The continuing sideways movement in silver is allowing more time to build a portfolio of silver investments ahead of the major bull market that we know is incubating. Right now it is being held in restraint like gold, by the dollar rallying, but that won’t carry on forever and, as is the case with gold, the dollar may be rallying against most other currencies, but they are all spiraling [down] the drain.

investments ahead of the major bull market that we know is incubating. Right now it is being held in restraint like gold, by the dollar rallying, but that won’t carry on forever and, as is the case with gold, the dollar may be rallying against most other currencies, but they are all spiraling [down] the drain.

The original article has been edited here for length (…) and clarity ([ ])

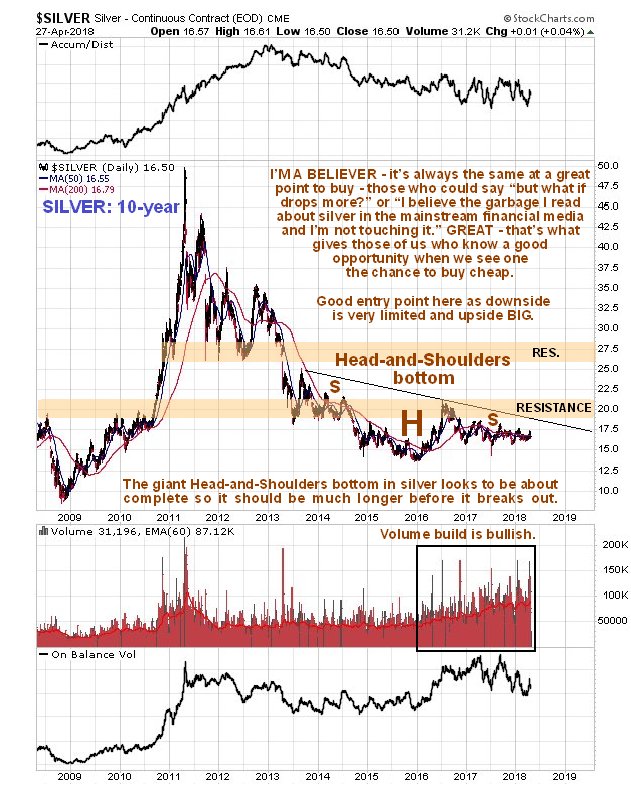

Silver: 10 Year Chart

Like gold, silver has marked out a giant Head-and-Shoulders bottom pattern which is fast approaching completion… [as] can be seen on the latest 10-year chart below.

Before leaving the 10-year chart, another point to note is that, like gold, we have seen a steady and pronounced volume buildup in silver for over 2 years – since the final low of the Head of the Head-and-Shoulders bottom late in 2015 and early in 2016 – [and] this is very bullish although volume indicators have not fared so well as with gold.

Silver: 3 Year Chart

On silver’s 3-year chart [below] we see that it has been underperforming gold in recent months, which…is quite normal at this stage in the cycle. It is still not far off the Right Shoulder lows, which means that this is a good time to continue accumulating silver investments. Although we could see some minor weakness in the event of continued dollar strength, downside is considered to be very limited. Actually, with the price down close to support and the continued volume buildup, silver looks like a coiled spring here. When it decides it’s going to make a big move it usually happens when it’s least expected, leaving most investors watching as mere spectators.

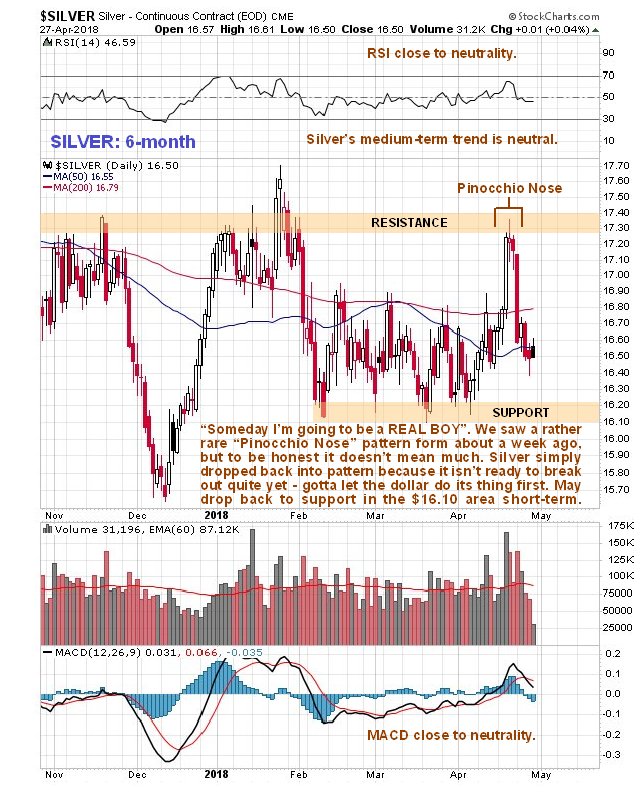

Silver: 6 Month Chart

On the 6-month chart [below] we can see that silver is in a broadly neutral trend on a near-term time horizon…Silver is not quite ready to break out yet, and will probably wait until it gets the “all clear” from the dollar.

