“Follow the munKNEE” via twitter & Facebook or Register to receive our daily Intelligence Report

Just as US investors are advised not to fight the Federal Reserve, gold investors worldwide would be well advised not to fight the Government of India. India is the world’s largest gold consumer [and their intent on curbing gold imports by any means necessary could have a negative effect] on world gold demand [and, as such, most likely, on gold prices. IMO,] at best, we will see a sideways market in the price of gold in 2013, and at worst, this will be the year when gold prices start the inexorable drop.

investors worldwide would be well advised not to fight the Government of India. India is the world’s largest gold consumer [and their intent on curbing gold imports by any means necessary could have a negative effect] on world gold demand [and, as such, most likely, on gold prices. IMO,] at best, we will see a sideways market in the price of gold in 2013, and at worst, this will be the year when gold prices start the inexorable drop.

So writes the Macro Investor in edited excerpts from an article* posted on Seeking Alpha under the title Gold Under Pressure From New Indian Government Push.

This article is presented compliments of www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say in further edited excerpts:

First, some context. India is the world’s largest gold consumer at ~800 tonnes of imports in 2012. This is a major drag on Indian foreign currency reserves contributing majorly to the current account deficit, so the Government of India has over 2012-13 taken steps to curb gold imports:

- banks were prohibited from lending money to buy gold and then

- the import duty on gold was increased in steps to the current 6%.

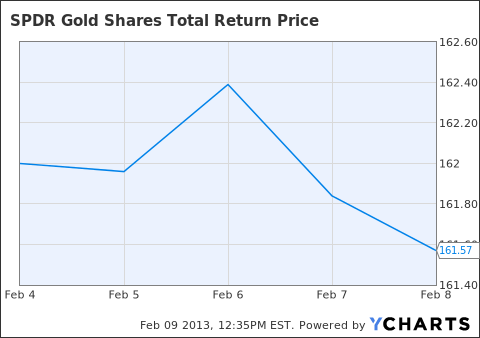

This suppressed gold demand and with it the price of gold. After rising steeply untill end 2011, gold prices have more or less moved sideways, as the chart below shows.

[Earlier this month] the Indian Central Bank, the Reserve Bank of India, released the recommendations of its gold control panel. The messages couldn’t have been more direct: if the import price hikes are not enough to lower gold imports to a level that the Government of India approves, they will set outright demand quotas. So, from price manipulation via import duties, they are going to move outright to quantity manipulation via quotas.

The price imports alone cut down gold demand by ~200 tonnes in 2012, going from ~1000 tonnes in 2011 to ~800 tonnes in 2012. The Government of India is clearly not happy with this level and wants to push it even lower. Another ~200 tonne drop in 2013 may not be out of the question here.

How did the market react to this declaration by the Government of India? As expected, gold prices dropped, as the chart below shows.

Conclusion

The abovementioned declaration by the Government of India means 2013 will likely be a difficult year for gold bulls. The silver lining (pun intended) in the story is that China is apparently going to make up for some of the lost demand. However, even with increased Chinese demand, it is hard to project a scenario where world gold demand rises significantly in the near future, as lower Indian demand is merely offset by higher Chinese demand. So at best we will see a sideways market in the price of gold in 2013, and at worst, this will be the year when gold prices start the inexorable drop.

What does this mean for your investment thesis for the rest of 2013, dear reader? Well, my projection for gold prices in 2013 remains unchanged:

Shorting gold — especially via the miners (GDX, DUST, NUGT) — remains the play for 2013….I think the miners are really setting up to be perma shorts with falling gold prices and rising mining costs….

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/1171041-gold-under-pressure-from-new-indian-government-push

Register HERE for Your Daily Intelligence Report Newsletter

It’s FREE

The “best of the best” financial, economic and investment articles

An “edited excerpts” format to provide brevity & clarity for a fast & easy read

Don’t waste time searching for informative articles. We do it for you!

Register HERE and automatically receive every article posted

“Follow Us” on twitter & “Like Us” on Facebook

Related Articles:

1. I Will Not Turn Bullish On Gold Until 1 of 2 Things Happen

My forecast — despite all the hate mail and pressure I get to change it — has not changed. Based on my systems and models, I will not turn bullish on gold until either spot gold has closed above $1,823 an ounce on a weekly and monthly basis – or gold cracks the $1,527 level and plunges to the $1,400 level or a tad lower. I know that’s not what you want to hear. I know that you are as eager as I am to see the next leg of gold’s bull market begin….[but its] time to shine is not here yet. It will come again so stay the course, build up your ammo, and be ready to pull the trigger when I issue a headline like “Back Up the Truck, NOW!”

