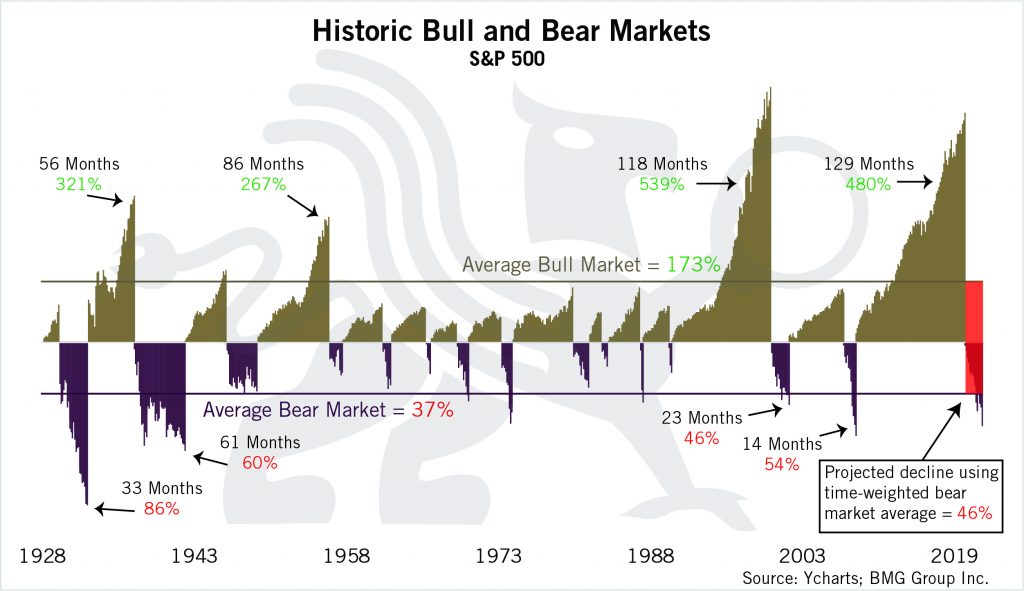

While conventional advice is to always stay invested, this is not the best strategy when we are at the end of the current paradigm. As we enter 2020, the question we have to ask is: How close to the edge of the cliff do we dare to go?…

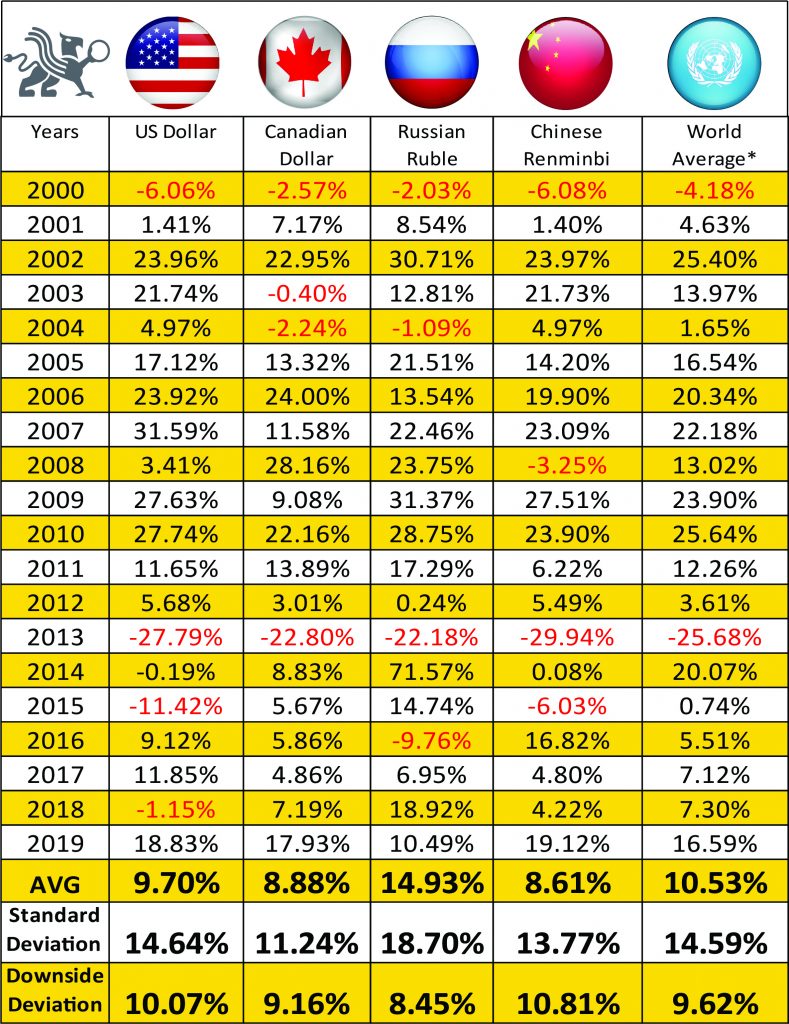

Gold Returns

Gold had a good year in 2019, rising about 18%. Since 2000, gold has averaged 11% annually in the major currencies, with 9.7% in USD and 8.8% in Canadian.

