…Now I’m not going to blow smoke and tell you that high U.S. and global debt levels are not a risk, because they certainly are, but, in an effort to restore sanity to this discussion and talk readers out of making a potentially costly mistake (like staying away from stocks entirely), I’ve decided to do a multi-part series looking at the risks of another financial crisis. Here is an edited version of Part 1.

because they certainly are, but, in an effort to restore sanity to this discussion and talk readers out of making a potentially costly mistake (like staying away from stocks entirely), I’ve decided to do a multi-part series looking at the risks of another financial crisis. Here is an edited version of Part 1.

This version of the original article has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. Visit our Facebook page for all the latest – and best – financial articles!

This version of the original article has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. Visit our Facebook page for all the latest – and best – financial articles!

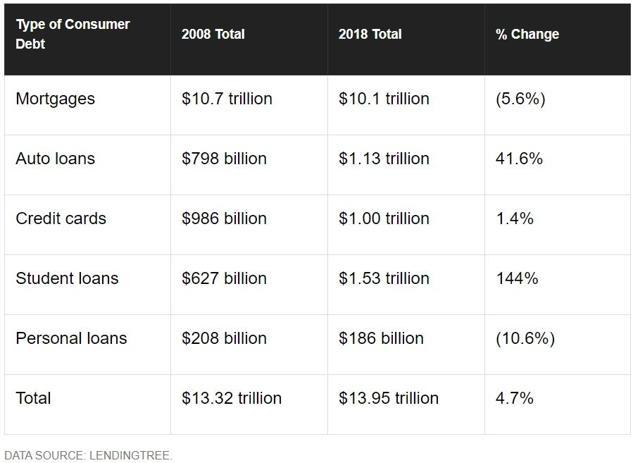

Let’s kick things off with a look at U.S. consumer debt, which was the trigger point for the Financial Crisis. Specifically let’s see why it’s not likely to be the fuse that lights the powder keg of the next one.

(Source: Motley Fool)

Many doomsday economic predictions point to U.S. consumer debt being at new all-time highs…[but] note, [however,] that:

1. mortgage debt, the underlying trigger of the 2008-2009 meltdown, has actually fallen. That’s because mortgage lending has tightened up considerably and the days of NINJA (no income, no job or assets) subprime mortgages, are gone. What small amounts of subprime mortgages are being created are neither supporting trillions in derivatives nor owned by systemically important financial institutions (too big to fail banks).

2. Credit card debt and personal loans have either declined or been largely unchanged, as U.S. households have spent most of the last decade deleveraging.

The above being said, however, it should be noted that:

1. U.S. auto loans have risen sharply…[because, in part,]

- the average new vehicle price has risen 27% from $28,350 in 2008 to $36,113 at the end of 2017. This is partially due to the rising popularity of cross-overs and trucks [and because]

- the average duration of a car loan has grown to 69.5 months, or nearly six years. The longest loans are for 96 months, or eight years. This is partially because 25% of car loans are now subprime (FICO score under 620), and buyers want to minimize their monthly payments. Longer duration loans with higher interest rates mean U.S. auto debt has grown substantially.

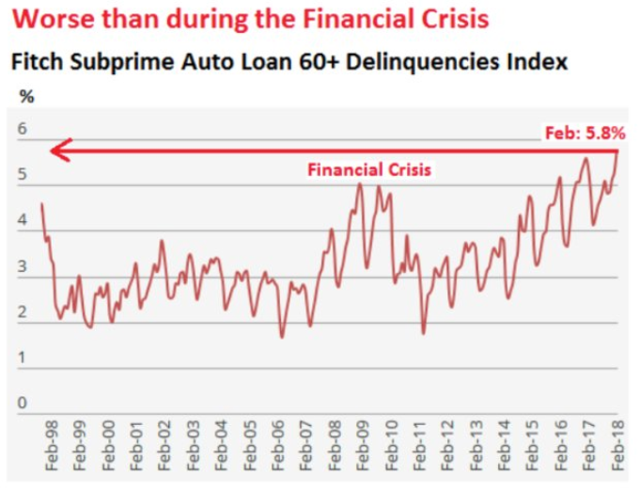

(Source: Business Insider)

2. …Subprime delinquency rates…are at their highest levels since October 1996 but didn’t result in a recession back then.

3. Subprime auto loan losses are approaching the same high levels [reached] in late 2003 but didn’t result in a recession back then…

It’s not the auto companies or the major banks who are making the subprime auto loans but mostly smaller private equity backed firms…[many of which] have recently gone bankrupt, [yet]…barely caused a blip on the radar of the broader financial markets or banking profits…

While [it is] true that in a recession such losses would rise, the point is that subprime auto lending itself is neither likely to trigger a recession nor cause a full-blown financial crisis. Rather it will be investors in subprime auto lenders and private equity firms that suffer, because major banks are not levered to the hilt on subprime-backed auto loans.