2. Gold Is Looking Increasingly Vulnerable – Here’s Why

The threats of global recession, insurmountable debt, terrible government policy, central bank support, and many other very persuasive arguments present gold as a very appealing investment or safe haven but all of this is an illusion. Gold was a sensible investment in the early part of the bull market (1999-07), but has now become a false sense of security for many investors who will soon learn the hard way. Not only are the fundamentals already priced in, the technicals severely weakened, and the extremes in gold optimism easily apparent, but the bad news for gold could soon get much worse. The next weeks or few months will hopefully give us a lot more clarity. Words: 1170

3. Bull Markets Always End With a Bang, Not a Whimper, So Gold’s Run Should Have More Legs

[Here is a summary of my]…thoughts on the 2011 gold price peak relative to the last time a long term bull market ended (back in 1980): Long-term bull markets almost always end with a bang, not a whimper, and last year’s price peak was clearly the latter. A 25% rise over a period of about two months last year [does not an] end-of-cycle, blow-off top [make]. No, I think there’s still some room to run for gold if for no other reason than that we haven’t even come close to the “mania” stage that characterizes the end of long-term market moves…[Let me explain further.] Words: 359; Charts: 14. It’s Time to Seriously Consider SHORTING Gold – Here’s Why

I view the current market weakness in gold, coupled with the pullback in trader positions, as a shorting opportunity which is strong in terms of reward vs. risk. I have come to that conclusion by questioning the assumptions that many make about it, isolating its fundamental drivers and providing a trading recommendation as to where I believe the price is headed in the future. Let me share my analyses with you. (Words: 1440; Charts: 4; Tables: 1)

5. With Gold Stocks Suffering So Badly Should You Sell Out or Buy In?

Gold stocks are down between 20% and 30% over the past year yet, in that same timeframe, the price of the gold has risen. As a result, sentiment toward gold stocks is pitiful. Even diehard gold bugs are tired of losing money in gold stocks and have been dumping their shares in disgust. This article discusses 4 main reasons I can think of why gold stocks might be so cheap. Words: 444

6. Equities Should Outperform Gold in the First Half of 2013- Here’s Why

I expect gold to move sideways or trend down in the first half of 2013 [and, as such,] I would consider this as a good opportunity to buy gold as there is still no long-term fix in place for the economic and financial problems [that the U.S., and indeed the world, face. Here’s why]. Words: 665; Charts: 5

7. Gold Miners Watch: Much Further GDX/HUI Weakness Could Result in a MUCH Further Decline – Here’s Why

GDX is currently at approx. 42 but should it drop below the 39 & 40 levels reached last May and July our analysis shows that a good deal of sellers could come forward and push GDX a large percentage lower. That double bottom needs to hold in GDX!!! Take a look at the chart below and you will clearly see why that is the case.

8. Finally the Final Bottom in Gold Stocks Is Coming – Finally!

The mining stocks have been a disaster if you’ve invested in the average fund, GDX or GDXJ and if you’ve invested in the wrong stocks, they’ve been a total disaster and you will now hate the sector forever. We’ve certainly been surprised by this protracted struggle. In my articles you’ve heard me talk about accumulating on weakness, buying support, being patient and waiting for better opportunities. Folks, this next week is one of those opportunities. The gold stocks are setting up similarly to the bottom in 2005 [and, as such,] are set to test a major bottom and could be on the cusp of a major reversal. Let me explain. Words: 438; Charts: 3

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Apparently this article is all about fear of Big Govt and qualitative sentiment indicators.

Latest data shows that January 2013 imports into India was 100 tons, compared to 860 tons in all of 2012! Thats a 40% RISE in imports. So much for the fear about what the paper tiger (Indian Government which sees one major scam after another roll out continuously).

I’m an Indian who’s lived all his life in India. Let me assure you. Indians for millenia have NOT trusted rulers. That is the BASIS for gold accumulation for thousands of years. Gold is at the very CORE of our culture and this is the best form of wealth preservation in an uncertain world (the logic was, you can’t pack up your land and run, but you sure can with your gold).

The average Indian citizen is FAR SMARTER than you think. The Govts action clearly signalled fear of runaway inflation and fiscal control. Any action against gold in India would push gold smuggling much higher (smuggling is already 10 times higher in January and this “import” does not show up in statistics at all) and trading in gold will become cash-based.

Lastly, every Indian politician has a substantial part of his/her wealth (including the Finance Minister P.Chidambaram, whose home state in South India is one of the largest hoarders of gold). So, check out what they do, not what they say! 🙂

Nope, the Indian Govt’s proposed actions will only start a stampede INTO gold, not away from it. And as it goes inderground, the Govt will lose whatever control they have over it now!

cheers

Yet another reason to invest in Silver.

I predict that Silver will out pace Gold in 2013, what do you think?