“…Most people still think that you need exposure all over the board to get good diversification…[but] that assumption is a fallacy…If you don’t choose to believe us, that is your loss – literally!”

Prepared by Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money!

[Editor’s Note: This version* of the original article by Andy Sutton has been edited ([ ]), restructured and abridged (…) by 48% for a FASTER – and easier – read. Please note: This complete paragraph must be included in any re-posting to avoid copyright infringement.]

”Types of Risk

…There are two broad types of risk:

- systematic (non-diversifiable)

- and non-systematic (diversifiable)

(Keep in mind that what we are discussing here is slightly different from geopolitical risk, currency risk, interest rate risk, etc. although each of those specific types of risk do contribute to the overall riskiness of a particular stock and as such cannot just be ignored.)

…The data below lists:

- the number of components,

- the standard deviation of annual returns for each portfolio,

- and a comparison of the standard deviation of the portfolio to that of a single component…

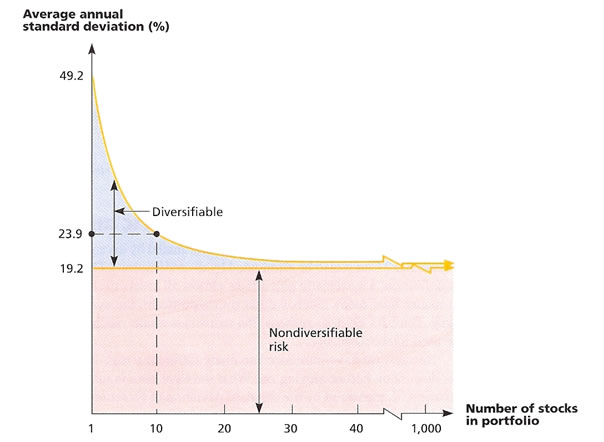

Below is a graphic representation of the data in the chart above. It…[shows] that standard deviation of the portfolio is asymptotic (law of diminishing returns) as it relates to eliminating the systematic (diversifiable) risk. In fact, once the number of portfolio assets surpasses 30, the standard deviation does not drop appreciably, even when another 970 components are added! Obviously, this reality enforces that quality is better than quantity.

…The upper portion of the chart [above] deals with non-systematic risk, which can be largely diversified away. Notice though that even when the portfolio contains 1000 components that the standard deviation is still 19.21%. That constitutes the systematic risk.

Beta (ß)

Beta (ß)

- Quantitatively, Beta is the generally accepted measure of systematic risk for a stock and is defined as the amount of systematic risk present in a particular risky asset relative to that in an average risky asset.

- Essentially what Beta does is compares a particular stock in this case with an average stock, or more accurately, a benchmark basket of stocks

where:

- ra measures the return of the asset,

- rp measures the return of a portfolio of risky assets (often the stocks in an index),

- and Cov(ra,rp) is the covariance of the returns.

Interpreting Beta is rather simple:

- Betas lower than 1.0 indicate that the stock in question has a lower level of systematic risk than the ‘market’,

- Betas greater than 1.0 indicate that a stock that has a greater level of systematic risk than the ‘market’.

Knowing this, it becomes a rather simple matter to calculate the Beta of your portfolio simply by ascertaining the weight of each component and then multiplying it by that component’s Beta.

Let’s use a hypothetical example where we have a 3 stock portfolio; Stock A is 25% of the portfolio, Stock B is 40% of the portfolio, and Stock C is 35% of the portfolio. The Beta of Stock A is .75, Stock B is .50, and Stock C is 1.25:

Betaportfolio= .75(.25) + .50(.40) + 1.25(.35)

Betaportfolio = .83

This calculation indicates that this 3 stock portfolio has systematic risk that is lower than that of the market, however, its non-systematic risk would be considerably higher than one would desire since there are only 3 components. All else being equal, the ideal would be to find a portfolio of perhaps 25-30 stocks that has a Betaportfolio of .83, as this would mitigate much of the non-systematic risk as well.

…Keep in mind, however, that just because you have diversified away non-systematic risk, this is no guarantee that your portfolio will never fall in value. While this exercise is valuable, in that it assists you in eliminating some of your risk, it is impossible to eliminate ALL risk. Even the ‘riskless asset’ used in most pricing models has currency, interest rate, and geopolitical risks embedded in it at a minimum. ALL allocation possibilities have at least some risk – even cash, which carries inflation, currency, and geopolitical risk. These risks will ebb and flow depending on the time period in question, but there is always risk.

Remember, the goal of all investment strategies should be to make sure that the return is commensurate with the risk taken…[and] that [is] the biggest problem facing investors today – balancing risk and return. There are few in the investment community that take the time to properly explain this concept to their clients and fewer still who actually go through the trouble required to build a properly balanced portfolio. We have seen countless examples where investors were taking on way too much risk given the returns they were experiencing.

Beta and the Risk Premium

…The concept of the risk-free asset has an important place in the discussion of risk vs. reward, particularly when selecting portfolio assets.

Example #1: Let’s use an example of:

- a stock [asset A] with an expected return of 20%

- with a Beta of 1.6…

- the risk-free asset has a return of 8%

- with a Beta of zero since it has neither systematic nor non-systematic risk.

In the case of expected return, we are relying on an educated guess, but in the case of stocks that pay dividends, one could easily plug the dividend yield into the expected return as well. When we plot out our stock and the risk-free rate and generate a Security Market Line (SML), we get the following:

The chart above is relatively easy to interpret; we consider the ‘risk-free’ asset Rf with its corresponding Beta of zero and return of 8% and our stock with its Beta of 1.6 and its expected return E(RA) of 20%. When we connect the dots and measure the slope of the line (rise/run), we get a slope of 7.5%. From this graph, we can ascertain that our stock [asset A] has a reward-to-risk ratio of 7.5% meaning that our stock has a risk premium of 7.5% for each ‘unit’ of systematic risk. Obviously, the higher the reward to risk ratio, the better, meaning we’d want to see higher E(RA) and/or lower Beta; either of which would increase the slope.

Example #2: Let us now compare our stock in the previous example (called Stock A) with a second stock (Stock B). Stock B has a Beta of 1.2 and an expected return E(RB) of 16%. When we construct our Security Market Line, we end up with a slightly different picture than we had with Stock A.

The reward-to-risk ratio (or slope of the line) for Stock B is 6.67%. What this tells us (all other things equal) is that in essence, Stock A is a ‘better’ choice than Stock B simply because it generates more reward for each unit of systematic risk undertaken.

…[The above] analysis is especially useful when one is selecting portfolio components and wants exposure to a particular industry or sector, has multiple candidates, but doesn’t want to include them all for fear of being overweight that particular area. In this manner, the candidates may be lined up and compared to see both visually and quantitatively where the best bang for the buck lies…

In summation, probably the most important takeaways from this article should be that:

- a portfolio doesn’t need 100 components to be adequately diversified in terms of non-systematic risk. 30-40 will do just fine as the math above demonstrates.

- and that, by using your economic themes and how they relate to systematic risks in your selection of an appropriate number of assets, you can mitigate a good deal of the systematic risk to your portfolio as well.”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money