“Despite all the ominous press being devoted to the soon-to-be-inverted yield curve, it’s not always clear why such a thing matters. In other words, how, exactly does a line on a graph slipping below zero translate into a recession and equities bear market, with all the turmoil that those things imply?”

By Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money!

[This synopsis of edited excerpts* (346 words) from the original article (581 words) by John Rubino provides you with a 40% FASTER – and EASIER – read. Please note: This complete paragraph, and a link back to the original article, must be included in any article re-posting to avoid copyright infringement.]

“The answer…is that:

- banks – the main driver of our hyper-financialized society – still make at least some of their money by borrowing short and lending long.

- They take money that’s deposited into savings accounts and short-term CDs (or borrowed in the money markets) and lend it to businesses and home buyers for years or decades….

- [However,] when the yield curve flattens and then inverts — that is, when short rates exceed long rates — banks lose the ability to make money this way. They lend less, which restricts building and buying and spooks the broader markets.

…[Below is a graph showing] the flattening, apparently soon-to-invert yield curve:

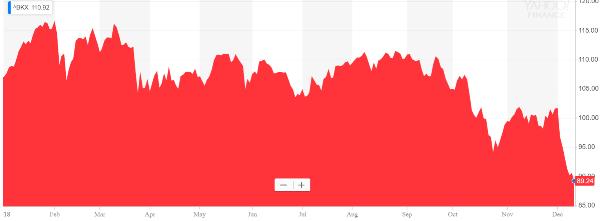

…[As a result,] here’s how bank stocks are behaving in response.

The above chart is for the BKX bank stock ETF that includes all the major US banks. Note how it was stable for the first nine months of the year and then fell off a cliff as it became clear that the yield curve really was going to invert.

Reuters conducted a poll of 40 bond analysts that…[concluded that:]

- the U.S. Treasury yield curve will invert next year, possibly within the next six months…

- with a recession to follow as soon as a year after that…[reminding us that,] while there is no set pattern on how long it takes for a recession to hit once the yield curve has flipped, it took about 18 months before the last deep recession about a decade ago.

The conclusion:

Sentiment in the bond market – and by implication the broader economy – took a huge hit in the past couple of months and, since in a fiat currency system sentiment is everything, it should be no surprise that banks are down and taking the rest of the stock market along for the ride.”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

Want your very own financial site? munKNEE.com is being GIVEN away – Check it out!A note from Lorimer Wilson, owner/editor of munKNEE.com – Your KEY to Making Money!:

“Illness necessitates that I spend less time on this unique & successful site so:

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money