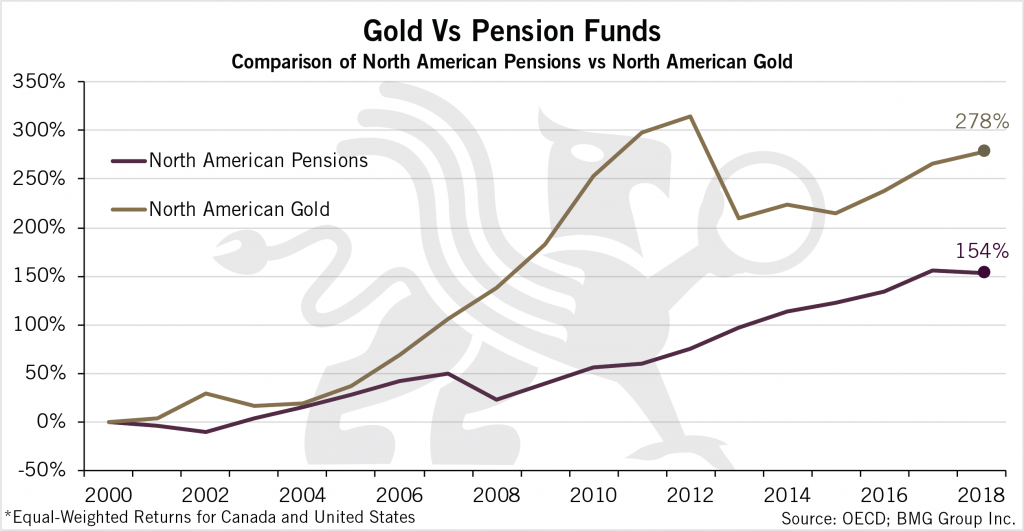

Pension Fund Returns

According to the OECD, the average annual 15-year pension returns were 6.6% in Canada and 2.6% in the U.S.. You don’t need a complicated algorithm or a computer to conclude that an allocation to gold would have improved returns and reduced volatility. However, other than three global pension funds, none have any gold and most have no allocation to REITs.

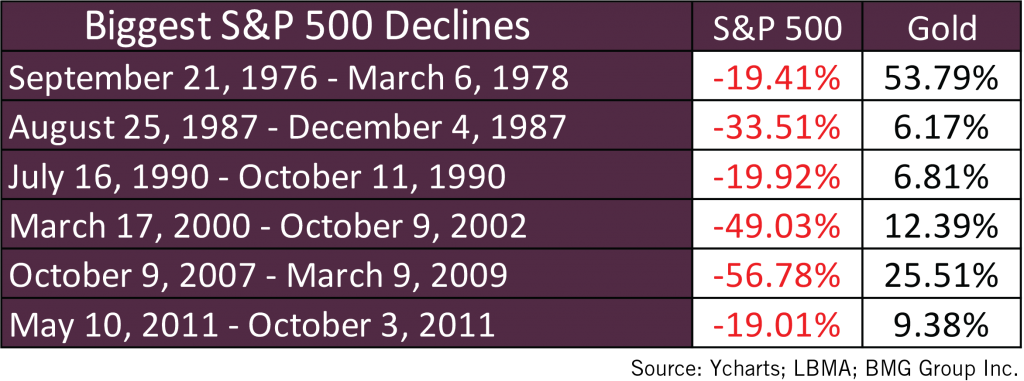

Gold vs. Equities During Market Instability

While conventional advice is to always stay invested, this is not the best strategy when we are at the end of the current paradigm. As we enter 2020, the question we have to ask is: How close to the edge of the cliff do we dare to go?…

As can be seen above, during times of market instability, gold serves its primary purpose of preserving wealth better than any other asset class.

A Recommended Course Of Action

Historically, great fortunes have been made in times of market downturns by those confident enough to exit the market before the downturn, and park their money in real assets, such as gold, that preserve purchasing power, then re-enter at a significant discount to current prices.

…We at BMG have developed a model that:

- uses an initial tactical allocation of 100% to gold bullion

- and when the inevitable correction is complete, the strategy calls for a reallocation to a long-term balanced and diversified strategic allocation of stocks, bonds, REITs, gold and silver bullion.

We have back-tested this strategy as applied to the 2008 Crash, and the model generated a 25% average annual compounded return. BMG has created a Hedge Fund to follow this strategy.

Conclusion

I encourage everyone to take some time to do some serious soul searching on this issue. It requires foresight, independent thought, and immense courage to swim against the tide of popular thought but the rewards of preserving — and possibly greatly enhancing — your family’s wealth for generations will be well worth it.

From a long-term strategic viewpoint, a 20% portfolio allocation to gold will reduce portfolio volatility and improve returns [and fulfill]…its primary purpose of preserving wealth better than any other asset class…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money