The gold/silver ratio has rather shockingly continued to rise steadily, and this month it has even broken above 90:1…but don’t expect some kind of automatic reversion of the gold/silver ratio down to dramatically lower levels in favor of silver just because the current ratio seems very high. It is much more likely that future silver rallies will peak and top out around a gold/silver ratio in the range of 50:1. Here’s why.

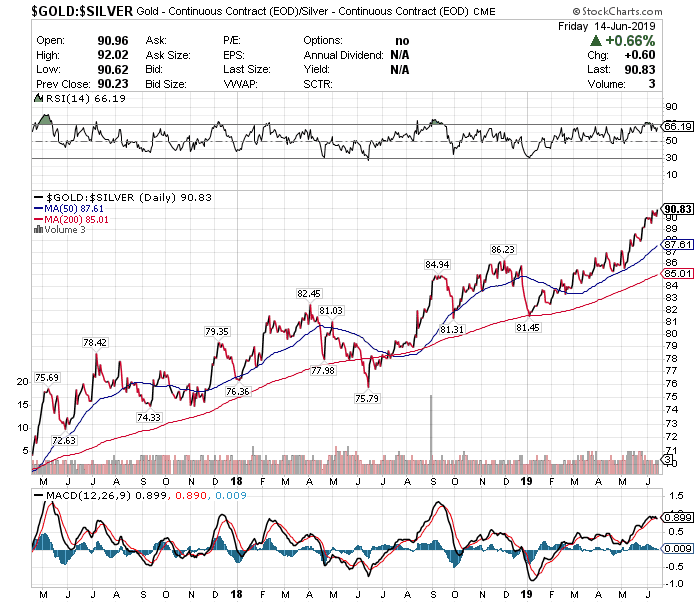

In fact, ever since the precious-metals rally ended in the summer of 2016, gold has outperformed silver so steadily and consistently that the gold/silver ratio chart is almost perfectly smooth in its ascent.

In the short term…there may be a tradable bounce back for silver…basically a corrective rally that compresses the gold/silver ratio back to its 50-day (87.5:1) or 200-day moving average (85:1)…[but] the timing of such a trade is fraught with risk. As you can see in the chart above, the trend has been running against such a trade for three years now and there is no guarantee that gold will not continue to outperform silver for the next month or more, and the gold/silver ratio could continue to rise and get even more overextended. Who knows? It might not be until the ratio gets close to or touches the psychologically significant 100:1 ratio that we finally get the bounce back corrective rally in silver.

In the medium and long term, however, the global economic and industrial slowdown…does not favor silver over gold…[as] silver is not purely a “safe haven” precious metal asset in the same way that gold is. Demand for silver declines when global economic and industrial activity are slowing down rather than growing. In the Great Depression, gold held its value but silver did not. The gold/silver ratio soared up to as high as 100:1 back then as well…

Right now the global economy, the U.S. economy, and stock markets are up in the air: We are not yet heading immediately into recession, especially not in the U.S., but more and more signs of economic slowdown are showing up all around us…so the sentiment of global investors and financial markets already embodies fears [of] an approaching economic downturn and recession…over the next 12 to 24 months. This kind of an environment is not conducive to a booming industrial market demand for silver.

Silver will be more likely to perform better in the aftermath and recovery from the next recession, when interest rates are still low and central bank policy is still very accommodative, but when global economic activity is picking up again. That is the time period to look at silver, along with copper and other industrial base metals…

