ammunition… [to deal with such a situation]. Is that true? “Not necessarily,” as it turns out – the whole issue is a bit more complicated – [and this article analyzes just] what monetary weapons the Fed could use. [and what each would mean for the price of gold].

slowdown in the next few years [and] some analysts argue that the Fed would be out of ammunition… [to deal with such a situation]. Is that true? “Not necessarily,” as it turns out – the whole issue is a bit more complicated – [and this article analyzes just] what monetary weapons the Fed could use. [and what each would mean for the price of gold].

The comments above and below are excerpts from an article by Arkadiusz Sieroń (SunshineProfits.com)which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read. Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner.)

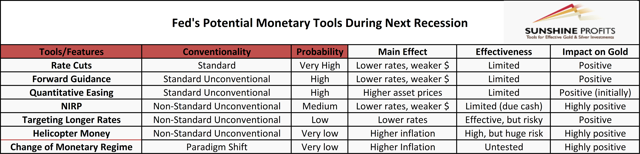

The table below presents a short summary of the Fed’s potential monetary tools during next recession:

1. First and most obvious, the U.S. central bank could drop any plans to raise interest rates further or even to cut them.

However, with the federal funds rate still close to zero, it would not relieve the economy significantly. The change of the Fed’s stance should be positive for gold, however, as prices have recently been under downward pressure from the expected monetary tightening and accompanying greenback’s strength.

2. Second, the Fed could continue its forward guidance and convince investors that short-term rates will stay low for a long while, pushing longer-term rates down that way.

Although it could help a bit, the market expectations of the future level of interest rates are already low. Dovish signals should be positive for…[gold], as the price of gold has recently been shaped, at least to a large extent, by the Fed’s open mouth operations.

3. Third, the Fed could return to quantitative easing, perhaps in a somewhat expanded version, as Janet Yellen suggested in Jackson Hole that future policymakers should explore “purchasing a broader range of assets”.

The ECB buys corporate bonds, while the Bank of Japan purchases stocks. Now, it seems that the Fed is also potentially open to this possibility, but investors should remember that the U.S. central bank is not allowed by law to make such purchases.

Moreover, it seems that next rounds of quantitative easing would be less helpful than before, given the amount of assets already purchased and held by the Fed, and the fact that the economy is already awash in liquidity…[In addition,] Ben Bernanke, the father of the American QE, has recently pointed out the problems with calibration and communication of such programs.

The resumption of QE in the U.S. would end, or at least diminish, the current divergence in monetary policy among the major economies, ease upward pressure on the dollar, and strengthen the case for gold. (Investors, however, should not forget that the third round of QE was negative for the shiny metal, as it was accompanied with the economic recovery, restored confidence in the Fed and a bullish stock market. However, the fourth round of QE would come in much gloomier economic conditions, so it would be rather positive for gold.)

4. Fourth, instead of operating by influencing short-term interest rates, the Fed could start targeting long-term interest rates.

For example, the Bank of Japan adopted such a policy in September, committing itself to purchase 10-year government bonds so that yields will remain around zero percent. The Fed will certainly monitor the outcome of the Japanese program closely and the program could be copied one day in the U.S., as it did with quantitative easing and other unorthodox policies.

Importantly, this policy would not be unprecedented, as the Fed pegged the long-term Treasury yields in 1942-1951. In such a framework, the Fed set the price at which it stands ready to purchase securities, but the quantity actually purchased depends on the investors’ eagerness to buy. Therefore, such a policy could lower the rates, but with a risk that the Fed’s balance sheet would be greatly expanded. It goes without saying that lower longer-term interest rates would support gold, which usually shines when the real interest rates are low.

5. Fifth, the U.S. central bank could introduce a negative interest rate policy (NIRP).

Assuming that they would help the economy – some economists treat them as just as tax on banks’ reserves and taxes are not very stimulative – the support would be limited, since overly negative rates lead to hoarding cash. For this very reason, some radical economists call for the abolition of cash. Fortunately, such an extreme step is unlikely in the foreseeable future.

The introduction of NIRP would lower the real interest rates, which would be positive for…[gold]. Moreover, the worries about the consequences of such a policy should move the gold prices up, as the example of Bank of Japan’s action clearly showed. However, it seems that Yellen is not a big fan of NIRP (she did not mention them in her speech in Jackson Hole about the Fed’s future toolkit).

Conclusions

What are the conclusions on the basis of our short overview of the Fed’s toolbox? Well, the Fed has a few options available when the next recession comes (we have analyzed only some of them – we will examine more radical ideas like helicopter money or departure from the inflation targeting in the next parts of the current Market Overview)…[As such,] if investors believe that the U.S. central bank is not helpless but effectively controls the economy, the market uncertainty and demand for safe havens, such as gold, will diminish.

There are signs, however, that monetary policy in the U.S. and other developed countries is reaching its limits. This is why more and more economists desperately call for fiscal expansion, for helicopter money – which can be regarded as a quasi-fiscal policy – for a radical abandonment of the current monetary regime based on inflation targeting, or even for a departure from the current payment system based on cash. When such a narrative dominates the markets, each newly introduced monetary tool will be probably interpreted, at least initially, as a sign of desperation.

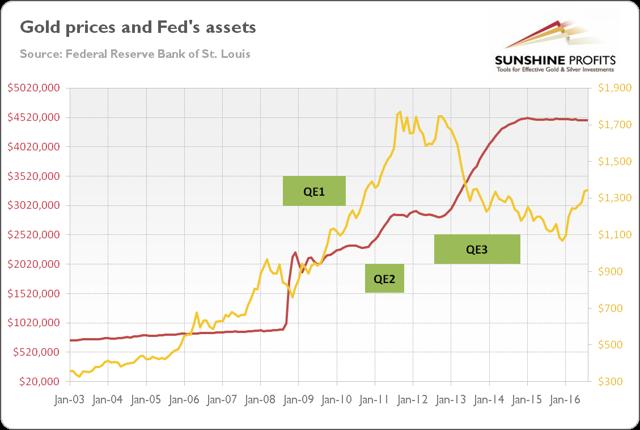

The loss of confidence in central bank policies could be an important driver for a bull market in gold. Indeed, the first two rounds of quantitative easing were bullish for gold, as one can see in the chart below [depicting] the price of gold (London P.M. Fix, yellow line, right axis) and the Fed’s assets (red line, left axis, in billions of $) from 2003 to 2016.

Based on this case, we bet that these new and more unconventional tools could be even more positive for…[gold], since monetary policy now faces diminishing returns, while all the other options are more complicated and controversial.

In other words, gold may be one of the biggest beneficiaries of the limits that the monetary policy can achieve. Unfortunately for the economy, but luckily for…[gold], central bankers feel pressure just to “do something” to stimulate economy. Therefore, we can be sure that quantitative easing is not the last word from the Fed. This is why gold investors should understand the available options in the central banks’ toolbox. They may only be a subject of academic debate now, but when the time comes, central bankers will introduce them as fast as you can say “helicopter money”.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money