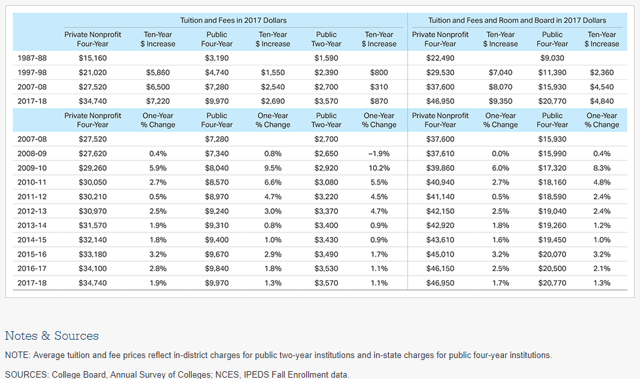

4. Student loan debt is soaring due to two main factors:

-

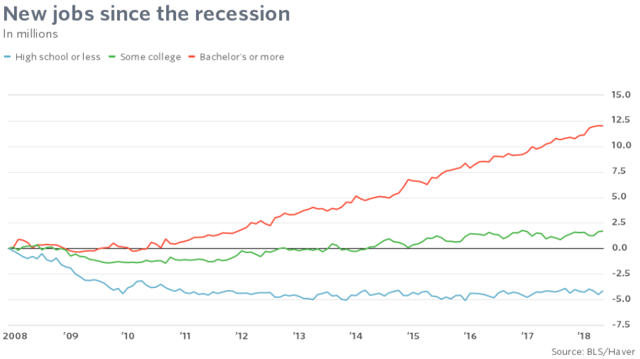

First, the inflation-adjusted annual cost of college, both private and public schools, has more than doubled in the past 30 years…because the value of a college degree has increased enormously since the Great Recession.

- (Secondly,] since 2009 about 75% of all net new jobs have gone to college graduates.

[Interestingly, the]…$1.5 trillion in student debt…doesn’t pose a risk of another financial meltdown…for a couple of reasons:

[Interestingly, the]…$1.5 trillion in student debt…doesn’t pose a risk of another financial meltdown…for a couple of reasons:

-

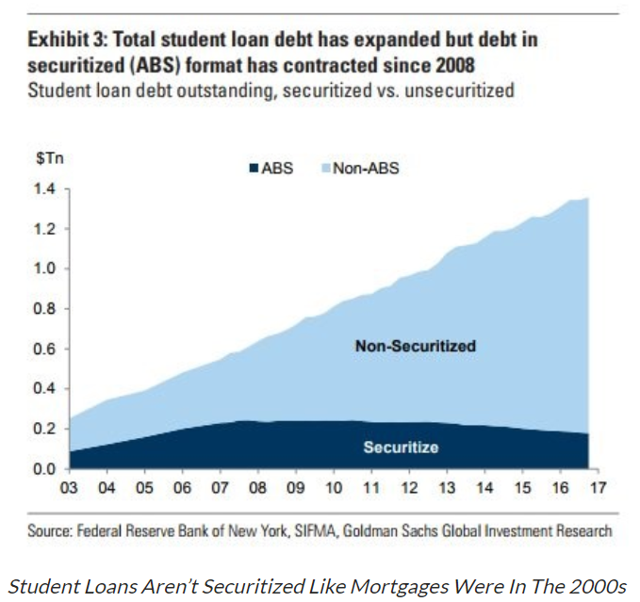

The first is that very little (under 20%) of student loans are securitized, and thus capable of spreading financial risk like subprime mortgages.

-

Then there’s the scale of the mortgage securitizations that we saw in the housing bubble. Every single year more home mortgages were bundled into loans (including those backed by subprime NINJA loans) than the cumulative student loan burden today. That smaller scale alone means that student loans aren’t likely to cause another financial crisis.

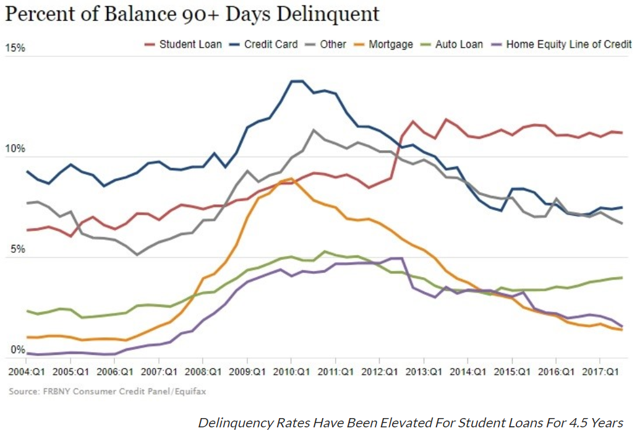

How can we be confident of this? Because student loan delinquency rates have been high or rising for about five years now and have not blown a major hole in bank balance sheets.

