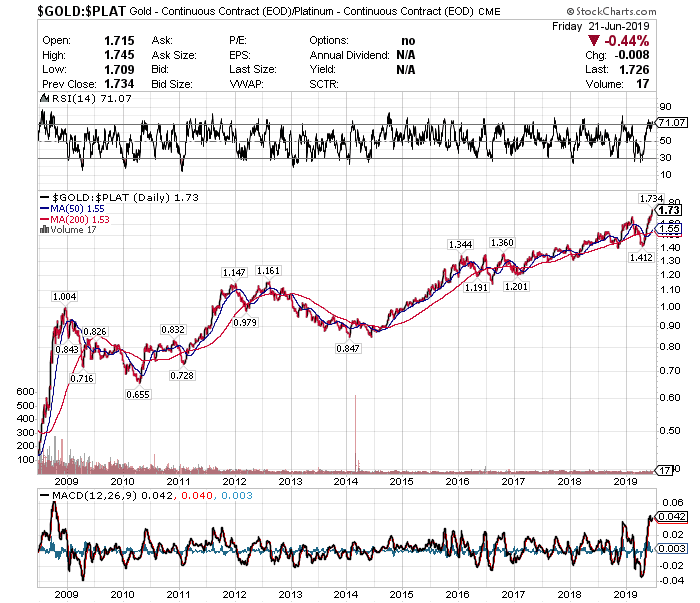

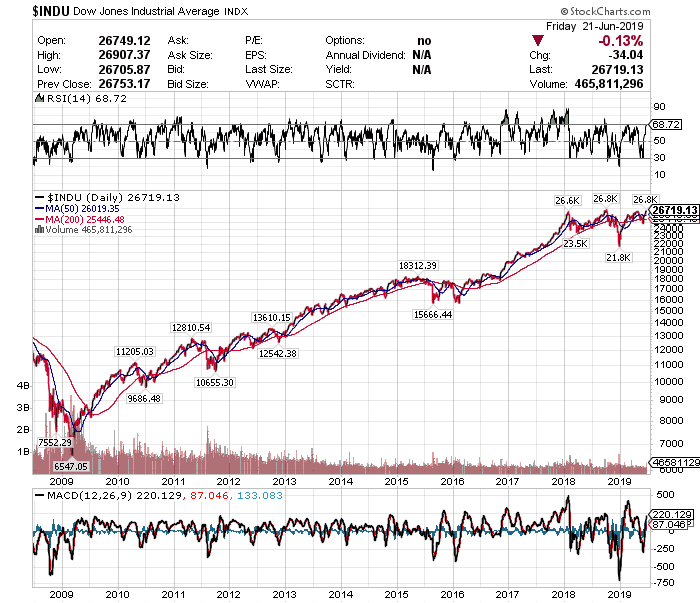

The gold-platinum ratio (GPR) has had a significantly better track record than most other indicators in forecasting the stock market’s 12-month direction; it’s bearish when the ratio is low, and bullish when—as it is now—at high levels. The ratio today is at its highest level in more than 10 years so what does that say about the future of the stock market?

Written by Lorimer Wilson, editor of munKNEE.com

According to a study by Prof. Huang, a Cornell University professor, the ratio of gold’s price to platinum’s has been—at least over the 40-plus years since gold began freely trading in the U.S.—impressively correlated with the stock market’s subsequent performance, as measured by broad indexes like the Wilshire 5000, Dow and S&P 500. Furthermore, when he tested this ratio’s track record against numerous other indicators that prior research had found to have value, the ratio came out ahead of nearly all of them.

The GPR is a good stock market predictor because:

- platinum primarily reflects industrial demand, while

- gold’s price reflects both industrial demand as well as investor demand for a hedge against economic and geopolitical trouble.

A high GPR like we have now, therefore, means investors collectively are anticipating a higher-than-average level of risk and expect higher-than-average returns as compensation for that higher risk.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money