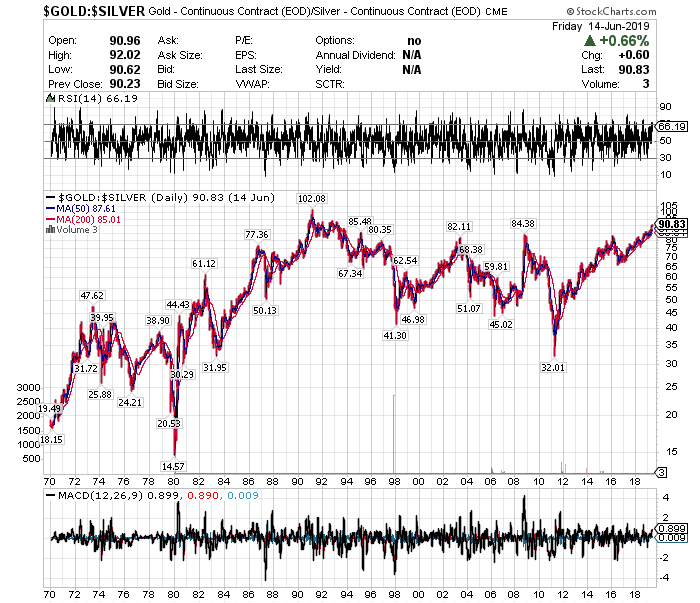

[In the] long-term…the trend (for the past 150 years) has been for silver’s value to decline relative to gold’s value [so] it is going to take a lot to overcome [such] a trend…[Below] is a chart of the gold:silver price from 1970 to the present:

I…

- am rather skeptical that the gold:silver ratio will return to ancient or classical 19th century levels like 10:1 or 15:1…

- doubt that the next big silver price rally, whenever it takes place, will even bring the gold/silver ratio down near 30:1, like we saw in 2011,

- suspect it is much more likely that future silver rallies will peak and top out around a gold/silver ratio in the range of 50:1, or maybe temporarily 45:1, as we saw in the late 1990s or the mid-2000s (see the chart above) and I

- expect that the typical long-term average for the gold/silver ratio will reset to around 75:1 or so, while oscillating in a range from 50:1 to 100:1…This, I think, is a more realistic long-term perspective for gold and silver investors.

Conclusion

…Do not expect some kind of automatic reversion of the gold/silver ratio down to dramatically lower levels in favor of silver just because the current ratio of 90:1 seems very high…Even when a silver rally finally arrives, it may not bring the long-term gold/silver ratio any lower than 75:1, although of course temporary spikes and oscillations in both directions are always possible.

In other words, if gold rallies to $1,700/ounce over the next year or two, I think the silver price is more likely to remain in the $17-$25/ounce range, rather than soaring to the $30-$50/ounce range.

Editor’s Note: The above excerpts* from the original article by Geoffrey Caveney have been edited ([ ]) and abridged (…) for the sake of clarity and brevity. Caveney is receiving compensation from Seeking Alpha for pageviews of his original article as posted there so please refer to it for the unedited version. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

1. Silver Breakout To $22.50-$24.00 Coming In Next 2-4 Months – Then Quickly To +$85/ozt!

Silver has been in a descending triangle over the past 8 years but looks to be nearing completion. This suggests a large move in Silver is near.

3. Silver Will Soon Move Suddenly & Shockingly Higher – Here’s Why (+4K Views)

I am convinced that silver will soon explode in price in a manner of unprecedented proportions, both in terms of previous silver rallies and relative to all other commodities. By unprecedented, I mean that the price of silver will move suddenly and shockingly higher in a manner never witnessed previously, including the great price run ups in 1980 and 2011. The highest prior price level of $50 will quickly be exceeded.

4. Silver Prices Are Way Too Low Any Way You Look At It

5. This Opportunity Is Being Handed to You On A Silver Platter!

6. Analysis: Silver Prices Too Low – Could Rise Above $30 in 2019 – Here’s Why

7. Silver is Now Even More Precious Than Gold! Do You Own Any? (+5K Views)

8. Buy Silver Instead of Gold! Here’s Why (Almost 9K Views)

We are at the beginning of a major shift out of paper assets into real assets and the more I studied the merits of owning gold and silver the more I realized that silver was the smart decision. Let me explain.

9. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher! (+20K Views)

The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Something has to give..What well that’s a gamble..My thought, is there really a market for the average investor to make money with Silver…

thousands of years of data say you are wrong.

A very fair and welcome contrary-opinion. Thanks.