Conclusion

…To conclude, silver appears to be in the very late stages of its Head-and-Shoulders bottom and, with the price still not far off the Right Shoulder lows, we are [at] a very good point to continue accumulating silver investments – silver itself, silver coins, silver stocks and ETFs and, for those who are set up to do so and know what they are doing, silver futures and options.

Related Articles From the munKNEE Vault:

1. Silver Prices: How High Will They Go? $100? $300? $500?

Silver prices have risen exponentially for the past 90 years as the dollar has been consistently devalued. Expect continued silver price rises.

2. Silver Trend Is Inevitable In Its Outcome – Here’s Why

Supply and demand trends are clearly poised to continue tightening the silver market and when the next crisis hits the silver price will be significantly impacted by this trend. It may not happen this year, but the 20,000-foot view of this market says a crunch is on the way. It’s supply/demand 101.

3. Frustrated By the Comatose Silver Price? Don’t Be. Here’s Why

Frustrated by the comatose silver price? Tired of it going nowhere and being held down? Well, history has a message for you: This trading behavior is normal. Furthermore, similar scenarios from the past say the next price explosion is on the way.

4. Silver Could Hit $150 A Troy Ounce – Here’s Why

…A collapse of the U.S. dollar is inevitable. The U.S. Dollar Index has been bouncing off of four-year lows for the past several weeks but this cannot last much longer with a global trade war and U.S. equity correction looming….The U.S. dollar and fiat currencies are in trouble, hinting that gold and silver prices could again go screaming higher…[as] the two still generally trade inverse to each other and, while gold is perhaps the safest way to hedge against a falling dollar, the most profitable option is silver.

5. In Coming Upsurge Silver Will Move Up Almost 4x As Fast As Gold! Here’s Why

The moves in gold and silver will be explosive. The time to own physical gold and silver is today and not when they move to new highs. Both metals are at inflation adjusted historical lows and the downside risk is minimal. Also, they probably are the most undervalued of all assets currently.

6. A Breakout In the Silver-Gold Ratio Could Spring Silver Much Higher & Carry Gold With It

A breakout here would “spring” silver much higher, and likely carry gold with it. Precious metals investors need to be watching this ratio here!

9. Are You A Silver Bug? Take This 10-question Quiz To Find Out

If you’re a silver believer like us, check out our 10-question quiz to see if you can call yourself a silver bug.

10. Silver: Diversify Your Holdings & Juice Your Returns – Here’s How

50 ways to diversify your silver holdings. Now you can make sure you have the right form of silver, for the right purpose, for the right time, for a diversified hard-asset portfolio.

11. Silver Is In A Massive Bull Market – Here’s Why

It’s Economics 101. Price works to balance supply and demand. Limited supply causes higher prices; higher prices help curb demand…[and] that equation is playing out right now in the silver market. Mined silver supplies have been drying up over the past few years, while silver prices have climbed 20% in the same time frame…

Silver has often rebounded nearly 100% within 12-15 months after bad and long bear markets. History says Silver is ripe for a similar move over the next 12 to 18 months.

13. Silver is Now Even More Precious Than Gold! Do You Own Any?

Silver is now rarer than gold and will be for all of eternity. From this point forth we work from current silver production alone and, from this point forth, demand will outstrip production without exception. Can you imagine what that means for the future price of this, indeed, precious metal? Forget about the popular expression: ‘Got gold?’ The much more important – and potentially more profitable – question to ask these days is, ‘Got silver?’

14. Silver Is THE Antidote to Bubble Craziness – Here’s Why

Silver in early 2018 is inexpensive compared to M3, National Debt, government expenditures, the Dow and gold.

For all the latest – and most informative – financial articles sign up (in the top right corner) for your FREE tri-weekly Market Intelligence Report newsletter (see sample here)

Support our work by liking us on Facebook, following us on Twitter, or sharing this with a friend. munKNEE.com – the internet’s most unique financial site!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money