A budget is a basic necessity, even if you do it just once, to understand where your money is flowing yet most people spend money as quickly as it comes in – like sand flowing through their fingers – [so this article takes a]…look at the latest spending breakdown of Americans to see where most of our money is going.

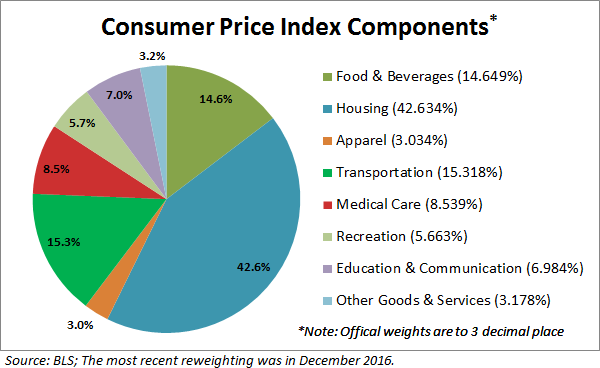

Three major categories consume the bulk of net income: housing, food, and cars…Most Americans have their net worth tied up in housing but food and cars also take up a healthy portion of your paycheck as illustrated in the pie chart below.

The BLS chart above breaks down categories based on how your typical American spends their money:

- 43% goes to housing. What is interesting about housing is that it is measuring the owner’s equivalent of rent (OER). The issue with using this as a measure of home values is that it assumes all owners are renting out their homes and it doesn’t factor in the large Fed intervention on interest rates.

- Transportation makes up about 15% of the BLS basket of goods. Buying cars and financing them has become a big part of our economy. Over $1 trillion in auto loans are outstanding. You also have a large part of the auto market now being financed by subprime auto loans so what you have is people spending beyond their means for transportation.

- Spending on food is slightly below 15%. There was an interesting milestone crossed last year in that Americans now spend more on eating out than they do on grocery shopping…

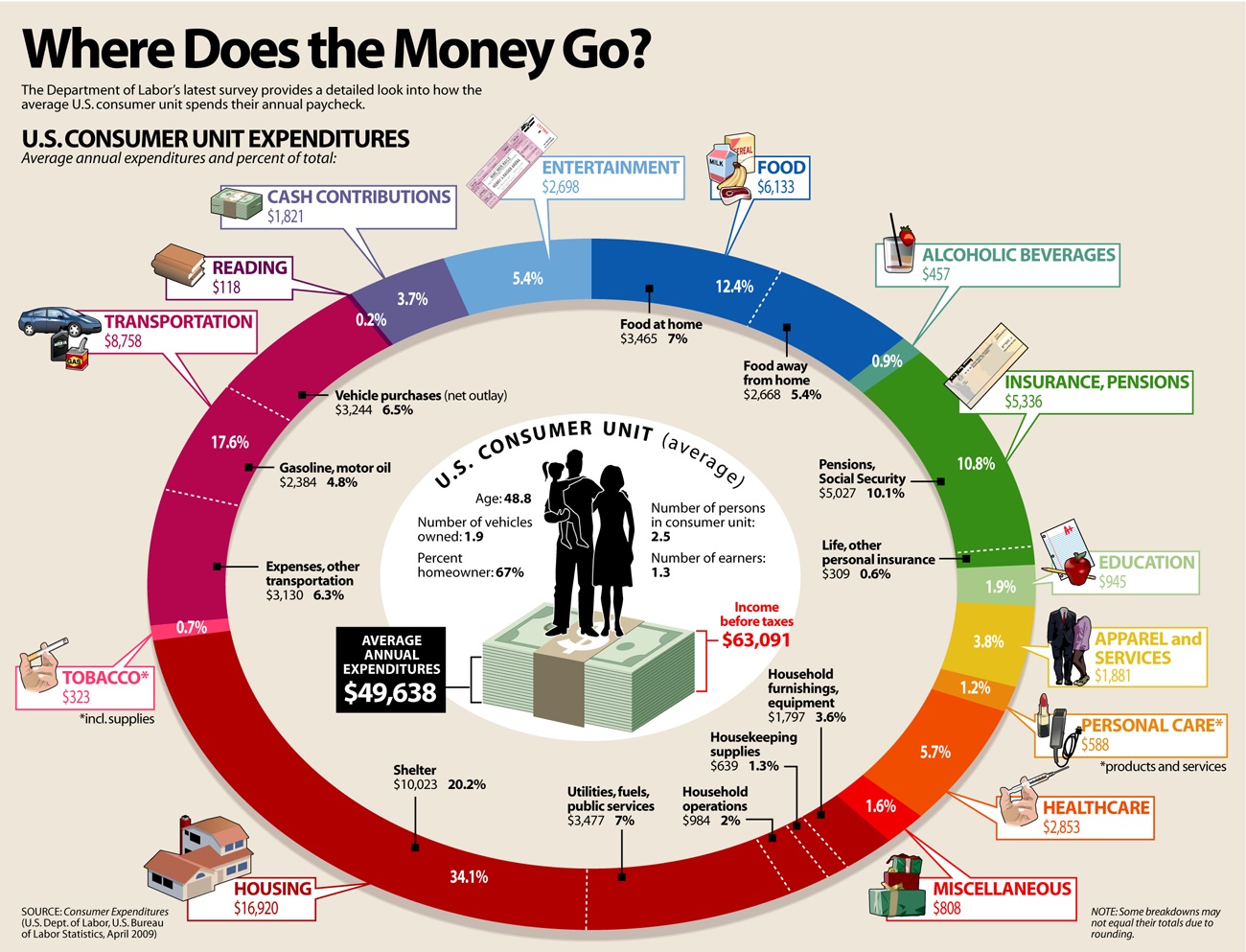

Here is another breakdown of how Americans spend their money:

Interestingly, 8 times more is spent on tobacco and alcohol than goes into reading. Reading is a great way of opening your mind and exposing [yourself] to new ideas. Being critical and skeptical are skills that are developed…and can go a long way towards enabling you to learn more about how to manage your money. That is the point of all of this and yet some people continue down a path of spending more than they have.

…Some people live paycheck to paycheck because they have little money and some live paycheck to paycheck because they spend beyond their means. [What is your situation?]

The comments above are edited ([ ]) and abridged (…) excerpts from the original article by mybudget360.com

Thanks for reading! If you want more articles like the one above visit our Facebook page (here) and “Like” any article so you can get future articles automatically delivered to your feed. You can also “Follow the munKNEE” on Twitter or register to receive our FREE tri-weekly newsletter (see sample here , sign up in top right hand corner).

Remember: munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Very interesting! This analysis studies net income spending which is fine but unfortunately that net is shrinking very quickly through increased taxation at all levels of government.

Also the exponential rise in health insurance costs.

Add the two together and we find that someone who was living fairly comfortable is suddenly not making monthly bills so easily. Add to that any unexpected drop in income and CRASH.

As this happens to more and more people the economic house of cards in this country collapses.