(Source: upfina.com)

5. …Total consumer credit is once more at all-time highs, [however, so] doesn’t that mean that another crisis is imminent? Well, no actually, because we have to remember to put total consumer debt levels in context…You have to keep in mind two things:

- U.S. Population is up 8.1% since 2008

- U.S. GDP 2008 (not adjusted for inflation) is up 39% since 2008

so, while U.S consumer debt is up 4.7% in the past 10 years, that is spread out over a population that’s 8.1% larger. Thus,

- on a per person basis, consumer debt is actually lower and that debt s now more easily supported by an economy that’s about 40% bigger…[and,] more importantly,

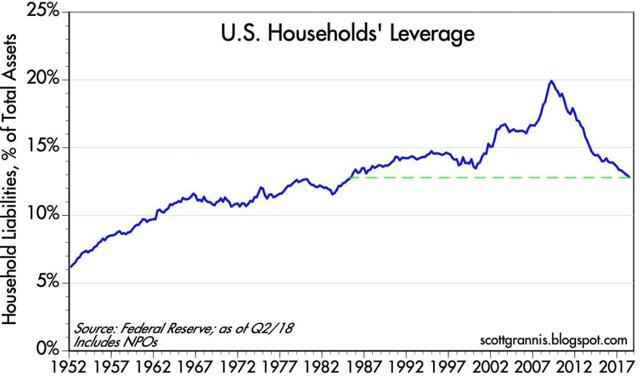

- at an aggregate level U.S. household leverage (debt/assets) is way down over the past 10 years and

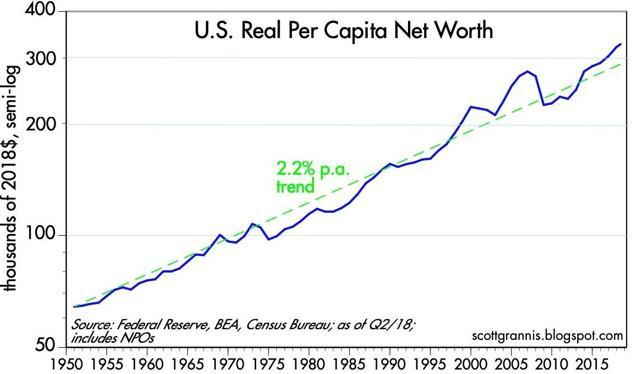

- America’s household leverage ratio is now at its lowest level since 1985 (33 years) and, as a nation, our inflation adjusted net worth per capita is at an all-time high meaning that servicing that debt is not hard.

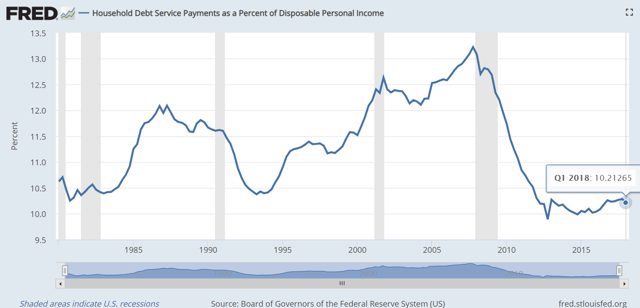

- Now it’s true that greater wealth inequality means that any given individual may not necessarily be able to pay off rising debt with asset sales, and much of those assets are in the form of real estate and stocks, which can rapidly fall in value or are not highly liquid so let’s instead look at what percentage of household disposable (post tax and mandatory cost of living) income is going to paying interest costs. In Q1 2018, the figure was 10.2%, one of the lowest levels in the past 40 years.

- What about rising interest rates? Won’t that cause rising consumer debt defaults that might tank the financial system yet again? Probably not, for two reasons:

- Interest rates are not expected to rise nearly as high as they hit in 2000 or 2007. At that time households were spending 12.5% and 13% of disposable income on debt service.

- The St. Louis Fed’s financial stress index, an indicator consisting of 18 metrics to see the state of the overall US financial system today shows a reading of -1.3 (a reading of zero is correlated to the average financial stress over time) indicating below average financial stress. That’s despite high and rising auto and student loan delinquencies.

Thus we have further proof that today’s consumer debt levels are just not likely to cause another financial crisis, and probably won’t even trigger a mild recession.

That doesn’t mean that another financial crisis will never be triggered by consumer debt (or any kind of debt for that matter…[because, historically, over the past 400 years, one has happened every 4 years on average…Unlike the catastrophe of 2007-2009 that many fear is returning soon, most of these were like the euro crisis and resulted merely in stock market volatility. They usually didn’t cause negative GDP growth, and certainly not a recession “worse than the Great Depression”.

It’s impossible to pinpoint when and where the next crisis will spring from but, looking at the actual U.S. consumer debt data today, it’s not likely that consumer debt will be the trigger point of the next major capital market meltdown…

If you enjoyed the above article sign up in the top right hand corner of this page and receive our FREE bi-weekly newsletter (see sample here)

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money